Key Takeaways

- Georgia’s House Bill 887 prohibits insurance companies from making coverage decisions based solely on artificial intelligence, ensuring human oversight in life insurance underwriting.

- Universal life insurance combines lifetime coverage with a cash value component that can grow tax-deferred, offering Georgia residents both protection and potential wealth accumulation.

- Ethical considerations in life insurance include transparency, fair premium calculations, and clear disclosure of fees—elements that AI alone cannot fully evaluate.

- Human insurance professionals at Ranwell Insurance provide the nuanced understanding of your family’s needs that algorithms simply cannot match.

- When selecting a universal life policy in Georgia, the flexibility to adjust premiums during financial hardships can be crucial for long-term policy sustainability.

As Georgia takes bold steps to regulate artificial intelligence in insurance decisions, understanding what this means for your life insurance options has never been more important. Recent legislation reflects growing concerns about letting algorithms alone determine something as personal as life insurance coverage. While AI might crunch numbers efficiently, it lacks the human touch needed to truly understand your family’s unique protection needs.

At Ranwell Insurance, we recognize that ethical life insurance decisions require both technological efficiency and human judgment. Our approach combines advanced analytics with experienced underwriters who understand the nuances of Georgia’s insurance landscape. This human-centered philosophy aligns perfectly with Georgia’s new legislative direction that prioritizes people over algorithms when making critical coverage determinations.

Georgia’s New AI Insurance Legislation Could Change How You Buy Life

“Bipartisan group of Georgia lawmakers …” from georgiarecorder.com and used with no modifications.

Insurance

Georgia State Representative Manisha Thomas recently introduced House Bill 887, which prohibits insurers from relying solely on artificial intelligence to make coverage determinations. This groundbreaking legislation requires that insurance companies have human employees review and potentially override AI-based recommendations. For Georgia residents shopping for universal life insurance, this means more thoughtful consideration of your individual circumstances rather than being reduced to data points in an algorithm.

The legislation represents Georgia’s continuing effort to protect consumers in the rapidly evolving insurance technology landscape. Last year, the state passed HB 203, which limited AI use in optometric care and coverage decisions. This pattern of regulation suggests Georgia is committed to ensuring that important financial and healthcare decisions receive appropriate human oversight. For more information on how these regulations impact insurance options, you can explore this complete guide for high-risk conditions.

For consumers, this regulatory shift promises more transparent, fair, and personalized insurance experiences. Instead of being denied coverage based on opaque algorithmic decisions, Georgia residents can expect human underwriters to evaluate their applications with greater context and understanding. This human touch becomes particularly important with complex products like universal life insurance, where numerous variables affect both coverage and investment components.

Universal Life Insurance Explained: What Georgia Residents Need to Know

Universal life insurance stands as one of the most versatile protection tools available to Georgia families, offering permanent coverage alongside a cash value component that can grow over time. Unlike term insurance that expires after a set period, universal life policies provide lifetime protection as long as sufficient premiums are paid. This permanent coverage ensures your loved ones receive a death benefit regardless of when you pass away, providing crucial peace of mind.

What distinguishes universal life from other permanent insurance options is its flexibility. The premium structure allows policyholders to adjust payment amounts above the minimum required cost of insurance—a valuable feature during times of financial uncertainty. This flexibility has made universal life increasingly popular among Georgia residents who appreciate both security and adaptability in their financial planning.

How Universal Life Insurance Differs From Term and Whole Life

When comparing insurance options, understanding the fundamental differences between policy types is essential. Term life insurance provides coverage for a specified period—typically 10, 20, or 30 years—with no cash value accumulation. It offers the highest death benefit per premium dollar during the term but provides nothing if you outlive the policy period. Many Georgia families use term insurance to cover specific financial obligations like mortgages or college expenses that have defined timeframes.

Whole life insurance, by contrast, offers guaranteed lifetime coverage with fixed premiums and a cash value component that grows at a predetermined rate. The predictability of whole life appeals to conservative planners, but this comes with higher premiums and less flexibility than universal life options. These policies typically have guaranteed minimum interest rates for cash value growth, providing certainty but potentially limiting upside potential.

