Key Takeaways

- Georgia residents with high-risk conditions can still secure life insurance coverage.

- Medical conditions like diabetes, heart disease, and cancer don’t automatically disqualify you from coverage in Georgia – specialized policies exist for nearly every health situation.

- Guaranteed issue policies offer an accessible option for Georgia residents labeled “uninsurable,” with no medical questions or exams required.

- Ranwell Insurance specializes in helping Georgia residents with high-risk conditions find appropriate life insurance coverage tailored to their unique situations.

- Working with Ranwell Insurance who specializes in high-risk cases can significantly improve your chances of finding affordable coverage in Georgia.

Hope for the ‘Uninsurable’: Georgia Residents Can Still Get Life Insurance

“How Many People Live In Atlanta …” from atlantafi.com and used with no modifications.

Being labeled “high-risk” or “uninsurable” doesn’t mean you can’t get life insurance coverage in Georgia. The truth is, almost everyone can secure some form of life insurance protection, regardless of their health status or risk factors. Insurance companies may view certain conditions as red flags, but specialized policies and carriers exist specifically to serve those with complex health histories.

In Georgia, residents face unique challenges when seeking life insurance with pre-existing conditions. The state’s higher-than-average rates of diabetes, heart disease, and obesity can complicate applications. However, the Georgia Office of Insurance and Safety Fire Commissioner provides consumer protections that help ensure access to coverage. Ranwell Insurance, a leading provider of supplemental insurance, helps Georgia residents navigate these challenges to find appropriate coverage options regardless of medical history.

Understanding your options is critical when traditional policies seem out of reach. From guaranteed issue plans to graded death benefit policies and group coverage through employers, multiple pathways exist for Georgia residents with significant health concerns. Even with conditions like diabetes, heart disease, or cancer history, you can find protection for your loved ones—though you may need to explore beyond conventional coverage types.

- Guaranteed issue policies offer coverage with no health questions or medical exams

- Group policies through Georgia employers often accept higher-risk individuals

- Graded benefit policies provide coverage with a waiting period for full benefits

- Simplified issue policies ask limited health questions but no medical exam

- Modified traditional policies offer full coverage with higher premiums

Working with an agent who specializes in high-risk cases is perhaps the most valuable step you can take. These professionals understand which Georgia insurance carriers are more lenient with specific conditions and can guide you through the application process to maximize your chances of approval. They can also help you understand how to time your application for the best possible outcome, especially if you’ve recently made positive health changes or reached important treatment milestones.

Why Georgia Residents Get Labeled “High-Risk” or “Uninsurable”

“Everything about Diabetes Mellitus, the …” from hospitalcmq.com and used with no modifications.

Risk Classification Factors in Georgia

Medical Conditions: Diabetes, heart disease, cancer, obesity

Lifestyle Factors: Tobacco use, alcohol consumption, dangerous hobbies

Occupational Risks: Construction, fishing, aviation, timber, agriculture

Age Considerations: Advanced age increases risk rating

Driving Record: DUIs, multiple violations significantly impact rates. For seniors in Atlanta, it’s crucial to get final expense insurance quotes to mitigate potential financial burdens.

Insurance companies assess risk based on mortality statistics, and certain factors statistically correlate with shorter lifespans. In Georgia, insurers follow standardized underwriting guidelines that place applicants into risk categories—from “preferred plus” to “standard” to various “substandard” ratings. These ratings determine whether you’ll be approved and how much you’ll pay. Each insurer maintains proprietary underwriting guidelines, meaning a decline from one company doesn’t necessarily mean rejection from all companies.

Medical conditions represent the most common reason Georgia residents receive high-risk classifications. Chronic conditions like diabetes, heart disease, kidney disease, and cancer history trigger careful scrutiny from underwriters. The severity, treatment compliance, and stability of your condition all factor into the decision. For example, well-controlled Type 2 diabetes might result in a moderate rating increase, while recently diagnosed Type 1 diabetes could lead to much higher premiums or even a decline.

Beyond health issues, lifestyle choices significantly impact insurability in Georgia. Tobacco use remains one of the most significant premium drivers, often doubling rates compared to non-smokers. Alcohol consumption histories, particularly those involving treatment or legal issues, raise red flags. High-risk hobbies like skydiving, rock climbing, or private aviation can similarly trigger rate increases or policy exclusions.

