Key Takeaways

- Most life insurance policies remain intact when seniors move out of Georgia, as they’re contracts with national insurance companies, not state-specific programs

- Ranwell Insurance specializes in helping seniors maintain seamless life insurance coverage during interstate moves

- Unlike Medicare and Medicaid, life insurance typically doesn’t require geographical adjustments when relocating

- Updating your address with your insurance provider is critical to ensure you continue receiving important policy documents and premium notices

- Some seniors may benefit from reviewing their life insurance coverage amounts when moving to areas with different costs of living

Moving to a new state can be stressful for seniors, especially when considering what happens to your various insurance policies. The good news is that life insurance typically travels with you seamlessly when you relocate from Georgia to another state. Unlike health insurance programs like Medicare and Medicaid that may require significant adjustments, your life insurance policy is a contract between you and your insurance company that remains valid regardless of where you live in the United States. Ranwell Insurance helps seniors navigate these transitions with confidence, ensuring your life insurance protection continues without interruption.

Life insurance policies are portable because they’re issued by national companies operating across state lines. Your death benefit, premium payments, and policy terms generally remain the same after your move. However, it’s crucial to notify your insurance provider of your new address to prevent any disruption in communication or policy maintenance. This simple step ensures you’ll continue to receive premium notices, policy updates, and other important correspondence at your new location.

What Happens to Medicare When Seniors Move Out of Georgia

“Medicare Coverage Options” from networkhealth.com and used with no modifications.

When you relocate from Georgia to another state, your Original Medicare (Parts A and B) coverage continues automatically since it’s a federal program. You’ll keep the same Medicare card and benefits regardless of where you live in the United States. However, while your life insurance remains stable during a move, Medicare-related products require more attention and potentially significant changes.

Medicare is administered at the federal level, but many Medicare-related products are tied to specific service areas and networks. This creates a stark contrast with life insurance policies, which generally remain unchanged when moving across state lines. The geographic limitations of Medicare Advantage and Part D plans highlight why seniors should appreciate the stability their life insurance provides during a move – it’s one less thing to worry about in an already stressful transition.

Medicare vs. Life Insurance When Moving

Medicare Advantage: Must enroll in a new plan if moving outside service area

Part D Drug Coverage: May need a new plan with different formularies

Life Insurance: Maintains same coverage, terms, and premiums nationwide

Unlike the potential disruptions with Medicare coverage, your life insurance policy from Ranwell Insurance provides consistency during your relocation. While Medicare may require you to research new doctors, plans, and coverage options, your life insurance death benefit remains a constant financial protection for your loved ones. This stability is particularly valuable during major life transitions like moving to a new state, when other aspects of your financial and healthcare planning may be in flux.

Medicare Advantage Plans Require Action When Moving

Unlike life insurance policies that remain intact during a move, Medicare Advantage plans are regionally based and require immediate attention when relocating. If you move outside your Medicare Advantage plan’s service area, you’ll need to enroll in a new plan available in your destination state. This creates a special enrollment period lasting two months before your move through two months after the move. Failing to switch plans during this window could result in automatic enrollment in Original Medicare without supplemental coverage, potentially leaving you with unexpected out-of-pocket costs.

The contrast between Medicare Advantage plans and life insurance highlights why working with specialists like Ranwell Insurance provides peace of mind during interstate moves. While you must navigate new healthcare networks and providers, your life insurance policy remains consistent, ensuring your beneficiaries’ financial protection never wavers. This consistency becomes even more valuable during the uncertainty that accompanies relocation.

Part D Prescription Drug Coverage Changes

Like Medicare Advantage plans, Part D prescription drug coverage is tied to specific service areas and formularies that vary by state and region. When moving out of Georgia, you’ll likely need to enroll in a new Part D plan that services your new location. The medications covered, pharmacy networks, and costs may differ significantly from your Georgia plan. This contrasts sharply with life insurance, which doesn’t require such adjustments when crossing state lines.

