Key Takeaways

- Key Person Insurance protects Georgia businesses from financial losses if an essential team member passes away, with Ranwell Insurance offering some of the most competitive rates in the state.

- Buy-sell agreements funded with life insurance provide a clear succession plan for Georgia business owners, ensuring business continuity and fair compensation for heirs.

- Cash value life insurance serves dual purposes for Georgia entrepreneurs – providing death benefit protection while accumulating a tax-advantaged financial reserve accessible during the business owner’s lifetime.

- Georgia’s Guaranty Association provides additional protection for business life insurance policies, covering up to $300,000 in death benefits if your insurer becomes insolvent.

- Group life insurance offers Georgia business owners an attractive employee benefit that can improve retention while providing basic coverage at rates typically lower than individual policies.

Looking for the right life insurance to protect your Georgia business doesn’t have to be overwhelming. The best option will depend on your specific business structure, succession plans, and financial goals. Ranwell Insurance helps Georgia business owners find customized life insurance solutions that address both personal and business protection needs, with expert guidance through the entire process.

Why Georgia Business Owners Need Life Insurance Now

“Smart Estate Planning for Georgia …” from estatelawatlanta.com and used with no modifications.

Georgia’s business landscape is thriving, with entrepreneurs across the state building valuable enterprises that support families, employees, and communities. Yet many business owners overlook one critical aspect of financial planning: proper life insurance protection. Without it, the business you’ve worked so hard to build could face severe financial strain or even collapse if something happens to you or another key person.

Unlike personal life insurance that primarily protects your family, business life insurance serves multiple strategic purposes. It can fund buy-sell agreements, provide liquidity for estate taxes, retain valuable employees, and ensure business continuity during unexpected transitions. The right coverage creates financial stability that benefits everyone connected to your business operation.

Georgia’s specific business climate makes certain types of coverage particularly valuable. With the state’s growing economy and business-friendly environment, protecting your enterprise has never been more important. Additionally, Georgia’s Life & Health Insurance Guaranty Association provides an extra layer of security by covering up to $300,000 in death benefits should your insurance provider become insolvent – an important consideration when selecting a carrier for long-term business planning.

1. Key Person Insurance

“Key Person Insurance: Essential Guide …” from www.investopedia.com and used with no modifications.

Key Person Insurance functions as a financial safety net specifically designed to protect your business if an essential team member passes away unexpectedly. This specialized coverage allows your Georgia business to remain operational during a critical transition period by providing immediate liquidity when you need it most. The business owns the policy, pays the premiums, and becomes the beneficiary of the death benefit.

When determining appropriate coverage amounts, companies typically calculate 5-10 times the key person’s annual salary or their specific contribution to company revenue. For Georgia businesses, Ranwell Insurance offers competitive Key Person policies with flexible underwriting and term lengths extending up to 40 years – longer than the industry standard of 30 years. This extended coverage period is particularly valuable for younger business owners looking for long-term protection.

The funds from a Key Person policy can be used in multiple ways: covering operational expenses during a leadership transition, recruiting and training a replacement, paying off business debts, or providing financial stability until business continuity plans can be implemented. For Georgia business owners, this coverage becomes particularly important when seeking business loans, as lenders often require Key Person protection on the principal business owner before approving financing.

2. Buy-Sell Agreement Funding

“Corporate Buy-Sell Agreement …” from lions.financial and used with no modifications.

Buy-sell agreements create a clear roadmap for business transitions following an owner’s death, disability, or retirement, but they’re only effective if properly funded. Life insurance provides an ideal funding mechanism for these agreements, ensuring that remaining partners have immediate access to the capital necessary to purchase the departing owner’s share from their heirs. This arrangement protects both the business’s operational continuity and the financial interests of the deceased owner’s family.

Georgia business owners can structure buy-sell funding through several approaches. In a cross-purchase agreement, each owner maintains policies on the other owners. In an entity-purchase arrangement, the business itself owns policies on each principal. The optimal structure depends on the number of owners, tax considerations, and business valuation methods, making professional guidance essential in establishing these arrangements. For more insights on choosing the right policy, you can explore term or whole life insurance.

For multi-owner businesses in Georgia, companies like Legal & General America offer specialized buy-sell funding solutions with streamlined underwriting when multiple policies are purchased simultaneously. This can simplify implementation while potentially reducing costs through volume discounting – an important consideration for partnerships and closely-held corporations seeking comprehensive coverage.

