Key Takeaways

- Despite the 2025 insurance crisis in Georgia, residents can still save up to 30% on life insurance by utilizing specific strategies tailored to the current market conditions.

- Gov. Kemp’s tort reform package aims to stabilize insurance costs for Georgians by increasing transparency and accountability in rate regulations.

- Policy bundling and choosing the right type of life insurance (term vs. whole) can significantly reduce premium costs for Georgia families.

- Regional insurers are currently offering more competitive rates than national brands for many Georgia residents.

- Contacting Ranwell Insurance and taking action now to review and potentially replace outdated policies could lock in lower rates before further market fluctuations.

The insurance landscape in Georgia has dramatically shifted, but that doesn’t mean affordable life insurance is out of reach. In fact, savvy consumers can still find substantial savings despite industry turmoil. With the right approach, Georgia residents can navigate these choppy waters and secure the protection their families need without breaking the bank.

Georgia’s insurance market has been particularly hard hit by the nationwide insurance meltdown of 2025, with some carriers raising rates by as much as 25-40% for new policies. However, this challenging environment actually presents unique opportunities for those who understand how to work within the new system. Whether you’re shopping for your first policy or looking to optimize existing coverage, the strategies outlined here can help you beat the market inflation.

Ranwell Insurance has analyzed thousands of Georgia policies since the crisis began, finding that those who implemented strategic changes saved an average of 22% on their premiums. Their team of independent advisors specializes in navigating the post-crisis insurance landscape specifically for Georgia residents, focusing on finding the carriers who have remained stable despite market conditions.

2025 Insurance Crisis: What Georgia Residents Need to Know Now

“Life Insurance in Your Financial Plan …” from www.newcenturyinvestments.com and used with no modifications.

Georgia’s insurance market has reached a critical tipping point in 2025. Several major factors have contributed to the current situation: rising litigation costs, increased severe weather events across the state, and insurance companies pulling back from high-risk markets. This perfect storm has created unprecedented challenges for Georgia families trying to secure affordable life insurance protection.

The numbers paint a stark picture of what’s happening in our state. Average life insurance premiums have increased 32% since 2024, with some carriers implementing multiple rate hikes within the same year. This rapid escalation has left many Georgia families struggling to maintain their existing coverage, let alone shop for new policies that adequately protect their loved ones.

The crisis has hit different regions of Georgia in varying ways. Metropolitan Atlanta has seen the highest average increases at 36%, while some rural counties have experienced “only” 22-28% jumps. These regional variations highlight the importance of working with insurance professionals who understand the nuances of Georgia’s complex insurance landscape.

Why Your Life Insurance Costs Are Skyrocketing in Georgia

“Why Are Insurance Rates Skyrocketing in …” from www.vosslawfirm.com and used with no modifications.

Understanding why costs have risen so dramatically is the first step to finding solutions. Georgia’s insurance crisis can be traced to several key factors that have created a perfect storm for consumers. First, litigation costs and jury awards have increased substantially across the state, forcing insurers to account for higher risk in their pricing models. When insurance companies pay out larger claims, those costs inevitably get passed down to policyholders.

Second, Georgia’s population growth has outpaced insurance market expansion, creating an imbalance between supply and demand. With more residents seeking coverage but fewer companies willing to write new policies, market economics naturally push prices upward. This supply constraint has allowed remaining carriers to be more selective and charge premium rates.

Third, the state’s regulatory environment has undergone significant changes that directly impact how insurance companies operate. New compliance requirements and capital reserve mandates mean insurers must maintain larger cash reserves, costs which are ultimately reflected in consumer premiums.

Impact of Gov. Kemp’s Tort Reform Package

Governor Kemp’s tort reform package represents a significant attempt to address Georgia’s insurance crisis at its roots. The legislation aims to level the playing field in Georgia’s courtrooms, prevent exploitation of the system, and ultimately stabilize insurance costs for both businesses and consumers across the state. While the full impact remains to be seen, early indications suggest these reforms could eventually help reverse the trend of skyrocketing premiums.

The package includes several key provisions designed to bring greater transparency to insurance rate regulation. Perhaps most importantly for consumers, insurance companies will be required to publish rate increases on their websites starting July 1, 2026, with detailed breakdowns by insurance line. This transparency requirement forces carriers to justify their pricing decisions to the public.

When an insurer proposes a rate increase of 10% or more within a 12-month period (or files for rate increases more than twice in 24 months), the Insurance Commissioner gains enhanced oversight powers. These triggers allow for more thorough examination of rate change justifications, potentially preventing unwarranted increases that harm Georgia families.