Lifestyle Factors Insurance Companies Flag

Georgia’s outdoor recreation opportunities come with insurance considerations. Hunting, one of the state’s popular activities, generally doesn’t affect rates unless it involves dangerous methods or exotic locations. However, scuba diving beyond recreational depths, private aviation, and extreme sports like rock climbing or racing can trigger significant premium increases or exclusions. Insurance companies typically evaluate these activities based on frequency, skill level, safety measures, and professional versus amateur status. For instance, a Georgia resident who occasionally rides motorcycles for leisure may see a small premium increase, while a professional motocross competitor might face substantial surcharges or struggle to find coverage altogether.

Age-Related Concerns for Georgia Seniors

Age represents a significant factor in life insurance underwriting, with rates increasing substantially for Georgia residents over 60. While younger applicants might receive preferred rates despite minor health issues, seniors often face standard or substandard classifications even with well-controlled conditions. Georgia’s substantial retiree population means many seniors seek coverage later in life, when securing affordable policies becomes challenging. Insurance companies generally limit term length options for older applicants, with most carriers capping availability around age 80. Traditional policies typically charge significantly higher premiums for seniors, making specialized products like final expense or guaranteed issue insurance increasingly important options for Georgia’s aging population.

How Georgia Insurance Laws Affect High-Risk Applicants

Georgia insurance regulations provide important protections for high-risk applicants while still allowing carriers to set appropriate rates based on risk factors. The state prohibits unfair discrimination in underwriting but permits reasonable differentiation based on sound actuarial principles. Georgia’s Office of Insurance and Safety Fire Commissioner oversees carrier practices and provides consumer assistance for residents facing unfair denials. Unlike some states, Georgia doesn’t mandate guaranteed issue options for medically underwritten life insurance, meaning carriers can decline applications based on health status. However, the state does require insurers to provide clear explanations for adverse underwriting decisions and prohibits arbitrary denials without actuarial justification, giving high-risk applicants certain procedural protections.

5 Types of Life Insurance Available for High-Risk Georgia Residents

“Life Insurance …” from napkinfinance.com and used with no modifications.

Finding life insurance when you’re classified as high-risk doesn’t mean settling for inadequate coverage. Georgia residents have multiple policy types designed specifically for various risk levels. Each option balances accessibility with cost and coverage limitations. Understanding these distinctions helps you select the most appropriate protection for your specific situation while avoiding unnecessary premium increases. For instance, whole life insurance is a popular choice for those seeking lifetime security.

1. Guaranteed Issue Life Insurance: No Medical Questions Asked

Guaranteed issue policies represent the most accessible option for Georgia residents with serious health conditions. These policies accept virtually all applicants regardless of medical history, with no health questions or medical exams required. Coverage amounts typically range from $5,000 to $25,000, making them appropriate for final expense planning rather than income replacement. The trade-off for this guaranteed acceptance is significantly higher premiums and a graded benefit period, usually 2-3 years, during which death from natural causes pays only a return of premiums plus interest rather than the full death benefit. Accidental deaths, however, are typically covered immediately at the full amount. For more information, you can explore life insurance with pre-existing conditions.

2. Graded Death Benefit Policies: Understanding the Waiting Period

Graded death benefit policies offer a middle ground between guaranteed issue and fully underwritten coverage for Georgia residents with health concerns. These policies implement a waiting period—typically 2-3 years—during which death benefits are limited for natural causes. If the insured dies from natural causes during this period, beneficiaries receive a return of premiums paid plus interest (usually 10-15%), rather than the full face value. After the waiting period expires, the full death benefit becomes available regardless of cause of death. Most graded benefit policies still pay the full death benefit immediately for accidental deaths, even during the waiting period.

3. Group Life Insurance Through Georgia Employers

Many Georgia employers offer group life insurance as part of their benefits package, presenting a valuable opportunity for high-risk individuals. These policies typically provide basic coverage (often 1-2 times annual salary) without medical underwriting, making them accessible regardless of health status. For Georgia residents with serious conditions, employer-provided coverage may represent the most affordable option, though coverage amounts are usually limited. Some Georgia employers allow employees to purchase additional coverage through guaranteed issue or simplified issue options during open enrollment periods. The primary disadvantage is portability—if you leave your job, you may lose coverage, though some policies offer conversion options to individual plans without medical qualification. For more information on related insurance options, consider exploring mortgage protection life insurance for Georgia homeowners.