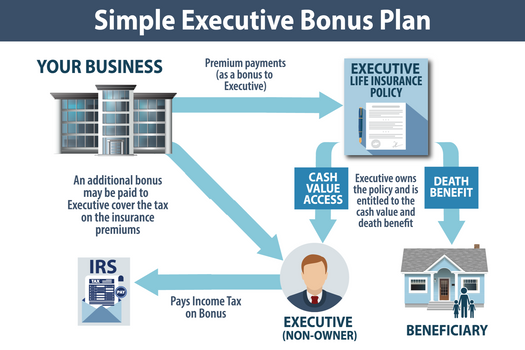

3. Executive Bonus Plans

“Executive Bonus Plans” from www.ffgadvisors.com and used with no modifications.

Executive bonus plans, also known as Section 162 plans, offer Georgia business owners a strategic way to reward and retain top talent while creating tax advantages for the company. These arrangements involve the business paying premiums on personally-owned life insurance policies for key executives. The company can deduct these premium payments as compensation expenses, while providing valuable employees with permanent life insurance protection that builds cash value over time.

This approach is particularly attractive for Georgia businesses that want to offer competitive benefits without the administrative complexities of qualified retirement plans. The executive owns the policy outright, including all cash value accumulation and death benefits, creating an immediate and tangible benefit that can help retain crucial talent in Georgia’s competitive job market. The simplicity of implementation makes this option accessible to businesses of various sizes across the state.

For Georgia business owners concerned about executive retention, these plans can be structured with vesting schedules or other mechanisms that incentivize long-term employment. Companies like Legal & General America offer customized executive bonus arrangements that can be tailored to meet specific business objectives, whether focusing on retirement supplementation or providing substantial death benefit protection for executives’ families.

4. Estate Planning Solutions

“Elder Law and Asset Protection Attorney” from www.solutionsattorney.com and used with no modifications.

Georgia business owners face unique estate planning challenges, particularly when business interests represent a substantial portion of their estate. Without proper planning, estate taxes and liquidity issues can force heirs to sell business assets at discounted values or burden the company with debt to pay tax obligations. Life insurance creates immediate liquidity to address these concerns without disrupting business operations.

Properly structured life insurance trusts can provide funds to pay estate taxes while keeping the proceeds outside the taxable estate. For family businesses in Georgia planning generational transfers, this approach helps ensure continuity while treating both active and non-active heirs equitably. The death benefit can provide cash for non-business heirs while allowing family members involved in the operation to retain control of the enterprise.

Georgia’s estate planning environment makes coordination between business succession and personal estate planning crucial. Insurance solutions can be designed to address both federal estate tax concerns and state-specific issues, providing comprehensive protection for your business legacy. Working with advisors familiar with Georgia’s business climate ensures these strategies align with both your business objectives and personal wealth transfer goals.

5. Business Continuation Coverage

“Business Continuation Insurance …” from www.investopedia.com and used with no modifications.

Business continuation coverage provides essential financial support during transitional periods following an owner’s death or disability. Unlike key person insurance that primarily covers revenue loss and replacement costs, business continuation policies focus on maintaining overall operations, meeting payroll obligations, and sustaining vendor relationships during critical transition periods. This comprehensive approach helps Georgia businesses maintain stability when leadership changes occur unexpectedly.

For sole proprietors in Georgia, continuation coverage can provide the necessary funding to either wind down the business in an orderly fashion or transfer it to identified successors. The policy proceeds can cover operating expenses while the business is being sold or restructured, protecting its value and reputation in the marketplace. This protection is particularly valuable for service businesses where client relationships might otherwise be disrupted during ownership transitions.

Georgia business owners can enhance their continuation strategies by combining life insurance with disability coverage, creating comprehensive protection against multiple risks that could threaten business continuity. Companies offering strong continuation coverage options for Georgia businesses include Legal & General America, which provides flexible terms and benefit structures that can be customized to your specific business model and continuity plans.

6. Group Life Insurance

“Group Life Insurance Explained: Types …” from www.investopedia.com and used with no modifications.

Group life insurance offers Georgia business owners a powerful tool for enhancing employee benefits packages while providing basic coverage at rates typically lower than individual policies. These employer-sponsored plans allow you to provide a foundational level of life insurance protection for your entire team, often at very competitive group rates. For growing Georgia businesses competing for talent, this benefit can significantly enhance your recruitment and retention efforts.