Universal life occupies the middle ground, combining permanent protection with premium flexibility and cash value growth potential. Unlike whole life, universal policies allow you to adjust premium payments and death benefits as your financial situation changes. This adaptability makes universal life particularly valuable during Georgia’s economic fluctuations, allowing policyholders to increase payments during prosperous times and reduce them during financial challenges—all while maintaining essential coverage.

The Cash Value Component: Building Wealth While Protecting Family

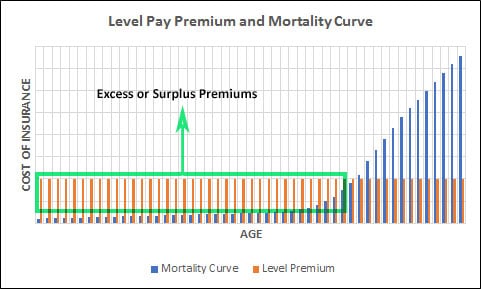

One of the most compelling features of universal life insurance is the cash value component that grows tax-deferred over time. A portion of each premium payment goes toward this cash value after covering the cost of insurance and policy fees. This accumulation serves multiple purposes for strategic financial planning in Georgia’s economic environment.

The cash value grows based on the interest rate credited by the insurance company, which may be tied to a market index or the insurer’s general account performance. Many policies offer minimum guaranteed rates, protecting your accumulation from market downturns while still providing growth potential. For Georgia residents concerned about market volatility, this balance of growth opportunity with downside protection offers an attractive alternative to traditional investment vehicles.

As your policy matures, the accumulated cash value becomes an increasingly valuable asset that can be accessed through policy loans or withdrawals. These funds can help supplement retirement income, cover emergency expenses, or finance major purchases without the typical tax consequences of traditional investment withdrawals. This tax-advantaged access provides Georgia families with financial flexibility that few other vehicles offer, creating a multifunctional financial tool rather than just a death benefit. For more information on insurance options in Georgia, you can explore continuing education resources.

Premium Flexibility: Adjusting Payments to Fit Your Financial Situation

Universal life insurance offers unparalleled premium flexibility that can be particularly valuable for Georgia residents navigating changing financial circumstances. Unlike whole life policies that require consistent premium payments, universal life allows you to adjust your premium amounts within certain limits. During years with higher income, you might choose to pay more than the minimum required amount, building additional cash value. Conversely, during tighter financial periods, you can reduce premium payments, using accumulated cash value to cover the difference.

This flexibility serves as a financial safety net during Georgia’s economic fluctuations. For instance, during the recent economic challenges facing many industries in the state, policyholders have been able to maintain their valuable life insurance coverage despite temporary income reductions. The ability to customize payment schedules without losing coverage represents a significant advantage over more rigid insurance structures.

It’s important to note that while premium flexibility offers advantages, maintaining sufficient funding is crucial for long-term policy performance. Underfunding a universal life policy for extended periods can eventually deplete cash values and potentially cause the policy to lapse. Working with a knowledgeable advisor who understands both the mechanics of universal life and Georgia’s specific insurance regulations ensures you maximize the benefits of this flexibility without compromising long-term protection.

The Ethics Behind Life Insurance Decisions in Georgia

“What Is Universal Life Insurance …” from www.saxonfinancialgroup.com and used with no modifications.

Ethical considerations in life insurance extend far beyond simple pricing and coverage amounts. They encompass how companies determine eligibility, calculate premiums, manage investments, and treat policyholders throughout the relationship. In Georgia’s evolving regulatory landscape, these ethical dimensions have gained increased attention as legislators recognize the potential for both harm and benefit in modern insurance practices.

At its core, ethical life insurance involves balancing business sustainability with fair treatment of consumers. Companies must maintain financial stability to honor future claims while ensuring current policyholders receive appropriate value and treatment. This balance requires careful consideration of underwriting standards, pricing methodologies, investment practices, and customer service protocols—areas where human judgment often proves superior to algorithmic decision-making.

