Article At A Glance

- Most Americans overestimate life insurance costs by 119-213%, with millennials believing it costs more than double its actual price.

- The average annual cost for a term life insurance policy is around $160 ($13/month) for a healthy 30-year-old, not the $400-1000 many people assume.

- Permanent life insurance can cost 6-10 times more than term insurance while providing coverage when you need it least.

- Insurance needs typically decrease with age as mortgage balances shrink and savings grow.

- Working with Ranwell Insurance agents can help identify the most cost-effective coverage options.

Life insurance doesn’t have to break the bank. In fact, you might be shocked to discover you’re paying several times more than necessary for your coverage. Whether you’ve been sold an expensive policy by a commission-motivated agent or simply haven’t reviewed your coverage in years, there are likely significant savings waiting to be unlocked.

The Hidden Truth About Life Insurance Costs

“How Much Is Life Insurance: Average …” from www.progressive.com and used with no modifications.

The misconception about life insurance costs runs deep in America. According to research by Life Happens and LIMRA, eight out of ten Americans dramatically overestimate what life insurance actually costs. This widespread misunderstanding prevents many families from securing the financial protection they need while causing others to overpay significantly.

Most Americans Overpay by 119-213%

The numbers are staggering. Millennials (ages 15-35) overestimate life insurance costs by an average of 213%, while Gen X (ages 35-55) overestimates by 119%. This perception gap explains why many people either avoid life insurance altogether or end up with overpriced policies. When people believe coverage costs three times its actual price, they’re more vulnerable to sales pitches that don’t represent the best value.

Average Annual Cost is $160, Not $400-1000

For context, a 20-year, $250,000 level term life insurance policy for a healthy 30-year-old typically costs about $160 annually—roughly $13 per month. Yet most Americans estimate this same coverage would cost $400 or more, with some guessing as high as $1,000 per year. That $13 monthly premium costs less than many streaming subscriptions or a few specialty coffees. For the price of one family dinner out, you could potentially cover several months of life insurance. For more insights, check out why life insurance may be more affordable than you think.

Price Perception vs. Reality

Average estimated cost by consumers: $400-1000/year

Actual average cost (healthy 30-year-old): $160/year ($13/month)

Items more expensive than monthly life insurance: Netflix subscription, gym membership, weekly coffee habit

Signs You’re Paying Too Much for Life Insurance

“Are you overpaying for life insurance …” from www.cbsnews.com and used with no modifications.

Many Americans carry unnecessarily expensive life insurance policies without realizing more affordable alternatives exist. Identifying whether you’re overpaying is the first step toward making a change that could save you thousands of dollars over your lifetime. Let’s examine the most common indicators that you might be paying too much.