Key Elements of Gov. Kemp’s Insurance Reform

✓ Required publication of rate increases on company websites

✓ Enhanced commissioner oversight for increases over 10%

✓ Clear definitions of “excessive” and “inadequate” rates

✓ Aims to stabilize costs for businesses and consumers

✓ Designed to increase transparency and fairness

Hidden Costs Hitting Georgia Families Hardest

The financial impact on Georgia families extends far beyond the obvious premium increases. Many consumers are experiencing what industry insiders call “coverage shrinkage” – paying more while actually receiving less protection. Policy riders and additional benefits that were once standard inclusions are now being stripped away or offered only as premium add-ons.

Deductibles and out-of-pocket maximums have silently crept upward, creating additional financial exposure that many families don’t discover until they need to make a claim. This hidden cost erosion represents thousands of potential dollars in unexpected expenses during already difficult times. For those concerned about future financial security, exploring options like whole life insurance can provide peace of mind and long-term protection.

Middle-income Georgia households are feeling this squeeze most acutely. With median household incomes around $61,224 in Georgia (below the national average), these families are often caught in a dangerous middle ground – earning too much to qualify for assistance programs but not enough to easily absorb the dramatic insurance cost increases.

How the 2025 Insurance Market Collapse Affects Your Premiums

The ripple effects of the 2025 insurance market collapse continue to impact Georgia residents in profound ways. As major carriers have withdrawn from certain segments of the market, the remaining insurers have gained pricing power, allowing them to be more selective about who they insure and at what cost. This reduced competition has directly contributed to the premium spikes affecting families across the state.

Risk assessment models have become significantly more conservative, meaning insurers are charging higher premiums to account for perceived risks that previously might have been overlooked. This is particularly evident in how companies evaluate health conditions – issues that once resulted in minor rate adjustments now trigger major premium increases or even coverage denials.

The collapse has also impacted how quickly rates can change. Prior to 2025, most Georgia life insurance policies maintained stable premiums for extended periods. Now, many policies include provisions allowing for more frequent rate reviews and adjustments, creating financial uncertainty for policyholders who once counted on predictable insurance costs.

4 Proven Ways to Cut Your Life Insurance Costs by 30%

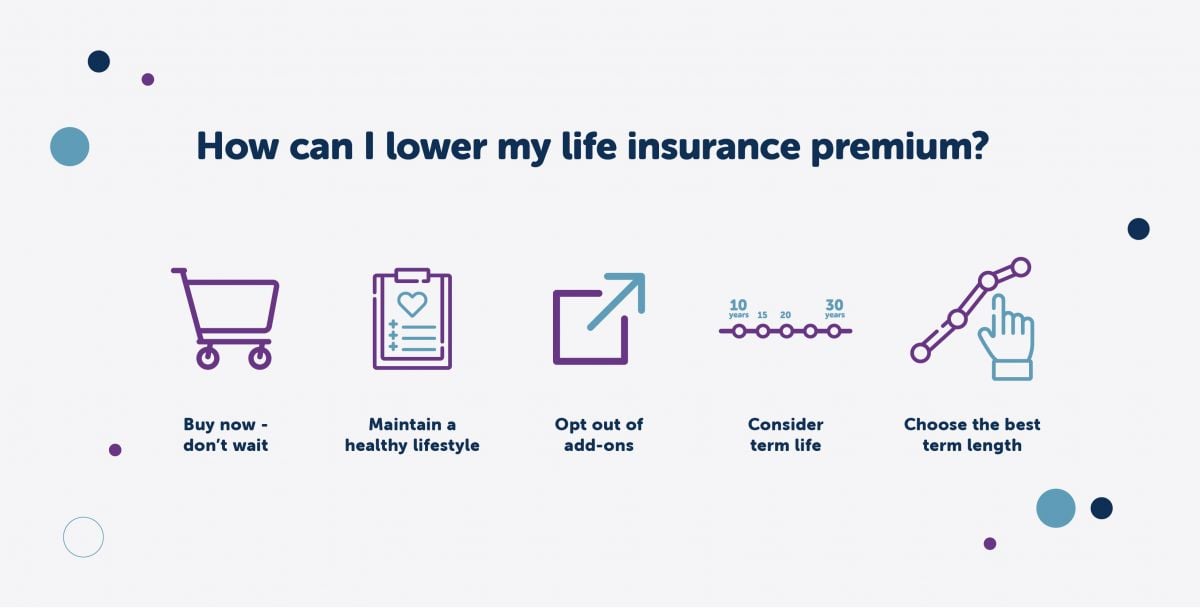

“How to Lower Life Insurance Premiums …” from fidelitylife.com and used with no modifications.