Most group plans offer simplified underwriting, making coverage accessible to employees who might otherwise face challenges obtaining individual policies due to health concerns. As the business owner, you can determine whether the company covers the full premium cost or shares expenses with employees through contributory arrangements. This flexibility allows you to balance budget considerations with the desire to provide meaningful benefits to your workforce. To understand more about why life insurance is important for financial security, you can read this article on life insurance importance in Georgia.

While group coverage provides valuable basic protection, Georgia business owners and key executives often need supplemental individual policies to fully address their specific business continuation and estate planning needs. Group coverage works best as one component of a comprehensive protection strategy rather than a complete solution for those with significant business responsibilities.

7. Cash Value Life Insurance

“Understanding Cash Value in Life …” from www.investopedia.com and used with no modifications.

Cash value life insurance serves dual purposes for Georgia entrepreneurs – providing death benefit protection while accumulating a tax-advantaged financial reserve accessible during your lifetime. These permanent policies (including whole life, universal life, and variable universal life) build equity over time that business owners can leverage through policy loans or withdrawals to fund business opportunities, manage cash flow challenges, or supplement retirement income.

For Georgia business owners concerned about having assets accessible for business needs, cash value policies provide liquidity without the credit approval processes associated with traditional financing. This flexibility becomes particularly valuable during economic downturns or when rapid response to business opportunities is essential. The accumulated cash value grows tax-deferred, and when structured properly, can be accessed tax-free through policy loans – creating significant advantages over traditional business savings vehicles.

Cash Value Comparison: Common Business Applications

Whole Life: Consistent premium, guaranteed growth, ideal for conservative business planning

Universal Life: Flexible premiums, good for businesses with variable cash flow

Indexed Universal Life: Growth potential tied to market indexes with downside protection

Variable Universal Life: Maximum growth potential with investment options, higher risk tolerance required

Georgia business owners often find that cash value policies complement their other retirement planning strategies, particularly when they’ve maximized contributions to qualified plans. These policies have no IRS contribution limits, allowing for significant supplemental retirement funding while maintaining the death benefit protection necessary for business continuation planning.

8. Split-Dollar Life Insurance

“Split Dollar Plan: Flexible and Cost …” from executivebenefitsolutions.com and used with no modifications.

Split-dollar life insurance arrangements provide Georgia business owners with flexible methods to share policy costs and benefits between the company and key employees. These sophisticated planning tools allow for customized allocation of premiums, cash values, and death benefits to achieve specific business objectives. The arrangement can be structured as either an endorsement method (company owns policy) or a collateral assignment method (employee owns policy), depending on your planning goals.

This approach is particularly valuable for Georgia businesses looking to provide supplemental benefits to selected executives without implementing broad-based qualified plans. Split-dollar arrangements can create golden handcuffs for vital team members while providing tax advantages not available through conventional compensation. The flexibility in design allows these arrangements to be tailored to your specific business structure, cash flow considerations, and retention objectives.

For family businesses in Georgia, split-dollar arrangements can also facilitate succession planning by providing the next generation with insurance protection while controlling costs and ownership rights. When properly structured with attention to IRS regulations, these arrangements offer significant planning opportunities for businesses concerned with both executive retention and orderly business transition planning.

9. Disability Buy-Out Insurance

“PPT – Principal Life Insurance Company …” from www.slideserve.com and used with no modifications.

While life insurance addresses business continuity following an owner’s death, disability actually presents a more likely risk for many Georgia business owners. Disability buy-out insurance specifically funds buy-sell agreements triggered by an owner’s permanent disability, providing capital to purchase the disabled owner’s interest according to predetermined terms. This specialized coverage ensures business continuity while providing fair compensation to the departing owner who can no longer participate in operations.

For Georgia partnerships and multi-owner businesses, combining life and disability buy-out coverage creates comprehensive succession protection against the two most common events that force unplanned ownership transitions. The policies typically include elimination periods (usually 12-24 months) to confirm the disability’s permanence before triggering the buyout provision, ensuring the arrangement activates only for genuinely career-ending situations.

When implementing disability buy-out coverage, Georgia business owners should carefully align definition of disability, elimination periods, and valuation methods with their buy-sell agreement to ensure seamless integration. Companies like Legal & General America offer coordinated life and disability buy-out solutions that provide comprehensive protection while simplifying the administrative aspects of maintaining these vital coverage types.