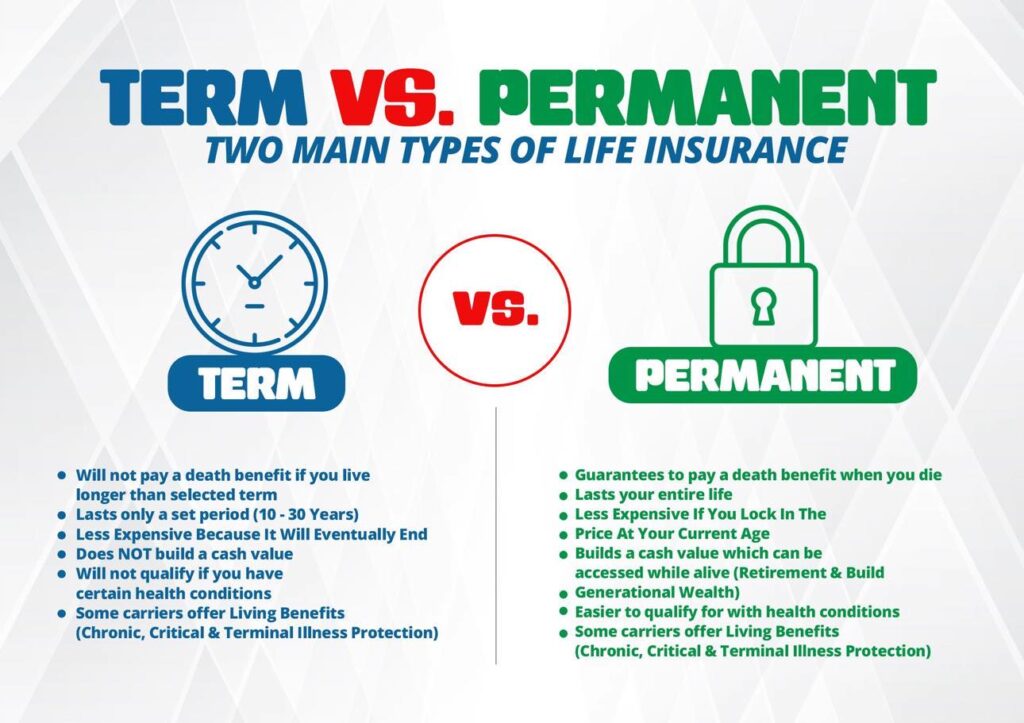

You Purchased Permanent Insurance When Term Would Suffice

The most significant cost difference in life insurance comes down to policy type. Permanent insurance (whole life, universal life, or variable life) often costs 6-10 times more than term insurance for the same death benefit. While permanent insurance includes a cash value component and lifetime coverage, these features come at a premium that most families don’t actually need.

Think of it this way: most people only need substantial life insurance during their working years when others depend on their income. Once you’ve paid off major debts, built retirement savings, and your children are financially independent, your life insurance needs typically decrease dramatically. Yet permanent insurance forces you to pay high premiums during your entire lifetime—including when you need the coverage least. For those looking to manage these costs effectively, slashing life insurance costs can be a practical solution.

An agent once told me about elderly clients in their 80s still paying enormous premiums on permanent policies they purchased decades earlier. By that point, they had spent tens of thousands more than necessary, all while being told they were making a “smart investment.” In reality, they were providing an ongoing revenue stream for their insurance provider long after their actual insurance needs had diminished.

- Term insurance covers you for a specific period (typically 10-30 years) when you need protection most

- Permanent insurance costs 6-10x more for lifetime coverage

- Most people’s insurance needs decrease significantly after age 60

- The money saved by choosing term can be invested elsewhere for potentially higher returns

Your Coverage Exceeds Your Current Financial Obligations

Life insurance exists primarily to replace lost income and cover financial obligations if you die prematurely. Many people carry death benefits far larger than necessary because they haven’t reassessed their needs in years or were sold policies based on exaggerated projections. While it’s important to have adequate coverage, paying for excessive insurance diverts money from other financial priorities like retirement savings or debt reduction. If you’re wondering if you’re paying too much for life insurance, it may be time to reassess your policy.

Your Coverage Exceeds Your Current Financial Obligations

Life insurance exists primarily to replace lost income and cover financial obligations if you die prematurely. Many people carry death benefits far larger than necessary because they haven’t reassessed their needs in years or were sold policies based on exaggerated projections. While it’s important to have adequate coverage, paying for excessive insurance diverts money from other financial priorities like retirement savings or debt reduction.

You’re Still Paying Premiums After Age 60

The most common life insurance mistake I see is people in their 60s, 70s, and even 80s still paying high premiums when they no longer have financial dependents. I recently met a couple in their mid-70s who were spending over $900 monthly on permanent life insurance policies. Their mortgage was paid off, their children were financially independent, and they had substantial retirement savings. Yet they continued making these large payments because “that’s what our insurance guy recommended.” They could have redirected that $10,800 annual expense toward enhancing their retirement lifestyle or legacy planning.