4. Simplified Issue Policies: Limited Health Questions

Simplified issue policies strike a balance between accessibility and affordability for Georgia residents with moderate health concerns. These policies require answering a limited set of health questions but skip the medical exam, making the application process quicker and less invasive. Coverage amounts typically range from $25,000 to $500,000, higher than guaranteed issue but lower than fully underwritten policies. While simplified issue policies cost more than standard coverage, they’re generally more affordable than guaranteed issue options. Georgia residents with well-managed chronic conditions or those who have passed the highest-risk period following a serious diagnosis often find approval through simplified issue policies when traditional coverage remains unavailable.

5. Modified or Rated Traditional Policies

For Georgia residents with moderate health issues, modified or rated traditional policies often provide the most coverage for the best value. These are standard term or permanent life insurance policies that have been adjusted with higher premiums to account for increased risk. Insurance companies assign “table ratings” based on the severity of health conditions, with each table level typically adding 25% to the standard premium. A Georgia resident with well-controlled diabetes might receive a Table 2 rating (50% above standard rates), while someone with a recent cancer history might be rated Table 8 (200% above standard) or higher. Despite the higher cost, these policies provide full death benefits immediately and offer the highest coverage amounts available to high-risk applicants, often reaching $1 million or more.

| Policy Type | Medical Requirements | Typical Coverage Limits | Waiting Period | Best For |

|---|---|---|---|---|

| Guaranteed Issue | None | $5,000-$25,000 | 2-3 years | Severe health conditions |

| Graded Benefit | Limited questions | $5,000-$50,000 | 2-3 years | Serious health issues |

| Group Life | None | 1-2x salary | None | Employed individuals |

| Simplified Issue | Health questions, no exam | $25,000-$500,000 | None or shorter | Moderate health issues |

| Modified Traditional | Full underwriting | Up to $1M+ | None | Well-controlled conditions |

The application process varies significantly between these policy types. Guaranteed issue policies can be secured in minutes with just basic personal information, while modified traditional policies require comprehensive medical underwriting that may take 4-8 weeks. Georgia residents should weigh the trade-offs between convenience, coverage amount, and premium costs when selecting the appropriate policy type. Working with an independent agent who specializes in high-risk cases can help identify which carriers are most likely to offer favorable terms for your specific situation.

Ranwell Insurance works with Georgia residents to identify appropriate coverage options based on their specific health conditions and coverage needs. By evaluating medical history, current treatment protocols, and other risk factors, Ranwell Insurance can recommend the most suitable policy type and help navigate the application process to maximize chances of approval at the best possible rates. For those considering different life insurance options, exploring whole life insurance might be a valuable step in planning for lifetime security.

Real Coverage Costs for High-Risk Conditions in Georgia

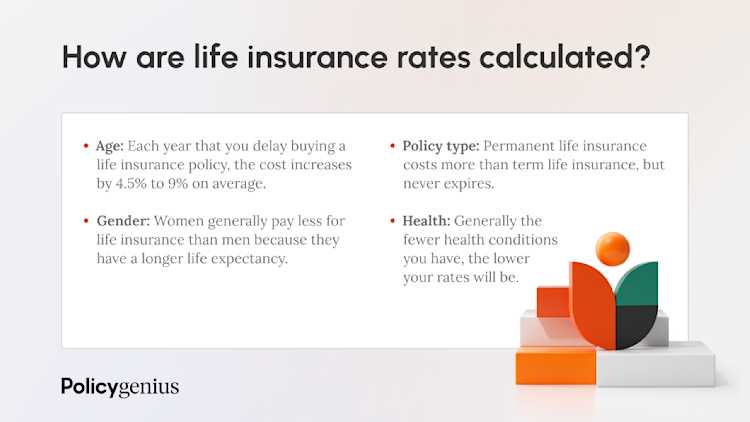

“Life Insurance Rates: $500K Term …” from www.policygenius.com and used with no modifications.

Life insurance premiums for high-risk applicants in Georgia vary dramatically based on the specific condition, its severity, treatment compliance, and the time elapsed since diagnosis or treatment. While standard rates for a healthy 40-year-old Georgian might be $25-35 monthly for $500,000 of term coverage, high-risk applicants could see premiums increase 25-400% depending on their risk classification. Understanding these cost variations helps set realistic expectations and budget appropriately for the protection your family needs.

Price Ranges for Different Policy Types

Guaranteed issue policies typically cost $50-300 monthly for Georgia residents, depending on age, gender, and coverage amount, though these policies offer limited death benefits ranging from $5,000-25,000. Simplified issue policies generally run $75-500 monthly for coverage between $25,000-500,000, with pricing heavily influenced by the specific health questions and how you answer them. Graded benefit policies fall somewhere in between, offering moderate coverage at premium rates higher than standard policies but potentially lower than guaranteed issue options. For traditional policies with table ratings, each rating level typically adds 25% to standard premiums, so a Table 4 rating would increase premiums by 100% over standard rates. Georgia residents with serious but well-managed conditions often find this option provides the best balance of coverage and affordability despite the higher initial cost.