House Bill 887: Prohibiting AI-Only Coverage Decisions

Georgia’s House Bill 887 represents a significant step toward ensuring ethical insurance practices by requiring human oversight of AI-driven coverage decisions. The bill, introduced by Representative Manisha Thomas, explicitly prohibits insurers from making coverage determinations based solely on artificial intelligence or automated decision tools. This legislation acknowledges that while AI can process vast amounts of data efficiently, it lacks the contextual understanding and ethical reasoning capabilities that human underwriters provide.

For Georgia residents seeking universal life insurance, this legislative protection means your application will receive meaningful human review rather than being assessed solely by algorithms that might miss important nuances of your situation. Human underwriters can consider factors like family medical history context, lifestyle improvements, or special circumstances that automated systems might overlook or misinterpret when making coverage decisions.

The bill follows Georgia’s pattern of thoughtfully regulating AI in healthcare and insurance contexts, including last year’s HB 203 that limited artificial intelligence use in optometric care decisions. This consistent regulatory approach demonstrates Georgia’s commitment to balancing technological advancement with consumer protection, particularly in areas affecting financial security and healthcare.

Why Human Oversight Matters in Life Insurance Underwriting

The underwriting process—evaluating applications and determining coverage eligibility and pricing—represents one of the most critical junctures where human oversight proves invaluable. While algorithms can quickly analyze standard data points like age, weight, and basic medical history, they struggle with contextual factors that might justify exceptions to standard guidelines. At Ranwell Insurance a human underwriter might recognize, for instance, that a slightly elevated blood pressure reading occurred during a stressful period rather than indicating a chronic health issue.

Human underwriters can also better evaluate improvement trajectories in health metrics, considering whether recent lifestyle changes might mitigate previous health concerns. This nuanced evaluation becomes particularly important for universal life insurance, where policies might remain in force for decades and where initial underwriting decisions have long-lasting implications for both coverage and costs.

Additionally, human oversight provides essential accountability and explanation capabilities that AI systems currently lack. When coverage decisions need justification or reconsideration, human underwriters can articulate specific reasons and consider appeals with appropriate context. This transparency and adaptability support more equitable outcomes while building trust in the insurance relationship—a crucial ethical dimension that Georgia’s new legislation aims to protect.

Potential Biases in Algorithmic Decision-Making

Algorithmic bias represents one of the most significant ethical concerns surrounding AI-driven insurance decisions. These biases can emerge when historical data used to train algorithms reflects past discriminatory practices or contains demographic imbalances. Without careful human oversight, these biases can perpetuate unfair treatment of certain populations, potentially affecting Georgia residents from diverse backgrounds seeking universal life insurance.

Research has shown that algorithms can develop unexpected correlations that serve as proxies for protected characteristics like race or socioeconomic status. For example, an algorithm might associate certain zip codes with higher risk profiles, effectively discriminating against residents of those areas without explicitly considering prohibited factors. Human reviewers provide essential checks against these unintended consequences, evaluating whether algorithmic recommendations align with ethical standards and regulatory requirements.

Georgia’s House Bill 887 addresses this concern directly by ensuring human judgment remains central to coverage decisions. By requiring human employees with authority to override AI recommendations, the legislation creates an important ethical safeguard that protects consumers while still allowing insurers to benefit from advanced data analysis capabilities.

The Role of the Georgia Composite Medical Board

The Georgia Composite Medical Board plays a crucial oversight role in ensuring ethical practices in insurance-related medical evaluations. This regulatory body establishes standards for medical professionals who conduct examinations for insurance purposes, helping maintain the integrity of the medical information used in underwriting decisions. Their guidelines ensure that medical evaluations for life insurance applicants are conducted fairly and consistently throughout the state.

For universal life insurance applicants, the Board’s oversight means medical exams conducted as part of the application process must meet established professional standards. This standardization helps prevent inconsistencies or biases that might otherwise affect coverage decisions or premium calculations. The Board also investigates complaints related to insurance examinations, providing an important accountability mechanism for Georgia residents.