You Own Multiple Overlapping Policies

Another red flag is owning multiple policies purchased at different times that create overlapping, excessive coverage. This often happens when people buy new policies without canceling old ones, or when they purchase supplemental policies through employers, associations, and private carriers without considering their total coverage picture. Each policy generates separate administrative costs and potentially separate commissions, unnecessarily increasing your overall insurance expense.

Why People End Up With Overpriced Policies

“Many Americans Overpay for Car Loans …” from www.consumerreports.org and used with no modifications.

Understanding why so many Americans overpay for life insurance requires looking at the industry’s sales practices and consumer psychology. The life insurance market is complex by design, making direct comparisons difficult and allowing costly options to seem reasonable or even advantageous. Let’s examine what drives people toward expensive policies they don’t need.

Commission-Motivated Sales Tactics

The life insurance industry’s commission structure creates problematic incentives. Agents typically earn 50-100% of the first year’s premium on permanent life policies, compared to much smaller commissions on term policies. This compensation model naturally steers recommendations toward products that generate larger commissions rather than those that best serve client needs. The conversation often shifts from “how much protection do you need” to elaborate pitches about cash value, retirement supplements, and tax advantages that justify the higher premiums.

Consider this typical scenario: you meet with an agent seeking $500,000 of basic coverage to protect your family. Instead of recommending a simple $30/month term policy, you leave with a $300/month permanent policy after hearing about the “investment component” and how you’d be “wasting money on term insurance with nothing to show for it.” What’s rarely disclosed is that the agent might receive $3,600 in first-year commission from the permanent policy versus perhaps $180 from the term option.

Fear-Based Marketing

Insurance companies understand that fear is a powerful motivator. Marketing messages often emphasize worst-case scenarios and play on emotional concerns about family security rather than rational analysis of actual needs. Sales pitches frequently use phrases like “What would happen to your family if you died tomorrow?” or “Can you afford to leave your loved ones unprotected?” These emotional appeals push consumers toward more expensive coverage than necessary, positioning higher premiums as the responsible choice for those who truly care about their families.

Outdated Coverage Never Reviewed

Life insurance needs change dramatically throughout your lifetime, yet most people purchase policies and rarely reassess them. The coverage appropriate for a 30-year-old with young children, a new mortgage, and minimal savings looks completely different from what’s needed at 50 or 60 when the mortgage is smaller, children are independent, and retirement accounts have grown. Without regular reviews, people continue paying for protection they no longer need, often at increasingly high premiums as permanent policies adjust with age.

The Life Insurance Coverage You Actually Need

The fundamental question isn’t how much life insurance you can afford, but how much you actually need. The answer varies based on your specific situation, but follows predictable patterns throughout life. Understanding these patterns helps you avoid overpaying while still maintaining appropriate protection for your loved ones. For more insights, explore how Georgia residents can slash life insurance costs even after significant market changes.

Understanding the Insurance Needs Curve

Life insurance requirements typically follow an inverted U-shaped curve over your lifetime. In your 20s and early 30s, as you start a family and take on major financial obligations like mortgages, your insurance needs increase rapidly. The peak usually occurs in your 30s and 40s when your financial responsibilities are highest and your accumulated assets are still relatively modest.

As you enter your 50s and 60s, your insurance requirements generally decrease. Your mortgage balance shrinks, your children become financially independent, and your retirement savings grow. Eventually, many people reach a point where they’re effectively self-insured – their assets are sufficient to provide for any dependents without additional life insurance. This natural progression explains why permanent insurance often becomes an unnecessary expense later in life.

Calculate Your True Financial Obligations

To determine your actual coverage needs, add up your major financial obligations and subtract your liquid assets. Include your mortgage balance, other debts, estimated education costs for children, and income replacement for dependents. Then subtract savings, existing insurance (through employers), and other assets that could support your family. This calculation provides a much more accurate figure than the common rule of thumb suggesting coverage equal to 10 times your annual salary. For more insights on managing life insurance costs, explore how Georgia residents can still slash life insurance costs.

