Key Takeaways

- Locking in life insurance while you’re healthy can save you 50-300% on premiums compared to waiting until health issues develop.

- Even minor health conditions that may develop later on in life can make you uninsurable or dramatically increase your rates.

- The younger and healthier you are when purchasing life insurance, the more policy options and riders will be available to you.

- Modern life insurance policies from Ranwell Insurance offer living benefits that you can access during your lifetime, not just death benefits.

- Converting a term policy to permanent coverage becomes expensive or impossible if your health deteriorates, making early planning crucial.

The best time to buy life insurance is when you don’t think you need it. That might sound counterintuitive, but your current good health is actually your most valuable asset when shopping for coverage. While many young, healthy people postpone purchasing life insurance until they have children or significant financial obligations, this approach often costs them thousands of dollars over their lifetime.

Your premium rates are primarily determined by your age and health status at the time you apply. Once you secure a policy, those rates are locked in for the duration of your coverage (the entire term or your whole life, depending on the policy type). This means the healthier you are when you apply, the lower your premiums will be for decades to come.

Life insurance companies categorize applicants into different health classifications, with “Preferred Plus” or “Super Preferred” being the best rating reserved for those in excellent health. Each step down in classification can increase your premiums by 25-50%. Many healthy individuals in their 20s and 30s can easily qualify for these top-tier rates, creating a financial advantage that compounds over time.

Why Healthy People Need Life Insurance Now, Not Later

“The time for life insurance is now …” from www.prcua.org and used with no modifications.

The primary reason to secure life insurance while healthy is simple economics. A healthy 25-year-old might pay $25-30 monthly for a $500,000 term life policy, while waiting until age 45 could cost $70-100 for the same coverage—even if they remain in good health. This difference becomes even more dramatic if health complications arise.

Beyond the obvious financial benefits, having coverage in place provides peace of mind. Life is unpredictable, and health status can change suddenly. By securing coverage while healthy, you create a financial safety net that protects your loved ones regardless of what happens to your health in the future.

Many people underestimate how quickly health conditions can develop. According to the CDC, about 60% of Americans will develop at least one chronic condition by age 40. Once diagnosed with conditions like diabetes, heart disease, or even anxiety and depression, insurance becomes significantly more expensive—if available at all. By waiting, you risk being priced out of the market entirely.

“There are two reasons to buy life insurance early: You lock in insurability while you’re healthy, and you secure rates based on your current age and health status that will never increase. The longer you wait, the more expensive and difficult obtaining coverage becomes.”

Health Changes That Can Make You Uninsurable

Most people don’t realize how many common health conditions can affect life insurance eligibility and rates. Even issues that you might consider minor or well-managed can have significant impacts on your insurability. High blood pressure, elevated cholesterol, or being 30+ pounds overweight can bump you down multiple rating classes, increasing your premiums by 50% or more.

More concerning are conditions like type 2 diabetes, heart arrhythmias, sleep apnea, and mental health diagnoses, which can result in substantial rate increases or even policy denials. What many don’t realize is that even seemingly routine prescriptions can trigger insurance concerns. Medications for anxiety, depression, ADHD, or chronic pain management will all flag your application for additional scrutiny.

Cancer history, even with successful treatment and remission, typically makes obtaining standard rates impossible for many years. Some survivors face premium increases of 200-300% or receive outright denials. Other serious conditions like heart disease, stroke history, or autoimmune disorders often lead to automatic application declines, regardless of how well-managed they might be. For more insights on the importance of securing coverage early, check out why life insurance is crucial.

- Minor conditions that affect rates: High blood pressure, elevated cholesterol, asthma, mild depression/anxiety, being overweight

- Moderate conditions that significantly increase rates: Type 2 diabetes, sleep apnea, history of alcohol abuse, rheumatoid arthritis

- Severe conditions that may make you uninsurable: Recent cancer diagnosis, heart disease, kidney disease, liver disease, HIV/AIDS