Your special enrollment period for Part D follows the same timeline as Medicare Advantage—beginning two months before your move and ending two months after. During this transitional period, reviewing your life insurance coverage with Ranwell Insurance can provide additional security and ensure it aligns with your new circumstances. The stability of your life insurance during a period when many other aspects of your financial planning are in flux offers valuable reassurance.

- Notify your current Part D provider about your move

- Research Part D plans available in your new location

- Compare formularies to ensure your medications are covered

- Enroll in a new plan before your special enrollment period ends

- Confirm your life insurance policy details remain unchanged

Medigap Supplemental Insurance Considerations

Medigap policies (Medicare Supplement Insurance) present unique challenges when moving across state lines. While you can typically keep your existing Medigap policy regardless of where you live, premium rates might change based on your new location. Some insurers maintain your original state’s rating, while others adjust to reflect your new state’s pricing structure. This variability contrasts with life insurance policies, which generally maintain consistent premiums regardless of your state of residence.

If you’re unsatisfied with potential Medigap premium changes after moving, you might consider shopping for a new policy in your destination state. However, this could subject you to medical underwriting unless you qualify for guaranteed issue rights. Life insurance through Ranwell Insurance doesn’t face these same geographical complications, providing continuity during your transition and ensuring your loved ones remain protected regardless of where you settle.