10. Business Owner Insurance Riders

“What Are Life Insurance Riders …” from www.westernsouthern.com and used with no modifications.

Business owner insurance riders allow Georgia entrepreneurs to customize their coverage with specialized protections addressing specific business risks. These optional additions to standard policies enhance coverage without requiring separate insurance contracts, creating cost-effective solutions for targeted concerns. Common riders particularly valuable for Georgia business owners include accelerated death benefits, waiver of premium, and business continuation endorsements.

The disability income rider deserves special consideration, as it provides monthly income to the business if the owner becomes disabled and unable to work. Unlike personal disability coverage, these benefits flow directly to the company, helping maintain operations during the owner’s absence. For sole proprietors and small partnerships where individual contributions directly impact revenue, this protection helps preserve the business value during recovery periods.

- Return of Premium Rider: Refunds premiums if the policy ends without a claim, appealing to cost-conscious Georgia business owners

- Guaranteed Insurability Rider: Allows increasing coverage as business value grows without additional medical underwriting

- Accidental Death Benefit: Provides additional payment if death occurs accidentally, addressing higher-risk business activities

- Long-Term Care Rider: Enables accessing death benefits for long-term care expenses, creating multi-purpose protection

When evaluating riders, Georgia business owners should focus on those addressing their specific industry risks and business structure rather than adding unnecessary features that increase premiums without providing meaningful protection. A targeted approach creates cost-effective coverage aligned with your particular business vulnerabilities and continuity concerns.

How to Choose the Right Coverage for Your Georgia Business

“Columbia County is a Top Choice for …” from developcolumbiacounty.com and used with no modifications.

Selecting optimal life insurance protection for your Georgia business requires balancing immediate budget considerations with long-term protection goals. Start by conducting a comprehensive business valuation to determine accurate coverage amounts for buy-sell funding and key person protection. This assessment provides the foundation for meaningful coverage that properly reflects your company’s true value and replacement costs for essential team members.

Next, evaluate your business structure, succession plans, and tax situation to identify which policy types best align with your specific needs. Sole proprietors face different challenges than partnerships or corporations, requiring tailored approaches to business continuation. Working with advisors familiar with Georgia’s business environment ensures your coverage addresses both federal and state-specific considerations affecting your enterprise.

Finally, compare options from multiple carriers with strong financial ratings and track records in the business insurance market. Companies like Legal & General America offer competitive options for Georgia business owners, with flexible underwriting and specialized business protection features. Remember that premium costs should be just one factor in your decision – carrier stability, conversion options, and policy flexibility often provide greater long-term value than the lowest initial premium.

Protection That Grows With Your Business

The life insurance strategy you implement today should have the flexibility to adapt as your Georgia business evolves over time. Look for policies with guaranteed insurability options that allow increasing coverage as your company grows in value. This feature ensures your protection keeps pace with your success without facing additional medical underwriting requirements that might limit future coverage options.

Regularly review your coverage in conjunction with your overall business continuity planning. As your organizational structure, leadership team, and succession strategy develop, your insurance protection should evolve accordingly. Most financial advisors recommend conducting a comprehensive insurance review every 2-3 years or whenever significant business events occur, such as adding partners, entering new markets, or taking on substantial debt obligations.

For Georgia business owners looking to secure their company’s future, Policygenius offers specialized expertise in business continuation planning and customized insurance solutions. Their team can guide you through the process of selecting and implementing the right protection strategy for your unique business situation, ensuring both your enterprise and the people who depend on it remain financially secure. Protect what you’ve built – your business deserves nothing less than comprehensive coverage designed for its specific needs.

Frequently Asked Questions

Georgia business owners frequently have questions about implementing life insurance strategies that protect both their companies and personal financial security. These common inquiries address the most important considerations when structuring business continuation coverage and understanding how these policies interact with Georgia’s specific business environment.

How much life insurance coverage do Georgia business owners typically need?

Most Georgia business owners require coverage roughly equal to 5-10 times their annual business profit contribution plus any outstanding business debts they’ve personally guaranteed. This calculation provides a baseline, but proper coverage amounts should be customized based on your specific succession plans, buy-sell agreements, and family financial needs outside the business. Companies with significant key person dependency may require additional coverage to fund recruitment and revenue replacement during transition periods.