Lock In These 4 Benefits By Buying Young

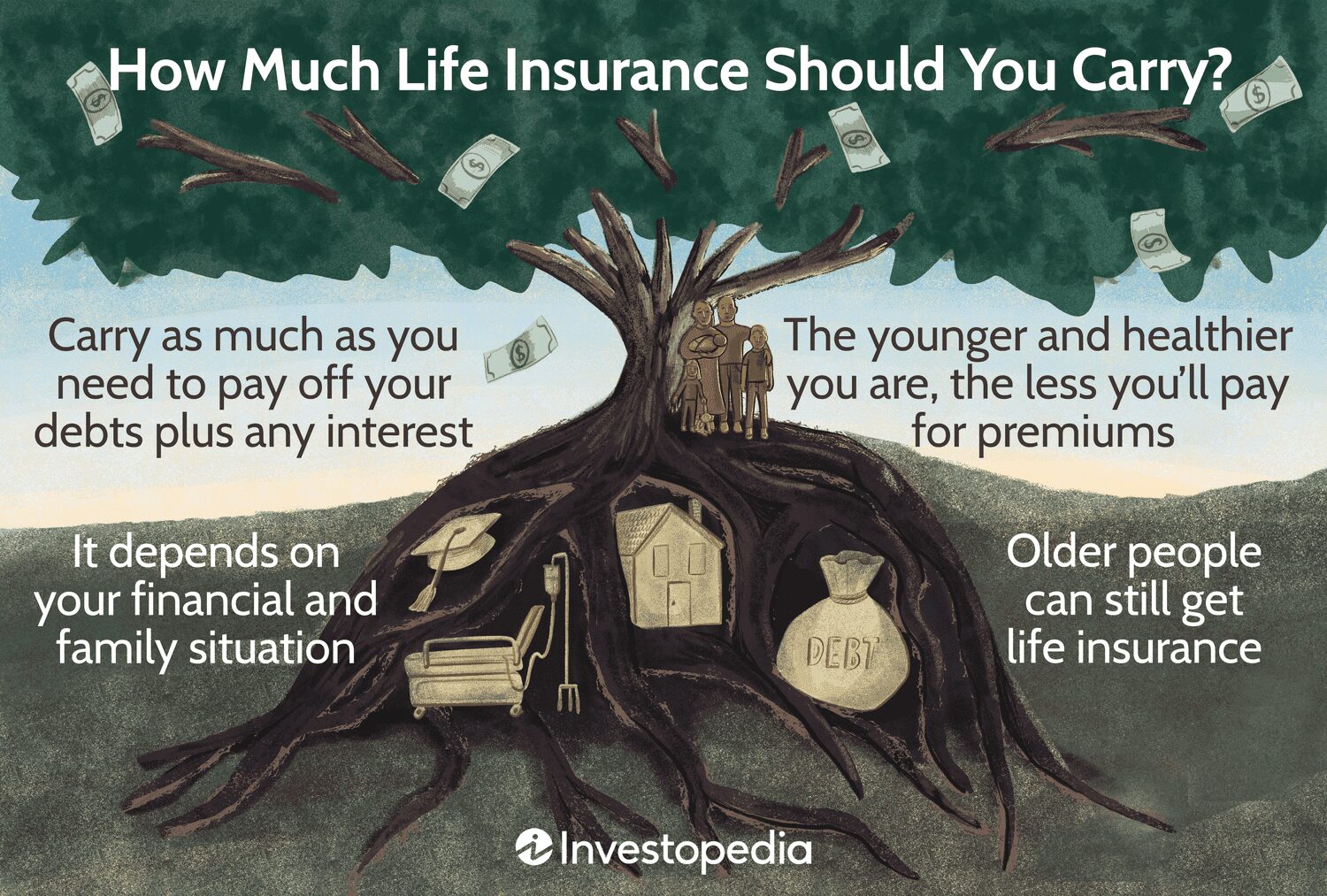

“Life Insurance Council of New York” from licony.org and used with no modifications.

Guaranteed Low Rates For Life

Securing coverage while young and healthy creates a lifetime of savings. Life insurance premiums increase by approximately 8-10% for each year you age, even without health changes. This means a healthy 35-year-old will pay about twice what a healthy 25-year-old pays for the same coverage. By locking in rates early, you’re essentially freezing your biological age in the eyes of the insurance company, regardless of how your actual health evolves.

This advantage becomes even more pronounced with permanent life insurance policies, where the premium differential can add up to tens of thousands of dollars over your lifetime. Many whole life policies paid up by age 65 will cost substantially less in total if purchased at 25 versus 35, despite the additional decade of payments.

More Policy Options and Features Available

Your health status doesn’t just affect your rates—it determines which policies and riders you qualify for. Premium policy features like waiver of premium (which continues your coverage if you become disabled), critical illness benefits, and long-term care riders are typically only available to those in excellent health. Many people don’t realize these valuable options become unavailable once health issues emerge, regardless of your willingness to pay extra.

Cash Value Growth Advantage

For those considering permanent life insurance with a cash value component, the benefits of starting young are even more compelling. Cash value in whole life and universal life policies grows tax-deferred over time, operating somewhat like a forced savings vehicle. The longer your money has to compound, the more significant the growth potential becomes. A policy started at age 25 versus age 40 could accumulate twice the cash value by retirement age, simply due to the power of time and compound growth.

This cash value becomes a flexible financial asset you can access through policy loans or withdrawals without credit checks, making it valuable for opportunities like business ventures, education funding, or supplemental retirement income. Unlike retirement accounts, there are no penalties for accessing this money before a certain age, giving you financial flexibility throughout life.

Living Benefits You Can Access

Modern life insurance policies often include “living benefits” that allow you to access a portion of your death benefit while still alive if you experience qualifying events like chronic illness, critical illness, or terminal diagnosis. These accelerated benefit riders essentially transform your life insurance into a financial safety net that protects you during your lifetime, not just your beneficiaries after you’re gone. The catch? These valuable riders are typically only available when you apply in good health, making early purchase crucial for maximizing your policy’s utility.