How Coverage Amounts Affect Premiums

Life insurance premiums don’t scale linearly with coverage amounts, creating important considerations for high-risk Georgia residents. Coverage of $500,000 doesn’t cost twice as much as $250,000—it’s often only 70-80% more expensive due to administrative cost efficiencies. This pricing structure means that reducing coverage amounts to save money may not be as effective as expected. For example, cutting coverage in half might only reduce premiums by 30-40%, potentially leaving your family underprotected to save relatively modest premium dollars.

This pricing dynamic becomes particularly relevant for high-risk applicants already facing elevated premiums. A Georgia resident with well-controlled Type 2 diabetes might pay $150 monthly for $250,000 of coverage but only $240 monthly for $500,000—making the higher coverage amount potentially more cost-efficient on a per-thousand basis. When evaluating coverage amounts, focus on your family’s actual financial needs rather than selecting an arbitrary reduction to manage costs, as the savings may not justify the coverage sacrifice.

Ways to Lower Your Costs

Despite being classified as high-risk, Georgia residents can employ several strategies to secure more affordable coverage. Improving controllable health factors often yields significant premium reductions—maintaining medication compliance, achieving better lab results, documenting weight loss, or reaching milestone periods since diagnosis or treatment completion. For example, a Georgian diagnosed with early-stage breast cancer might face prohibitive rates immediately after treatment but could qualify for standard rates after remaining cancer-free for 3-5 years. Similarly, reducing A1C levels below 7.0 could move a diabetic applicant from a high substandard rating to a lower table rating or even standard rates with certain carriers. For those considering their options, it’s worthwhile to explore whole life insurance as a potential solution for long-term security.

Working with an independent broker who specializes in high-risk cases represents perhaps the most effective cost-saving strategy. These professionals understand which Georgia insurance carriers are more lenient with specific conditions and can guide your application to companies most likely to offer favorable terms. For instance, some carriers view controlled sleep apnea as a standard risk while others apply significant ratings, creating opportunities for substantial premium savings through strategic carrier selection. Additionally, consider laddering multiple policies with different term lengths to match your declining insurance needs over time, potentially reducing lifetime premium costs while maintaining appropriate coverage when your family needs it most.

- Shop multiple carriers specializing in your specific condition

- Improve controllable health metrics before applying

- Document treatment compliance and stability

- Consider a combination of policy types for comprehensive coverage

- Apply when you reach milestone periods since diagnosis/treatment

- Adjust coverage amounts to match actual financial needs

- Explore rider options that allow future coverage increases

Remember that each insurance company evaluates risk differently, so receiving a high-rate offer or decline from one carrier doesn’t necessarily reflect your options across the entire market. Georgia residents with complex health histories often secure surprisingly affordable coverage after exploring multiple carriers through an experienced broker familiar with each company’s underwriting preferences.

Get Protected Today: Next Steps for Georgia Residents

“High-Risk Life Insurance …” from guaranteedissuelife.com and used with no modifications.

Securing life insurance with high-risk conditions requires strategic planning and informed decision-making. Begin by gathering your medical records, including treatment history, medication lists, and recent lab results. This documentation helps you present your health situation accurately and highlights positive factors like treatment compliance and condition stability. Most Georgia residents find better outcomes when they address controllable risk factors before applying—improving metrics like blood pressure, cholesterol, A1C levels, or achieving significant milestones since diagnosis or treatment completion. For those considering options, exploring whole life insurance can be a beneficial step in securing long-term protection.

Working with an independent broker who specializes in high-risk cases is perhaps the most crucial step in finding appropriate coverage. These professionals understand which carriers offer more favorable terms for specific conditions and can guide your application accordingly. Avoid submitting multiple applications simultaneously, as declined applications become part of your insurance record and can complicate future applications. Instead, allow your broker to strategically approach carriers one at a time, starting with those most likely to offer favorable terms for your specific situation.

- Gather complete medical documentation before applying

- Address controllable health factors and document improvements

- Work with an independent broker specializing in high-risk cases

- Apply strategically to carriers most likely to approve your condition

- Consider combining policy types for comprehensive coverage

- Be completely honest about health history to avoid claim denials

Ranwell Insurance understands the challenges Georgia residents face when seeking life insurance with complex health histories. Our specialists work with clients to identify appropriate coverage options based on their specific conditions and financial needs. We help navigate the application process to maximize approval chances at the most favorable rates possible. Remember, being classified as high-risk doesn’t mean you can’t protect your family—it simply requires more specialized knowledge to find the right policy for your situation.