Most financial advisors recommend focusing on term policies that align with specific financial obligations. For example, a 30-year term policy matching your 30-year mortgage ensures that debt can be eliminated if you die, while a 20-year policy might cover the period until your children are financially independent. This targeted approach provides protection when it’s truly needed without the expense of permanent coverage.

Term vs. Permanent Insurance: The Money Drain

“Life Insurance” from crainfinancial.com and used with no modifications.

The decision between term and permanent insurance represents the single largest factor in whether you’re overpaying for life insurance. While both products provide a death benefit, the price difference is dramatic, and the additional features of permanent insurance rarely justify the extra cost for most families.

Many financial experts describe permanent life insurance as “bundling” two products – basic death benefit protection (insurance) and a forced savings component (investment). This bundling typically results in higher fees, lower investment returns, and less flexibility than keeping these functions separate. For most people, buying term insurance and investing the premium difference elsewhere creates significantly more wealth over time. To explore this further, you can read about why you’re paying too much for life insurance.

Cost Comparison: Term Costs 6-10x Less

The price differential between term and permanent insurance is staggering. For a healthy 35-year-old seeking $500,000 of coverage, a 20-year term policy might cost $30 monthly while a whole life policy for the same death benefit could run $300-400 monthly. That difference – approximately $270-370 monthly or $3,240-4,440 annually – compounds dramatically over time. If invested in a simple index fund averaging 7% returns, those premium savings would grow to $143,000-$196,000 after 20 years, potentially far exceeding the cash value in a whole life policy.

Insurance agents often downplay this enormous cost difference by emphasizing the “permanent” nature of whole life coverage and its cash value component. What they rarely explain is that most of your early premium dollars go toward commissions and fees, not your cash value, and that the internal rate of return on the investment portion typically underperforms even conservative investment alternatives.

When Permanent Insurance Actually Makes Sense

Despite the cost disadvantages, permanent insurance does serve legitimate purposes for specific situations. If you have a special-needs dependent who will require lifelong financial support, permanent coverage ensures that funding regardless of how long you live. Wealthy individuals sometimes use permanent policies for estate planning or tax advantages, particularly when they’ve already maximized other tax-advantaged investment options. Business succession plans may also utilize permanent insurance to fund buy-sell agreements.

These specialized cases represent a small minority of life insurance purchasers. For most families, term insurance aligned with specific time-limited needs provides the most cost-effective protection. The money saved by choosing term can then be directed toward retirement accounts, college savings, debt reduction, or other financial priorities with potentially higher returns and greater flexibility.