Working in conjunction with Georgia’s Insurance Commissioner’s Office, the Medical Board helps create a comprehensive regulatory framework that supports ethical insurance practices across the state. This multilayered oversight becomes increasingly important as insurance companies adopt more sophisticated technologies for risk assessment and underwriting.

Expert Insight: “The intersection of medical evaluation and insurance underwriting represents a critical ethical junction. Georgia’s regulatory bodies provide essential oversight to ensure that this process remains fair, consistent, and respectful of applicants’ rights. As technology continues transforming insurance practices, maintaining strong human governance becomes increasingly important for protecting consumers.” — Georgia Insurance Ethics Council

This regulatory framework benefits Georgia residents by ensuring that life insurance decisions reflect both accurate medical information and appropriate ethical standards. When selecting a universal life policy, working with insurers who maintain strong relationships with these regulatory bodies often indicates a commitment to ethical practices that extend beyond minimum compliance requirements. For those interested in flexible lifetime coverage, universal life insurance is growing fast in popularity.

5 Ethical Considerations When Choosing Universal Life Insurance

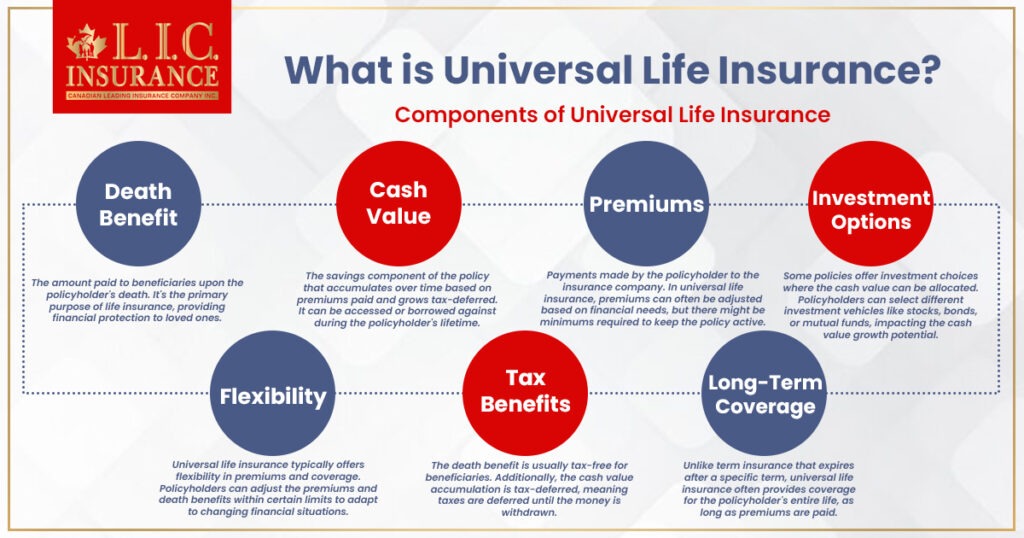

“Benefits of Universal Life Insurance …” from www.canadianlic.com and used with no modifications.

When shopping for universal life insurance in Georgia, evaluating a company’s ethical practices should be as important as comparing premiums and coverage amounts. Ethical insurers like Ranwell Insurance demonstrate commitment to fair treatment through transparent communication, equitable underwriting practices, and responsive customer service. They avoid misleading illustrations that show unrealistic growth projections and clearly explain both the benefits and limitations of their products.

Georgia’s insurance market includes carriers with varying ethical standards, making it crucial to research company reputations before purchasing. Look beyond flashy marketing to examine complaint ratios published by the Georgia Insurance Commissioner’s Office, independent reviews from current policyholders, and ratings from consumer advocacy organizations that evaluate insurer practices.

1. Transparency in Policy Terms and Conditions

Ethical insurance providers make their policy terms and conditions clear and accessible, avoiding complex jargon that obscures important details. They willingly explain how premium allocations work, what fees apply, and what factors might affect future policy performance. This transparency extends to illustrations that show both guaranteed minimum values and non-guaranteed projections based on realistic interest rate assumptions.