Frequently Asked Questions

Georgia residents with high-risk conditions frequently have questions about their life insurance options. Here are answers to some of the most common queries we receive from applicants navigating the specialized high-risk market.

Can I get life insurance if I’ve been diagnosed with cancer in Georgia?

Yes, many Georgia residents with cancer histories secure life insurance, though options vary based on cancer type, stage, treatment success, and time elapsed since treatment. Most traditional carriers consider applications after you’ve been cancer-free for 2-5 years, with more favorable rates becoming available as you reach the 5-10 year mark post-treatment. For recent diagnoses or those still in treatment, guaranteed issue policies offer immediate options with no health questions, though with limited coverage amounts typically between $5,000-25,000 and higher premiums.

Some specialized carriers offer more lenient underwriting for specific cancer types with favorable prognoses. For example, early-stage, well-differentiated prostate cancer might qualify for standard or slightly rated policies even shortly after treatment with certain insurers. Working with a broker who specializes in high-risk cases helps identify these carrier-specific opportunities that might not be apparent when applying directly to companies or through general agents. For those in Georgia, getting final expense quotes now can save your family thousands.

How long after a heart attack must I wait before applying for life insurance in Georgia?

Most Georgia insurance carriers prefer applications 6-12 months after a heart attack, when your condition has stabilized and the effectiveness of treatment becomes apparent. During this waiting period, focus on documenting treatment compliance, cardiac rehabilitation participation, lifestyle modifications, and improved metrics like cholesterol levels and blood pressure readings. These positive factors can significantly improve your classification and premium rates. While waiting, consider guaranteed issue or simplified issue policies for immediate coverage, then transition to traditional coverage when timing improves your prospects for favorable underwriting. For more details on types of life insurance, explore whole life insurance options available in Georgia.

Are guaranteed issue policies worth the higher premiums?

Guaranteed issue policies serve a specific purpose for Georgia residents who cannot qualify for other coverage types due to serious health conditions. While premiums are significantly higher relative to the coverage amount (often 3-5 times more expensive than standard policies), these policies provide essential protection when no other options exist. They’re particularly valuable for covering final expenses and small debts without burdening family members. The key consideration is whether you have alternative coverage options—if you can qualify for simplified issue or rated traditional policies, those typically provide better value. However, for Georgia residents with severe health conditions who would otherwise remain uninsured, guaranteed issue policies offer valuable protection despite the premium cost.

Will my diabetes automatically disqualify me from traditional life insurance?

Diabetes alone rarely disqualifies Georgia residents from traditional life insurance completely. Insurance companies evaluate diabetic applicants based on several factors: type (Type 2 generally receives more favorable rates than Type 1), age at diagnosis, control measures (A1C levels, typically seeking below 7.0), presence of complications, and other health factors. Well-controlled diabetes without significant complications might receive standard rates with certain carriers or moderate table ratings with others. Even with suboptimal control, most diabetic applicants can secure coverage, though with higher premium ratings. Several carriers specialize in diabetic applicants and offer more competitive terms, making broker selection particularly important for accessing these specialized underwriting opportunities.

Can I convert my employer group policy to an individual policy if I leave my job?

Many employer group policies in Georgia include conversion provisions allowing you to transition to an individual policy without medical qualification if you leave your job. These converted policies typically offer permanent coverage (whole life) rather than term, resulting in higher premiums than your group coverage. However, the key advantage is guaranteed approval regardless of health conditions that might otherwise make you uninsurable. Review your certificate of coverage or consult your benefits administrator to understand the specific conversion options, deadlines (typically 31 days after employment ends), and premium structures available under your plan. While converted policies cost more than group coverage, they may represent the most affordable option for Georgia residents with serious health conditions who lose employer-provided insurance.

Life insurance remains accessible for nearly all Georgia residents, regardless of health status or risk classification. Understanding your options and working with knowledgeable professionals helps identify appropriate coverage to protect your loved ones, even when traditional pathways seem closed. With proper guidance, most high-risk applicants find suitable protection at premiums that fit their budget.

For personalized assistance navigating the high-risk life insurance market in Georgia, contact Ranwell Insurance today to speak with a specialist who understands your unique situation and can help identify the most appropriate coverage options.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.