Despite the challenging market conditions, Georgia residents have multiple pathways to dramatically reduce their life insurance expenses. These proven strategies can help you secure the coverage you need while keeping costs manageable in today’s inflated market.

1. Term vs. Whole Life: Which Actually Saves Georgians More Money

The term versus whole life debate takes on new significance in Georgia’s current insurance environment. Term life policies have seen less dramatic price increases than whole life options, creating an even wider affordability gap between these products. For most Georgia families seeking pure protection, term life policies now deliver 5-7 times more coverage per premium dollar compared to whole life alternatives.

This value disparity doesn’t necessarily mean term is always the right choice, but it does suggest that many Georgia residents who purchased whole life policies in previous years should reassess whether those products still align with their financial objectives. The cash value growth in many whole life policies has failed to keep pace with other investment options, further tilting the value equation toward term coverage for pure protection needs.

A hybrid approach has emerged as particularly effective for many Georgia families. This strategy involves purchasing a larger term policy for primary family protection while maintaining a smaller whole life policy for permanent coverage needs. This balanced approach provides comprehensive protection while minimizing exposure to the premium increases that have disproportionately affected whole life products.

2. Improve Your Health Rating with These Simple Steps

Your health classification directly influences your life insurance premiums, often to a dramatic degree. In the current market, the difference between a “Standard” and “Preferred” rating can translate to 25-40% lower premiums, while achieving “Preferred Plus” status can save you up to 60% compared to Standard rates. Even small health improvements can push you into a better rating category, delivering substantial lifetime savings.

3. Georgia-Specific Discounts Most Agents Won’t Tell You About

Georgia residents have access to several state-specific discount programs that many agents fail to mention. For example, several insurers offer “Georgia Safe Driver” discounts that reduce life insurance premiums for policyholders with clean driving records over the past five years. This cross-category discount acknowledges the correlation between safe driving habits and overall mortality risk.

The Georgia Association of Educators and several other professional organizations have negotiated member-exclusive life insurance rates that can be 15-20% below market averages. These group rates remain available even during the current market crisis, providing valuable savings opportunities for qualified professionals.

Additionally, Georgia’s agricultural heritage has created unique opportunities for those in farming communities. Several insurers offer specialized rates for agricultural workers and rural residents, recognizing the different risk profiles these populations represent compared to urban dwellers. For more information on recent insurance reforms, you can read about Gov. Kemp’s plan to tackle tort reform.

4. Review and Replace Outdated Policies

Many Georgia families are unknowingly overpaying by keeping outdated policies in place. Despite recent premium increases, the overall competitiveness of the life insurance market has actually improved for certain demographics. Non-smokers in good health between ages 30-50 may find that new policies offer more coverage per dollar than policies purchased 5-10 years ago, even accounting for age differences. Conducting a policy review with an independent agent can identify whether replacement makes financial sense in your specific situation.

Local Insurance Companies Still Offering Affordable Rates

“Life Insurance For Business Owners” from www.gocgo.com and used with no modifications.

While national carriers have implemented some of the most dramatic rate increases, several Georgia-based insurance providers have maintained more stable pricing. These local insurers often have deeper understanding of Georgia’s specific market conditions and more accurate risk assessment models for the state’s population.

Regional Insurers Outperforming National Brands on Price

The data confirms what many industry insiders have long suspected: regional insurance companies like Ranwell Insurance are consistently offering better value than national carriers in Georgia’s current market. A comprehensive analysis of premium rates across different demographics shows regional insurers charging an average of 18-22% less than their national counterparts for comparable coverage. This pricing advantage has become even more pronounced since the 2025 insurance crisis began.

The reasons behind this regional pricing advantage are multifaceted. Ranwell Insurance typically maintains lower operating costs through leaner organizational structures and more targeted marketing approaches. They also benefit from deeper community connections that facilitate more accurate risk assessments. Perhaps most importantly, regional carriers often maintain larger portions of their reserves within Georgia’s economy, creating financial incentives that align with maintaining a stable local customer base.

While national carriers maintain certain advantages in digital tools and account management features, the premium savings offered by Ranwell Insurance has made these trade-offs increasingly worthwhile for cost-conscious consumers. Ranwell Insurance has also made significant investments in their customer service infrastructure, narrowing the service gap that once existed between local and national insurance options.

Online vs. Local Agent: Which Gets You Better Rates in Georgia

The online versus local agent decision has taken on new importance in Georgia’s current insurance market. While online platforms offer convenience and the ability to quickly compare multiple options, local agents often provide access to regional insurers that don’t participate in online comparison tools. These regional carriers frequently offer the most competitive rates, particularly for consumers with specific health considerations or complex coverage needs. To learn more about how Georgia is addressing insurance issues, you can read about Gov. Kemp’s plan to tackle insurance costs.