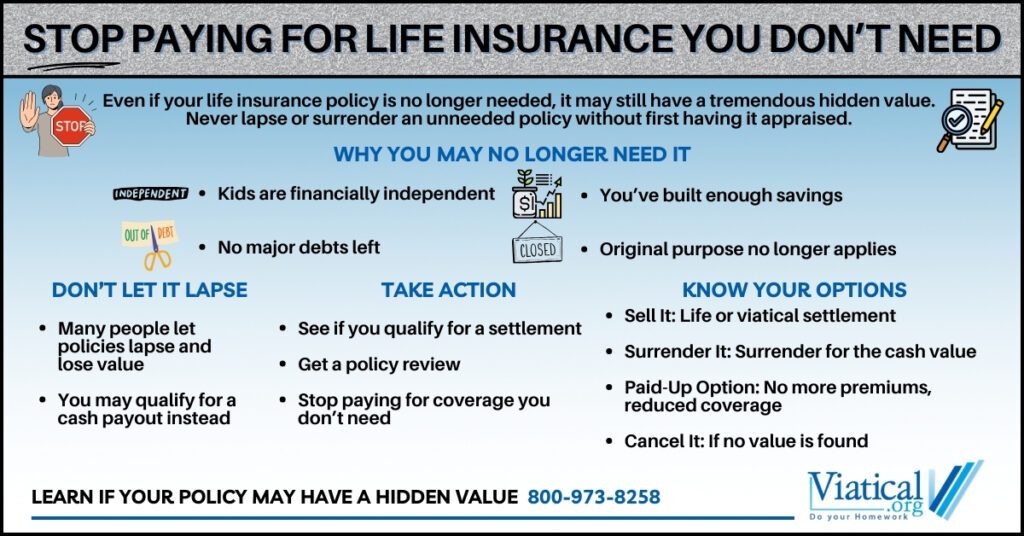

The Surrender Charge Trap

Many permanent life insurance policyholders discover they’re overpaying only after they’ve owned their policy for several years. Unfortunately, walking away isn’t always straightforward due to surrender charges – penalties for canceling the policy before a specified period (typically 7-15 years). These charges can claim a significant portion of any accumulated cash value, effectively trapping policyholders in expensive coverage they no longer want.

I recently advised a client who had paid $450 monthly for seven years into a universal life policy with a $175,000 death benefit. Despite contributing nearly $38,000 in premiums, his cash surrender value was only $12,600 due to high fees, commissions, and surrender charges. This trap makes it essential to carefully evaluate life insurance decisions from the beginning rather than assuming you can easily reverse course later.

5 Steps to Reduce Your Life Insurance Costs Today

“Stop Paying for Life Insurance You Don …” from viatical.org and used with no modifications.

If you suspect you’re overpaying for life insurance, taking action can potentially save you thousands of dollars over your lifetime. Here’s a systematic approach to reducing your costs while maintaining appropriate coverage for your family’s needs. For Atlanta families, exploring the best time to get term life insurance quotes can be an essential step.

1. Reassess Your Current Coverage Needs

Start by calculating how much protection your family actually requires based on your current situation, not what you needed when you first purchased coverage. Add up outstanding debts, education expenses for children, income replacement needs for dependents, and final expenses. Subtract existing assets, employer-provided insurance, and Social Security survivor benefits to determine your true coverage gap. Many people discover their insurance needs have decreased significantly as they’ve paid down debts, accumulated savings, and had children grow independent.

Remember that the primary purpose of life insurance is replacing lost income and covering specific financial obligations – not creating inheritance. Once your assets are sufficient to provide for your dependents, maintaining expensive coverage becomes unnecessary. For many people, this means their coverage needs decrease dramatically after age 60. If you are considering options, you might want to explore term life insurance quotes to find a plan that suits your current needs.

2. Compare Term Insurance Quotes

The life insurance marketplace has become increasingly competitive and transparent in recent years. Online comparison sites now allow you to quickly gather quotes from multiple providers without pushy sales tactics. To maximize your savings, compare policies with identical death benefits and terms across at least 5-7 companies, focusing on insurers with strong financial ratings (A or better from AM Best). The premium difference between companies for the exact same coverage can easily vary by 30% or more. For more insights, check out this discussion on life insurance costs.

When comparing quotes, pay close attention to the rate class assumptions. Some quotes might show “preferred plus” rates that require exceptional health metrics, while you might actually qualify for “standard” rates. An independent broker who represents multiple companies can help determine which insurers are likely to offer you the most favorable health classification based on your specific medical profile. For Georgia residents, there are strategies to slash life insurance costs even after market changes.

3. Consider Ladder Strategy for Coverage

Instead of purchasing a single large policy, consider a “laddering” approach that matches different coverage amounts and terms to specific financial obligations. For instance, rather than buying one $1 million 30-year policy, you might purchase: a $500,000 30-year policy to cover your mortgage, a $300,000 20-year policy for college expenses, and a $200,000 10-year policy for other debts. As each term expires, your coverage naturally decreases to align with your declining insurance needs, saving substantial premium dollars over time.

This strategy acknowledges that your largest insurance needs are typically temporary. As your mortgage balance decreases and college funding is completed, your insurance requirements naturally decline. Laddering allows your coverage to mirror this progression without requiring policy cancellations or adjustments.