For buy-sell funding specifically, coverage should align with your formal business valuation and be updated regularly as the company grows. Many Georgia businesses establish valuation formulas in their operating agreements, which provide guidance for appropriate coverage levels. Having inadequate coverage can create significant financial strain during business transitions, while excessive coverage unnecessarily increases premium expenses. Understanding why life insurance is important for financial security can help in making informed decisions about coverage levels.

Can I deduct life insurance premiums as a business expense in Georgia?

Generally, life insurance premiums paid by Georgia businesses are not tax-deductible when the company is the beneficiary of the policy. This includes key person insurance and policies funding company-owned buy-sell agreements. However, certain arrangements like non-discriminatory group term life insurance for employees (limited to $50,000 in coverage per employee) and executive bonus plans can create deductible premium scenarios.

For S-corporations and partnerships in Georgia, premium payments may be reported differently depending on ownership structure and policy arrangement. When the business pays premiums for policies owned by and benefiting individual owners, these payments might be treated as taxable compensation to the owner rather than deductible business expenses.

Always consult with a tax professional familiar with Georgia business regulations before implementing any business life insurance strategy. The tax treatment varies significantly based on policy ownership, beneficiary arrangements, and specific business structures, making professional guidance essential for optimal tax planning. If you are wondering why you should get life insurance in Georgia now, even if you’re healthy and feel fine, understanding the tax implications is a crucial part of the decision-making process.

What happens to my business life insurance policy if I sell my company?

When selling your Georgia business, the treatment of existing life insurance policies depends on their ownership structure and purpose. For key person policies owned by the business, the policies typically transfer to the new owner as business assets, who may choose to maintain, surrender, or modify the coverage. If your business owns policies funding buy-sell agreements, these usually terminate or require restructuring since their original purpose no longer applies. For more information on life insurance options in Georgia, visit Policygenius.

For personally-owned policies used in business planning, you maintain ownership and can repurpose these policies for personal needs or new business ventures. Many Georgia business owners convert business-related coverage to personal protection when exiting their companies, particularly when the policies have accumulated cash value or favorable underwriting terms that would be difficult to replace with new coverage.

Are there any Georgia-specific regulations affecting business life insurance?

Georgia’s Life & Health Insurance Guaranty Association provides important protections for business life insurance policies, covering up to $300,000 in death benefits and $100,000 in cash surrender value if your insurance carrier becomes insolvent. This protection applies to policies issued by carriers licensed to operate in Georgia, providing an additional layer of security when selecting insurance partners for long-term business planning.

Georgia also has specific insurable interest requirements that must be satisfied when implementing business life insurance. Generally, the business must demonstrate a legitimate financial interest in the insured person’s life, such as potential financial loss upon their death. For complex arrangements like split-dollar plans or corporate-owned policies on employees, proper documentation of insurable interest and compliance with notice and consent provisions is essential. To understand more about why life insurance is important for financial security, you can read this article on life insurance importance in Georgia.

- Georgia’s Insurance Code § 33-24-3 establishes insurable interest requirements

- Notice and consent provisions apply to employer-owned policies under GA law

- State guaranty fund protection follows the policyholder if you move out of state

- Georgia has no state estate tax, but federal estate tax still affects business succession

Working with insurance professionals familiar with Georgia’s specific regulatory environment ensures your business life insurance implementation complies with all applicable state requirements while maximizing protection for your enterprise.

How do life insurance needs differ between sole proprietors and corporations in Georgia?

Sole proprietors in Georgia face unique life insurance challenges since their businesses typically have no legal existence separate from themselves. Without proper planning, the business often dies with the owner, making personal life insurance with appropriate beneficiary designations crucial for providing family members with financial resources to either continue or wind down the business. These policies should cover both personal family needs and business obligations to create comprehensive protection.

Corporations and partnerships, meanwhile, can implement more complex arrangements like corporate-owned policies, formal buy-sell funding, and executive benefit programs that aren’t applicable to sole proprietorships. These entities must navigate additional regulatory requirements regarding notice, consent, and corporate ownership of policies, but gain access to sophisticated planning techniques that can address multiple business continuation needs simultaneously.

S-corporations in Georgia present hybrid planning opportunities, where insurance strategies must consider both business and personal tax implications for shareholders. The flow-through tax treatment of these entities creates unique planning considerations when implementing buy-sell funding and key person protection, making specialized guidance particularly valuable for S-corporation owners evaluating life insurance options.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.