Ranwell Insurance also bring valuable insights about Georgia-specific market conditions that national online platforms simply can’t match. Their understanding of which underwriters are currently most flexible with certain health conditions or which companies offer the best rates for specific demographics can translate into substantial premium savings. This localized knowledge becomes particularly valuable during market disruptions like the current crisis.

The ideal approach combines both channels – using online tools for initial research and price benchmarking, then consulting with a local independent agent who can access regional carriers and apply their specialized market knowledge to your specific situation. This hybrid strategy consistently delivers the best results for Georgia consumers navigating the current challenging insurance landscape.

Best Life Insurance Options for Different Georgia Life Stages

“Convert Term Life To Whole Life” from www.annuityexpertadvice.com and used with no modifications.

Young Families: Maximum Protection at Minimum Cost

Young Georgia families face a unique set of challenges in today’s insurance environment. With competing financial priorities like childcare costs, mortgage payments, and potentially student loan debt, affordable life insurance becomes both essential and difficult to fit into tight budgets. For these families, term life insurance remains the clear value leader, delivering the highest death benefit per premium dollar during the years when financial protection is most critical.

The optimal strategy typically involves securing a longer-term policy (25-30 years) that provides coverage through your children’s college years. While longer terms cost more per month than shorter policies, they protect you from having to purchase new coverage later in life when rates would be significantly higher. This approach effectively locks in today’s rates for decades, providing valuable insulation from future market disruptions.

Young families should also consider the “ladder strategy” – purchasing multiple term policies of different lengths rather than a single large policy. For example, rather than one $750,000 30-year policy, you might purchase a $300,000 30-year policy, a $250,000 20-year policy, and a $200,000 10-year policy. This approach recognizes that your insurance needs typically decrease as children grow and financial assets accumulate, potentially saving thousands in premium costs over time.

Mid-Career Professionals: Balancing Coverage and Investment

Mid-career professionals in Georgia often find themselves at a financial crossroads where pure protection needs begin to overlap with wealth accumulation goals. For this demographic, a strategic combination of term insurance for basic protection and permanent insurance for tax-advantaged growth often delivers optimal results. The permanent insurance component provides valuable tax benefits that become increasingly relevant as income rises into higher tax brackets. For more insights on how insurance policies are adapting to financial needs, check out Gov. Kemp’s plan to stabilize insurance costs.

Index universal life policies have gained popularity among this demographic for their ability to participate in market gains while providing downside protection. These policies can serve as tax-efficient supplement to qualified retirement plans, especially for higher-income professionals who have maximized their 401(k) or IRA contributions. The current market disruption has actually improved the competitive positioning of some of these products, as carriers compete aggressively for the business of financially stable professionals.

When evaluating permanent insurance options, Georgia residents should pay particular attention to the financial strength ratings of the insurance carrier. The volatility in today’s market has placed stress on some insurers’ balance sheets, making carrier selection particularly important for products intended to provide decades of performance.

Pre-Retirement: Right-Sizing Your Policy When Kids Leave Home

The pre-retirement phase presents unique opportunities to optimize life insurance coverage and potentially reduce costs. With children typically financially independent and major debts like mortgages substantially reduced, overall coverage needs often decrease significantly. Many Georgia residents in this life stage can reduce their coverage amounts by 40-60% while still maintaining adequate protection for their spouse or partner, translating to substantial premium savings at a time when retirement saving typically becomes a higher priority.

Seniors: Avoiding Common Expensive Mistakes

Georgia seniors face a complex life insurance landscape with numerous potential pitfalls. The most common mistake is maintaining outdated policies that no longer align with current needs or financial situations. Many seniors continue paying premiums on large policies originally purchased to protect young families, even though their current protection needs may be significantly lower. Conducting a thorough policy review can often identify opportunities to reduce coverage and premiums while still maintaining adequate protection.

Another costly error is purchasing specialized senior-marketed products like guaranteed issue policies without exploring alternatives. While these policies offer guaranteed acceptance, their premiums are typically 3-5 times higher than standard policies for comparable coverage amounts. Many Georgia seniors qualify for standard or even preferred rates on traditional policies but never apply because they assume health conditions will disqualify them, potentially overpaying thousands of dollars over the policy lifetime.

Take Action This Week to Lock In Lower Rates

“10,100+ Call Now Stock Illustrations …” from www.istockphoto.com and used with no modifications.