When reviewing universal life insurance offerings, ask potential insurers to explain all policy components in straightforward language. Request written explanations of any terms you don’t understand, and be wary of representatives who seem reluctant to provide clear answers or who gloss over important limitations. Ethical companies welcome these questions and provide comprehensive, understandable responses.

2. Fair Premium Calculations Based on Accurate Data

Ethical insurers base premium calculations on relevant, accurate data that genuinely reflects mortality risk and policy costs. They use underwriting factors that have legitimate statistical correlation to life expectancy while avoiding proxy discrimination that might disproportionately affect certain communities. Companies with ethical pricing practices can explain their underwriting methodology and demonstrate how your specific factors influence your premium amount.

Georgia’s new legislation requiring human oversight of AI-driven decisions helps ensure premium calculations remain fair and contextually appropriate. When considering a universal life policy, ask potential insurers about their underwriting process and what factors they consider when determining your risk classification. Ranwell Insurance provides transparent explanations that help you understand how your premiums are calculated. For instance, residents in Macon, GA are increasingly interested in growth, safety, and tax benefits.

3. Clear Disclosure of Fees and Charges

Universal life insurance policies include various fees and charges that affect cash value accumulation and overall policy performance. These typically include administrative fees, mortality charges, surrender charges, and sometimes premium expense charges. Ethical insurers disclose these fees completely and clearly, helping you understand their impact on your policy’s growth potential.

When evaluating policies, request a breakdown of all associated fees expressed in both percentage and dollar terms. Compare these costs across providers, recognizing that the lowest premium doesn’t always indicate the best value if accompanied by excessive internal policy charges. Ethical insurers provide this information readily and help you understand how fees might change over time.

4. Appropriate Investment Options for Cash Value Growth

For indexed and variable universal life policies that offer multiple investment options, ethical insurers provide balanced information about each choice’s potential benefits and risks. They avoid pushing options that generate higher company profits while offering limited value to policyholders. Instead, they recommend allocations appropriate to your financial situation, risk tolerance, and long-term objectives.

When considering policies with investment components, ask about the historical performance of available options, associated management fees, and any limitations on allocation changes. Ethical companies provide materials that show both favorable and unfavorable performance scenarios, helping you make informed decisions about cash value investment strategies.

5. Responsiveness to Policy Owner Needs

Truly ethical insurers demonstrate ongoing commitment to policyholders through responsive service throughout the policy’s lifetime. They make policy information easily accessible, process changes efficiently, and provide regular updates about policy performance. This continuing relationship reflects the company’s recognition that universal life insurance represents a decades-long commitment rather than a one-time transaction.

Before purchasing a policy, research the company’s reputation for customer service after the sale. Contact Georgia’s Insurance Commissioner’s Office to check complaint histories, and ask potential insurers about their policy service standards. Companies with ethical practices welcome these inquiries and can demonstrate their commitment to ongoing policyholder support.

Universal Life Insurance Costs for Georgia Residents

“Benefits of Universal Life Insurance” from mericleco.com and used with no modifications.

Universal life insurance costs vary significantly based on individual factors including age, health, gender, coverage amount, and specific policy features. For a healthy 40-year-old Georgia resident, universal life insurance with $500,000 in coverage might start around $250-350 monthly, with costs increasing for older applicants or those with health conditions. These premiums typically include both the cost of insurance coverage and contributions to the policy’s cash value component. If you’re concerned about overpaying, you might be interested in learning why you might be paying more for life insurance than you need.

The flexibility of universal life policies allows Georgia residents to adjust premium payments above the minimum required amount. Paying higher premiums in early years can substantially increase cash value accumulation, potentially allowing for reduced payments later or creating a self-sustaining policy. This flexibility provides valuable options for managing changing financial circumstances throughout life.

- Cost of insurance charges – Cover the actual mortality risk and typically increase as you age

- Administrative fees – Pay for policy maintenance and servicing

- Premium expense charges – Usually calculated as a percentage of premiums paid

- Cash value contributions – The portion of premiums that builds your policy’s investment component

- Surrender charges – Fees for canceling or substantially withdrawing from policies, typically highest in early years

When comparing costs between providers, Georgia residents should look beyond the quoted premium to understand the complete fee structure. Some policies offer lower initial premiums but charge higher internal costs that reduce cash value growth. Ethical insurers provide transparent cost breakdowns that help you understand the total cost of ownership over the policy’s lifetime.