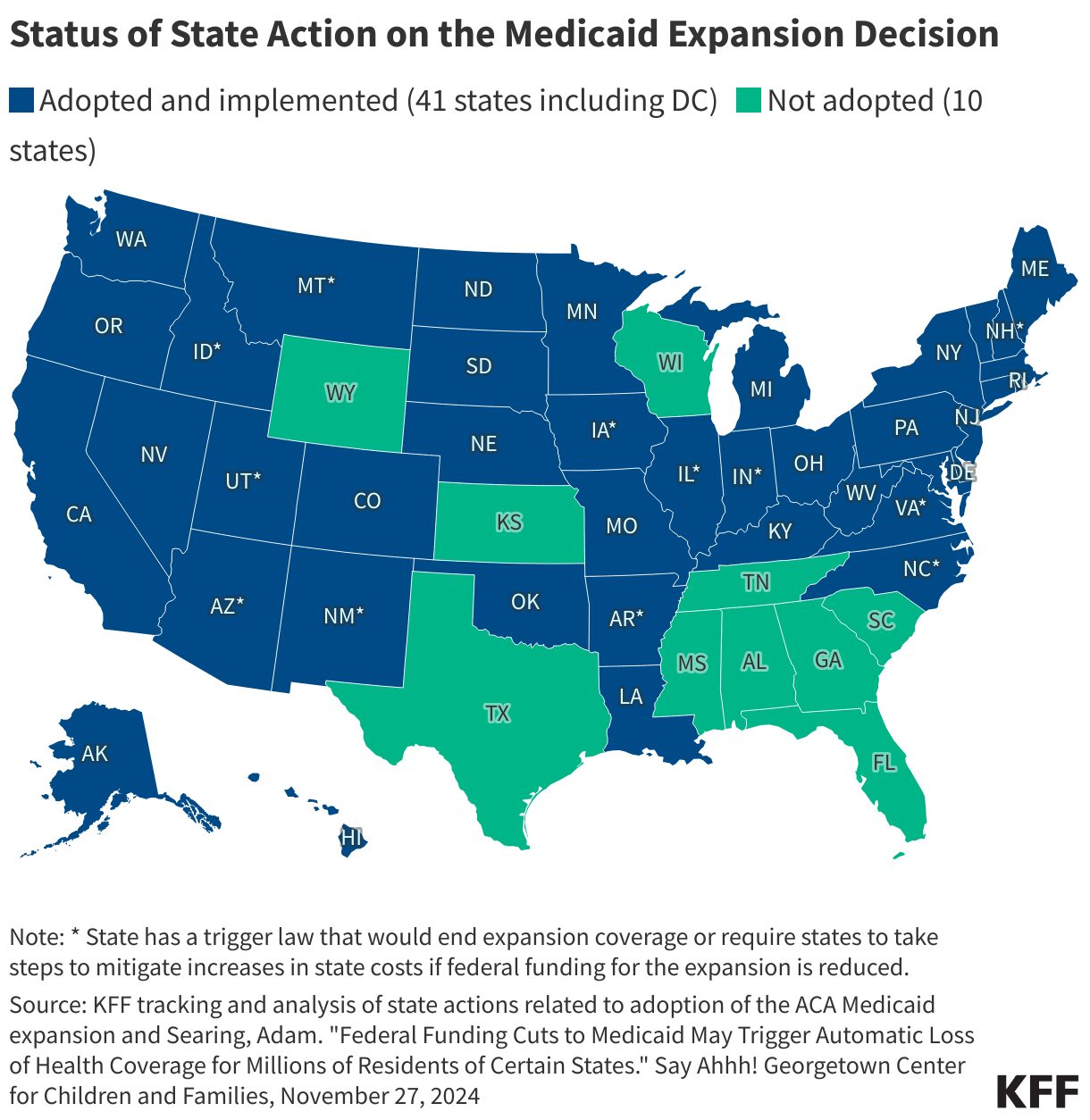

Georgia Medicaid Does Not Transfer to Other States

“Georgia and the One Big Beautiful Bill Act” from www.ndds.org and used with no modifications.

Unlike your life insurance policy, Medicaid benefits cannot transfer between states because each state administers its own Medicaid program with different eligibility requirements and covered services. If you’re receiving Medicaid in Georgia and plan to move, you’ll need to apply for Medicaid in your new state of residence. This process can take time and there’s no guarantee you’ll qualify under the new state’s criteria, even if you were eligible in Georgia.

The non-transferability of Medicaid highlights the importance of having consistent life insurance coverage during your move. While your healthcare coverage undergoes significant changes, your life insurance policy from Ranwell Insurance remains stable, providing continuity of protection for your loved ones regardless of where you live. This stability becomes especially valuable during the potentially vulnerable transition period when your healthcare coverage may be in flux.

When preparing for an interstate move, contact the Medicaid office in your destination state at least 30-60 days before relocating to understand their specific application process and eligibility requirements. Simultaneously, ensure your life insurance policy information is updated with your new address to maintain seamless coverage. This dual approach helps protect both your healthcare needs and your family’s financial security during the transition.

Steps to Take Before Moving Out of Georgia

Planning ahead is crucial when managing insurance transitions during an interstate move. While life insurance requires minimal adjustment, your healthcare coverage demands more attention. Start by notifying Social Security of your address change, as Medicare uses this information to update their records. This can be done online through your my Social Security account, by phone, or at a local office.

Next, contact your current Medicare Advantage and/or Part D plan providers to inform them of your move and understand how it affects your coverage. Research available plans in your destination area before moving so you can make informed decisions during your special enrollment period. Meanwhile, notify your life insurance provider about your address change to ensure you continue receiving important policy documents and premium notices without interruption.

- Update your address with Social Security at least 30 days before moving

- Research Medicare Advantage and Part D plans in your new location

- Contact your current insurance providers to understand transition options

- Notify your life insurance company about your address change

- Prepare a list of current medications to ensure continued coverage

Don’t Let Your Coverage Lapse During Your Move

“Car Insurance is Cancelled …” from www.selectquote.com and used with no modifications.

The transition period during an interstate move creates potential coverage gaps that require careful navigation. While your life insurance remains consistent throughout the process, your Medicare-related coverage could experience disruptions if not properly managed. Set calendar reminders for enrollment deadlines and follow up on all applications to ensure continuous coverage.