4. Improve Your Health Rating

Life insurance premiums are heavily influenced by your health classification. Moving from a “Standard” to “Preferred” rating can reduce your premiums by 20-30%, while achieving “Preferred Plus” status might save 40-50% compared to Standard rates. Simple health improvements like maintaining healthy weight, controlling blood pressure, quitting smoking, or managing cholesterol can potentially save thousands of dollars over the life of your policy. If you’ve made significant health improvements since purchasing your current policy, applying for new coverage might result in substantial savings.

Some insurers offer more favorable ratings for specific health conditions than others. For example, company A might classify controlled sleep apnea as a standard risk while company B offers preferred rates for the same condition. Working with an experienced broker familiar with different companies’ underwriting guidelines can help match your specific health profile to the most favorable insurer.

5. Review and Adjust Coverage Every 5 Years

Life Insurance Checkpoints

Age 30-40: Maximum coverage needed (mortgage, young children)

Age 40-50: Begin reducing coverage as debts decrease

Age 50-60: Significant reduction as children become independent

Age 60+: Minimal coverage for final expenses only

Life insurance needs aren’t static, yet many people purchase policies and never reassess them. Setting a calendar reminder to review your coverage every five years ensures your protection aligns with your current situation rather than past circumstances. During these reviews, consider whether your existing policies still match your financial obligations and whether market changes offer opportunities for better rates.

These periodic checkups are especially important if you’ve purchased permanent insurance with the assumption you’d need coverage throughout your lifetime. As you approach retirement with substantial assets, the original rationale for expensive permanent coverage may no longer apply. Converting to a paid-up policy with a reduced death benefit or replacing with a small term policy could eliminate ongoing premium obligations while maintaining essential protection. For those considering alternatives, understanding who needs whole life insurance can provide valuable insights.

If your health has declined since purchasing your current policy, these reviews might confirm you should maintain existing coverage rather than seeking new options. However, even in these cases, you might discover opportunities to adjust death benefits or reduce optional riders to better match your current needs and budget.

When reviewing policies sold by commissioned agents, consider seeking a second opinion from a fee-only financial advisor who doesn’t sell insurance products. Their unbiased assessment can help determine whether your coverage aligns with your financial plan without the inherent conflict of interest that commissioned recommendations might involve.

When Canceling Existing Policies Makes Sense (And When It Doesn’t)

“Can You Cancel Your Life Insurance …” from www.insurancehero.org.uk and used with no modifications.

If you’ve discovered you’re paying for coverage you no longer need, canceling or replacing existing policies might seem like the obvious solution. However, this decision requires careful analysis of surrender charges, tax implications, and insurability concerns. Making the wrong move could cost you more than continuing with slightly overpriced coverage.

The most important rule when considering policy cancellation is never to cancel existing coverage until new protection is in place (if still needed). Even a small gap in coverage creates unnecessary risk, particularly if health issues arise during the transition. Many insurance companies allow you to time the cancellation of old policies with the effective date of new coverage, ensuring continuous protection throughout the process.

Evaluating Surrender Charges

Permanent life insurance policies typically impose surrender charges for the first 7-15 years, often starting at 7-10% of the cash value and gradually decreasing over time. If you’re still within this surrender period, calculate whether the premium savings from a new policy would offset these penalties within a reasonable timeframe. Sometimes it makes financial sense to wait until surrender charges decrease further before making a change, particularly if you’re close to the end of the surrender period.

Securing New Coverage First

The golden rule of replacing life insurance is always securing new coverage before canceling existing policies. Health conditions can develop unexpectedly, potentially making new insurance unaffordable or unavailable. Apply for and receive approval on replacement coverage before terminating your current policy. Most insurers will allow you to coordinate the timing so the new policy takes effect just as the old one terminates, ensuring no gap in protection for your family.