How to Evaluate a Universal Life Policy’s Ethical Standards

Evaluating a universal life policy’s ethical standards requires looking beyond marketing materials to examine the company’s practices and reputation. Start by requesting sample policy contracts and reviewing them thoroughly, noting any provisions that seem unclear or potentially problematic. Pay special attention to sections dealing with premium increases, interest crediting, and circumstances under which the company might adjust policy terms. For more guidance, you might consider exploring who needs indexed universal life insurance to understand the benefits and considerations involved.

Research the insurer’s financial strength ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. Strong financial ratings indicate the company’s ability to honor long-term commitments—an essential ethical consideration for products intended to last decades. Also review the company’s history of treating policyholders during challenging economic periods, as this reveals much about their commitment to ethical practices under pressure.

Finally, consult with an independent insurance advisor who understands Georgia’s specific insurance market and regulatory environment. These professionals can provide objective assessments of different companies’ ethical practices based on years of working with multiple insurers. Their experience helps identify companies that consistently demonstrate commitment to policyholder interests rather than just profitability. For those interested in universal life insurance in Macon, GA, seeking advice from an experienced advisor can be particularly beneficial.

Universal Life Insurance Tax Benefits for Georgia Residents

Tax-Deferred Growth of Cash Value

One of universal life insurance’s most significant advantages for Georgia residents is the tax-deferred growth of cash value components. Unlike taxable investment accounts where you pay annual taxes on interest, dividends, or capital gains, the cash value in a universal life policy grows without current taxation. This tax deferral allows your money to compound more efficiently over time, potentially resulting in substantially larger accumulation compared to taxable investments with identical returns. For more on why residents are choosing this type of coverage, see our guide on indexed universal life.

Tax-Free Death Benefits to Beneficiaries

The death benefit paid to your beneficiaries from a universal life insurance policy generally transfers income tax-free under current federal and Georgia state tax laws. This tax advantage makes universal life an extremely efficient wealth transfer tool, allowing you to pass significant assets to heirs without the erosion of income taxation. For Georgia families with substantial estates, this tax-free transfer can preserve wealth across generations more effectively than many alternative planning strategies.

Potential for Tax-Free Loans From Policy Value

Universal life insurance offers Georgia residents the ability to access cash value through policy loans that, when structured properly, don’t trigger immediate taxation. These loans aren’t considered taxable income because they represent an advance against the policy’s death benefit rather than a withdrawal of earnings. This tax treatment allows policyholders to supplement retirement income, fund major purchases, or cover emergency expenses using accumulated cash value without the tax consequences typically associated with investment withdrawals.

It’s important to note that these tax benefits remain subject to maintaining the policy as life insurance under IRS guidelines. Withdrawals that exceed your cost basis (premiums paid) or policy loans that cause the policy to lapse can trigger unexpected tax consequences. Working with advisors familiar with both insurance products and tax planning helps Georgia residents maximize these benefits while avoiding potential tax pitfalls.

Making the Right Choice: Human Expertise Trumps AI Automation

“What is Artificial Intelligence (AI …” from www.neilsahota.com and used with no modifications.

While artificial intelligence offers valuable efficiency in many aspects of insurance, Georgia’s recent legislation correctly recognizes that human expertise remains essential for complex life insurance decisions. AI excels at analyzing standard data points and identifying patterns, but struggles with the nuanced judgment needed to evaluate unique personal circumstances. Human insurance professionals bring contextual understanding, ethical reasoning, and personalized guidance that algorithms simply cannot replicate. For more on how Georgia residents can benefit from personalized insurance advice, read about potential savings strategies.

When selecting universal life insurance, working with knowledgeable professionals who understand both product mechanics and your specific needs creates substantially better outcomes. These experts can explain policy features in relation to your financial situation, help you evaluate trade-offs between different options, and provide ongoing guidance as your circumstances change. They serve as advocates who ensure insurance companies treat you fairly throughout the relationship—a role that becomes particularly valuable when navigating policy adjustments or claims.