Consider working with insurance specialists who understand both life insurance and Medicare transitions across state lines. Ranwell Insurance experts can help you maintain comprehensive coverage during your move, ensuring both your healthcare and your family’s financial future remain protected. Their experience with seniors relocating from Georgia provides valuable insights that can prevent costly coverage lapses. For more information on what happens to Medicare if you move states, consult reliable resources.

Pro Tip: Create a moving insurance checklist that includes contact information, policy numbers, and action deadlines for all your insurance policies. Keep this document easily accessible during your move to ensure nothing falls through the cracks.

Frequently Asked Questions

How soon do I need to notify Medicare about my move out of Georgia?

You should notify Medicare of your address change as soon as your moving plans are confirmed, ideally at least 30 days before relocating. This notification is handled through the Social Security Administration, not Medicare directly. You can update your address online through your my Social Security account, by calling 1-800-772-1213, or by visiting your local Social Security office.

While Medicare needs this information to update their records, your life insurance provider requires the same notification but for different reasons. Updating your address with your life insurance company ensures you continue receiving premium notices, policy statements, and other important communications. Without this update, you risk missing critical information that could potentially lead to policy lapse.

Remember that notifying Medicare about your move triggers your special enrollment period for Medicare Advantage and Part D plans. This period begins two months before your move date and extends two months after, giving you time to secure appropriate coverage in your new location. Your life insurance, meanwhile, continues without interruption regardless of your address change.

For the smoothest transition, create a comprehensive notification checklist for all your insurance providers, including both Medicare-related plans and your life insurance policy. This organized approach helps ensure nothing is overlooked during the busy relocation process.

Can I keep seeing my Georgia doctors after I move to a neighboring state?

If you move to a neighboring state but remain close enough to continue seeing your Georgia doctors, your ability to maintain these relationships depends on your Medicare coverage type. With Original Medicare (Parts A and B), you can see any doctor nationwide who accepts Medicare, including your existing Georgia physicians. This flexibility is a significant advantage if you’re moving just across the state line but wish to continue established medical relationships. It’s important to understand what consumers need to know about potential changes in health insurance policies that might affect your choices.

However, if you have a Medicare Advantage plan, the situation becomes more complicated. Most Medicare Advantage plans operate with regional networks, and out-of-network care is typically either not covered or significantly more expensive. Even if you’re moving to a bordering county in a neighboring state, your Georgia doctors may no longer be in-network under your new plan.

The geographic restrictions of Medicare Advantage plans highlight an important contrast with life insurance: while your healthcare access may change dramatically with a move, your life insurance protection through Ranwell Insurance remains constant. This stability ensures that regardless of how your healthcare arrangements evolve, the financial security for your beneficiaries remains unchanged.

- Original Medicare allows you to see any Medicare-accepting doctor nationwide

- Medicare Advantage plans typically restrict coverage to regional networks

- Consider proximity to current doctors when choosing your new residence

- Ask your doctors if they accept Medicare patients from neighboring states

- Evaluate whether maintaining doctor relationships outweighs other factors in your move

Will my Medicare premiums change if I move to another state?

Your Original Medicare (Parts A and B) premiums generally remain the same regardless of where you live in the United States, as these are federal programs with standardized costs nationwide. However, if your move coincides with changes in your income, your Medicare Part B and Part D premiums might adjust due to income-related monthly adjustment amounts (IRMAA), which are recalculated annually.

| Insurance Type | Changes When Moving | Action Required |

|---|---|---|

| Original Medicare | Premiums remain the same | Update address only |

| Medicare Advantage | New plan, potentially different costs | Enroll in new plan |

| Part D Drug Coverage | New plan, potentially different costs | Enroll in new plan |

| Medigap | Same policy, possibly different premium | Verify premium with provider |

| Life Insurance | No changes to policy or premium | Update address only |

While your Original Medicare premiums remain stable, Medicare Advantage and Part D premiums can vary significantly between regions. Your new location may have plans with different costs, coverage levels, and provider networks compared to what was available in Georgia. This variability makes it essential to research and compare plans in your destination state before moving.