If health issues prevent you from qualifying for new coverage at reasonable rates, maintaining your existing policy might be the prudent choice despite higher premiums. In these cases, explore options with your current insurer to reduce coverage amounts or convert to paid-up insurance to lower costs while maintaining some protection.

Frequently Asked Questions

When helping clients optimize their life insurance costs, certain questions arise consistently. These answers address the most common concerns about reducing insurance expenses while maintaining appropriate financial protection.

Will canceling my expensive policy hurt my credit score?

No, canceling a life insurance policy has no direct impact on your credit score. Unlike loans or credit cards, life insurance premiums and policy details aren’t reported to credit bureaus. You can cancel or replace policies without concern about credit implications, though you should ensure any policy loans are addressed before cancellation to avoid unexpected tax consequences.

What’s the best age to switch from permanent to term insurance?

The optimal time to convert from permanent to term coverage is typically before age 50, when term rates are still reasonable and you’ve likely accumulated sufficient assets to reduce your overall insurance needs. After age 50-55, term insurance becomes progressively more expensive, potentially offsetting some savings from switching. The decision should balance potential premium savings against surrender charges on your existing policy.

Your health status also significantly impacts this decision. If your health has deteriorated since purchasing your permanent policy, the higher term rates associated with your current condition might outweigh potential savings from switching. In these cases, exploring reduced paid-up options with your current insurer might provide better value than seeking new coverage.

The financial strength of your existing policy matters too. Some older whole life policies from mutual insurance companies have dividend histories that make them worth keeping despite higher premiums. Have a fee-only advisor analyze your in-force illustration before making any changes to ensure you’re not surrendering a policy with favorable performance characteristics.

Finally, consider your remaining insurance needs timeline. If you only need coverage for another 5-10 years, the upfront costs of switching policies might not be recouped through premium savings over that short period. Converting your existing permanent policy to a reduced paid-up status might offer a better solution in these situations.

Switching From Permanent to Term Insurance: Key Factors

– Current age (under 50 typically favorable)

– Health status (new health issues may make switch costly)

– Financial performance of existing policy

– Surrender charge period remaining

– Length of continued coverage needed

Can I convert my whole life policy to something more affordable?

Most permanent policies offer options to reduce costs without complete cancellation. You might convert to a reduced paid-up policy (stopping premiums while maintaining a lower death benefit), use accumulated dividends to offset premiums, or reduce the death benefit to lower ongoing costs. These approaches avoid surrender charges while decreasing or eliminating your premium obligations. Contact your insurance company to request an in-force illustration showing these options based on your specific policy provisions.

How do I know if I need life insurance at all?

You need life insurance if others would suffer financial hardship from your death. This typically includes people with dependent children, spouses who rely on their income, substantial debts that would burden others, or business partners. If you’re single with no dependents, have sufficient assets to cover final expenses, and no significant debts, you might not need life insurance at all. Many retirees with adequate savings, paid-off homes, and no dependents discover they can safely reduce or eliminate life insurance coverage.

What happens to the cash value in my policy if I cancel it?

When canceling a permanent life policy, you typically receive the cash surrender value (the accumulated cash value minus any surrender charges and outstanding loans). This distribution may have tax implications if the surrender value exceeds the premiums paid over the life of the policy. Before canceling, request an illustration showing your exact surrender value and consult with a tax professional about potential tax consequences, especially if you’ve had the policy for many years with substantial cash accumulation. For more information on lifetime security options, see why whole life insurance is a top choice in Atlanta, GA.

Rather than surrendering for cash, you might consider a 1035 exchange into an annuity if you no longer need life insurance but want to preserve the policy’s tax-deferred growth. This approach transfers your cash value to an annuity without triggering immediate taxation, potentially providing more favorable options for retirement income planning.

Life insurance is a crucial component of financial planning, providing peace of mind and security for your loved ones. Many people overlook the importance of mortgage protection life insurance, which can safeguard your home in the event of an untimely death. It’s essential to evaluate your options and choose a policy that aligns with your long-term goals and financial needs.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.