Frequently Asked Questions

Universal life insurance generates numerous questions due to its complexity and the significant financial commitment it represents. The following answers address common concerns specific to Georgia residents considering these policies in today’s changing regulatory environment.

How does Georgia’s new legislation on AI affect my existing universal life insurance policy?

Georgia’s House Bill 887 primarily affects new coverage decisions rather than existing policies already in force. The legislation requires human review of AI-based recommendations for coverage determinations, ensuring algorithms don’t make final decisions about approvals, premiums, or policy terms without human oversight. If you’re considering changes to your existing policy that would require new underwriting, these protections would apply to that process.

For policy servicing matters on existing coverage, the legislation provides additional consumer protection by ensuring that significant changes aren’t implemented based solely on algorithmic recommendations. This human oversight helps prevent inappropriate adjustments to cost of insurance charges or other policy components based on flawed automated analysis.

What happens to my universal life insurance policy if I move out of Georgia?

Your universal life insurance policy remains in force regardless of where you move, as insurance contracts follow you across state lines. The policy continues operating under the terms established when issued, governed by Georgia regulations in effect at that time. Premium payments, death benefits, and cash value components continue functioning exactly as before, with no need to replace coverage when relocating.

However, if you need to make significant changes to your policy after moving that would require new underwriting, those changes might be subject to regulations in your new state of residence. Additionally, if you purchase new insurance after moving, those policies would be governed by your new state’s insurance regulations rather than Georgia’s protections.

For questions about specific policy provisions after relocation, contact your insurance provider directly, as certain administrative procedures might vary by location even when core policy provisions remain unchanged. For more information on how to manage life insurance costs, you can explore how Georgia residents can still slash life insurance costs after significant changes in the industry.

Can I convert my term life insurance to universal life insurance in Georgia?

Many term life insurance policies issued in Georgia include conversion provisions that allow policyholders to convert to permanent coverage, including universal life, without new medical underwriting. These conversion options typically specify eligible permanent policy types, conversion deadlines, and any special pricing considerations. Reviewing your specific policy contract reveals whether this option exists and what limitations might apply.

When considering conversion, request illustrations showing how the universal life policy would work based on your current age and the coverage amount you wish to maintain. Compare these projections with obtaining a new universal life policy if you remain in good health, as a new policy might offer better pricing despite requiring medical underwriting. Georgia’s new AI legislation ensures that if you apply for new coverage, your application receives appropriate human review rather than being evaluated solely by algorithms.

How do I know if an insurance company is making ethical underwriting decisions?

Evaluating an insurer’s ethical underwriting practices requires examining several indicators. Start by reviewing the company’s complaint history through the Georgia Insurance Commissioner’s Office, which tracks consumer complaints and resolutions. Companies with high complaint ratios related to underwriting or claims practices may have concerning patterns worth investigating further.

Request information about the company’s underwriting guidelines and how they incorporate both technological tools and human judgment. Ethical insurers can explain their process transparently, including how they ensure fair treatment across demographic groups. They typically maintain strong human underwriting departments rather than relying exclusively on automated systems, aligning with Georgia’s new legislative requirements.

What’s the minimum coverage amount for universal life insurance in Georgia?

Georgia state regulations don’t specify minimum coverage amounts for universal life insurance, but most insurance carriers set their own minimum face values, typically starting around $25,000 to $50,000. Some premium insurers focus on larger policies and may set minimums of $100,000 or higher. These minimums reflect the administrative costs of maintaining permanent life insurance policies and the companies’ target markets. For more information on flexible lifetime coverage, check out this article on universal life insurance in Macon, GA.

When considering minimum coverage amounts, it’s important to evaluate whether smaller policies provide good value. Universal life insurance includes various fixed costs that can consume a disproportionate percentage of premiums in smaller policies, potentially reducing cash value growth. For many Georgia residents, a larger policy often provides better overall efficiency and value relative to the premiums paid.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.