Medigap supplemental insurance presents a middle ground. You can keep your existing policy when moving, but the premium might change based on your new location. Some insurers maintain your original state’s rating structure, while others adjust to your new state’s pricing. Contact your Medigap provider directly to understand how your specific policy handles interstate moves.

In contrast to these potential Medicare-related changes, your life insurance premiums through Ranwell Insurance remain constant regardless of your new address. This consistency provides financial predictability during your transition, allowing you to budget with confidence while other insurance costs may fluctuate.

What happens if I’m in the hospital when my address officially changes?

If you’re hospitalized during your move, your current Medicare coverage remains in effect until you’re discharged, even if your official address has changed. Medicare has provisions to ensure continuous coverage during healthcare emergencies that overlap with life transitions. This protection applies whether you have Original Medicare or a Medicare Advantage plan.

Once discharged, you’ll need to navigate your special enrollment period promptly to secure appropriate coverage in your new location. If you have a Medicare Advantage plan and are moving outside its service area, you’ll have a special enrollment period to select a new plan that covers your new residence. During this transition, Original Medicare will provide default coverage if needed.

The same continuous coverage principle applies to your life insurance. If something were to happen during your move or hospitalization, your life insurance policy through Ranwell Insurance remains in full effect regardless of your changing address. The death benefit would be paid to your beneficiaries according to your policy terms, providing crucial financial protection during an already difficult time.

To ensure all your bases are covered during such a vulnerable transition period, consider designating a trusted family member or friend as your healthcare proxy who can handle insurance matters if you’re unable to do so. This person should have copies of all your insurance information, including both Medicare and life insurance policy details.

- Your current coverage continues until hospital discharge regardless of address change

- Have a plan in place for selecting new Medicare coverage post-discharge

- Designate a healthcare proxy who can manage insurance matters if needed

- Keep digital copies of all insurance cards and policy information accessible remotely

- Notify your healthcare providers about your planned move as early as possible

Do I need a new Medicare card when I move to a different state?

You do not need a new Medicare card when moving to a different state. Your red, white, and blue Medicare card is valid nationwide and does not change when you relocate. After updating your address with Social Security, Medicare will send any future correspondence to your new location, but your Medicare number and the card itself remain the same regardless of where you live in the United States.

This consistency with your Medicare card parallels the stability of your life insurance policy. Just as your Medicare number follows you across state lines, your life insurance policy through Ranwell Insurance maintains the same policy number, coverage amount, and terms regardless of where you live. Both represent permanent financial protection that transcends geographical boundaries.

While your Medicare card remains the same, you may receive new cards for Medicare Advantage, Part D, or Medigap plans if you change these policies due to your move. Keep both your original Medicare card and any new supplemental insurance cards together in a secure but accessible location. Consider making digital copies as backups in case physical cards are lost during the moving process.

For complete peace of mind during your transition, Ranwell Insurance specialists can help you organize all your insurance information, ensuring you have the right coverage in place before, during, and after your move. Their expertise with seniors’ insurance needs makes them an invaluable resource when navigating the complexities of relocating with multiple insurance policies.

For comprehensive assistance with maintaining your life insurance coverage during your move and ensuring all your insurance bases are covered, contact Ranwell Insurance specialists who can provide personalized guidance for your specific situation.

Many seniors in Georgia wonder if their life insurance coverage will be affected if they move to another state. Generally, life insurance policies remain in force regardless of the policyholder’s location, as long as premiums are paid. However, it’s important to understand the specifics of your policy, especially if you have a high-value policy. For instance, if you’re considering a policy like a $500,000 life insurance policy, knowing the terms and conditions can help ensure that your coverage remains intact no matter where you reside.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.