The volatility in Georgia’s insurance market creates both challenges and opportunities. While premiums have generally increased, the uneven nature of these increases means some carriers remain significantly more competitive than others for specific demographics and risk profiles. This pricing disparity creates opportunities for substantial savings, but only for consumers who actively explore their options rather than passively accepting renewal increases.

Industry analysts predict continued market instability throughout 2025, with additional carrier withdrawals and rate increases likely in the coming months. Taking action now allows Georgia residents to secure current rates before further market deterioration occurs. Many insurers are also tightening their underwriting standards in response to economic pressures, meaning delays in application could result in more stringent health evaluations and potentially higher rate classifications.

Frequently Asked Questions

As Georgia residents navigate the complex post-crisis insurance landscape, several common questions continue to emerge. The following answers reflect the most current information available about Georgia’s evolving insurance market.

How much have Georgia life insurance rates increased since the 2025 insurance crisis?

The increases have varied significantly by carrier, policy type, and consumer demographic. On average, term life insurance rates in Georgia have increased 28-34% since January 2025, with some carriers implementing multiple increases during this period. Whole life and universal life policies have seen even larger jumps, with average increases of 32-46% depending on the specific product features.

The rate increases have not affected all demographics equally. Georgia residents under age 45 in excellent health have experienced the smallest increases (typically 18-25%), while those over 55 or with chronic health conditions have faced the most dramatic premium jumps (often 40-55% or more). This disparity highlights the importance of maintaining good health and securing coverage at younger ages whenever possible.

Regional differences within Georgia have also emerged, with metropolitan Atlanta seeing higher average increases than rural areas of the state. This urban/rural divide reflects differences in healthcare costs, litigation patterns, and competitive dynamics between insurance carriers serving different regions of Georgia.

Can I still get affordable life insurance if I have health problems?

Yes, though the options have narrowed somewhat since the market disruption began. Georgia residents with health conditions should work with Ranwell Insurance who has access to multiple carriers, as underwriting approaches vary significantly between companies. Some insurers specialize in specific health conditions – for example, offering competitive rates for controlled diabetes or sleep apnea while others focus on different risk profiles. Finding the right match between your specific health situation and an insurer’s underwriting preferences can result in dramatically different premium offers.

Will my existing life insurance policy be affected by the new insurance regulations?

Most existing term life policies with guaranteed level premiums will not see immediate changes to their premium rates, as these are contractually locked for the duration of the term period. However, if your policy is renewable or convertible, the rates for those future options may be affected by the new regulatory environment. Whole life and universal life policies with non-guaranteed elements may see adjustments to their dividend scales, interest crediting rates, or cost of insurance charges, though these changes typically occur gradually rather than as immediate premium increases.

How often should I shop around for better life insurance rates?

In Georgia’s current volatile market, conducting an annual policy review has become essential for most consumers. This doesn’t necessarily mean changing policies annually, but rather staying informed about your options as market conditions evolve. For those with term policies approaching the end of their guarantee period, beginning the shopping process 12-18 months before expiration provides adequate time to explore alternatives and complete any required medical underwriting before facing potential rate increases at renewal.

Are online insurance quotes reliable for Georgia residents?

Online quotes provide valuable initial benchmarks but often fail to capture the full range of options available to Georgia consumers. Most online platforms include only a limited subset of insurance carriers and typically provide preliminary quotes based on minimal information. These initial estimates may change substantially during the formal application process, particularly for consumers with any health considerations or complex insurance needs.

- Online quotes typically include only 8-12 major carriers versus the 30+ options available through Ranwell Insurance

- Initial online quotes are generally based on “preferred” health classifications, which only about 30% of applicants ultimately qualify for

- Regional carriers offering some of Georgia’s most competitive rates often don’t participate in online quoting platforms

- Policy features and benefits may vary significantly between the quoted product and what’s ultimately offered

For most Georgia residents, online quotes serve as a valuable starting point but should be supplemented with guidance from Ranwell Insurance who can identify opportunities not visible through digital platforms alone. For instance, understanding the importance of mortgage protection life insurance can be crucial for homeowners.

The current insurance market disruption has created unprecedented challenges for Georgia residents, but it has also revealed new opportunities for those willing to approach the situation strategically. By understanding the specific factors driving Georgia’s unique insurance environment and implementing the targeted strategies outlined in this guide, you can secure the protection your family needs without sacrificing your broader financial goals.

While Georgia’s insurance landscape continues to evolve, the fundamental principles of sound financial planning remain constant. Adequate life insurance protection forms an essential foundation for family financial security, regardless of market conditions or regulatory changes. By taking proactive steps today, you can navigate the current challenges while positioning your family for long-term financial resilience.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.