How to Choose the Right Coverage Amount

“Life Insurance Coverage …” from www.investopedia.com and used with no modifications.

While securing coverage while healthy is critical, ensuring you have adequate protection is equally important. Most financial advisors recommend coverage of 10-15 times your annual income as a starting point. This calculation helps replace lost income and cover major expenses like mortgage payoff, education funding, and debt elimination.

For young professionals early in their careers, considering your future earning potential rather than current salary often makes sense. Your income will likely increase substantially over the decades ahead, and locking in coverage based on that trajectory can be wise. Many insurers now offer options to increase coverage at key life events (marriage, children, home purchase) without new medical underwriting if you purchase a policy with this feature while healthy.

Remember that life insurance needs evolve throughout different life stages. Young singles might need modest coverage for final expenses and debt repayment, while those with young families need substantial protection to replace income, fund education, and cover mortgage obligations. The best approach is securing a baseline of coverage while healthy, with options to increase protection as your needs grow.

Term vs. Permanent Insurance: Which Locks In Better Value?

“How to Buy Life Insurance Wisely: A …” from www.quotacy.com and used with no modifications.

Both term and permanent life insurance offer advantages when purchased young and healthy, but they serve different purposes. Term insurance provides pure death benefit protection for a specific period (typically 10-30 years) at the lowest initial cost. It’s ideal for covering specific time-limited needs like mortgage protection or family income replacement during your working years.

Permanent insurance (whole life, universal life, or variable universal life) provides lifetime coverage with a cash value component that grows over time. While premiums are higher initially, they remain level for life, creating significant value when purchased young. The younger you are at purchase, the more time your cash value has to grow through tax-deferred compounding. To understand more about the differences, you might want to explore term or whole life insurance.

For many, a hybrid approach works best—securing a larger term policy for family protection during working years, paired with a smaller permanent policy that builds cash value and ensures lifelong coverage. The permanent component can later be expanded through conversion options or additional purchases. The key is starting with some level of coverage while rates are lowest and health qualification is easiest.

Frequently Asked Questions

Can I still get affordable life insurance if I have minor health issues?

Yes, but it depends on the specific condition and its severity. Minor conditions like controlled high blood pressure or mild asthma may result in a Standard rating rather than Preferred, increasing your premium by 25-50%. Working with an independent agent who has access to multiple insurance companies is crucial, as different insurers have varying underwriting guidelines for specific conditions.

Some insurers specialize in covering certain health conditions more favorably than others. For example, some companies offer better rates for well-controlled diabetes, while others are more lenient with anxiety disorders or sleep apnea. An experienced agent can direct your application to the company most likely to give you favorable rates for your specific health profile.

How much does my premium increase with each year I wait?

Life insurance rates increase approximately 8-10% annually based on age alone, compounding each year you wait. This means a policy could cost about 50% more at age 35 than at age 30, even with identical health status. The increases accelerate after age 40, often jumping 10-15% per year in your 50s and 20%+ annually in your 60s.

The actual impact is usually much greater when combining age increases with the likelihood of developing health conditions. A 45-year-old with high blood pressure and elevated cholesterol (common developments in middle age) might pay 3-4 times more than they would have for the same policy at age 30 with perfect health. This compounding effect makes each year of delay increasingly expensive.

If I lock in a term policy now, can I convert it later if my health changes?

Most quality term policies include a conversion provision allowing you to transform your coverage into permanent insurance without new medical underwriting. This valuable feature lets you leverage your initial health qualification throughout the conversion period, regardless of subsequent health changes. However, conversion privileges vary significantly between companies—some allow conversion throughout the entire term, while others limit it to the first 5-15 years. The available permanent policy options also differ, making it essential to understand these details before purchasing a term policy that you may want to convert later. For more insights, check out the key advantages of locking in whole life insurance while young.

Do I need to tell my insurance company if my health changes after I’m approved?

Once your policy is in force, you’re not obligated to report health changes to your insurance company. Your rates and coverage remain guaranteed as long as you continue paying premiums, regardless of how your health evolves. This is precisely why securing coverage while healthy is so valuable—it locks in your insurability based on your health at application, not your future health. Even if you develop a serious illness the day after your policy is issued, your coverage and premium remain unchanged for the duration of your policy.

What’s the youngest age someone should consider buying life insurance?

- Age 18-21: Appropriate for those with student loans with co-signers, helping support family members, or wanting to lock in ultra-low rates

- Age 22-25: Ideal timing for most young adults entering careers, offering the optimal balance of low rates and actual insurance needs

- Age 25-30: Common purchase window when establishing families, purchasing homes, or taking on significant financial responsibilities

- Age 30-35: Still provides good value, though rates begin climbing more noticeably, especially if minor health issues have developed

- Age 35+: Each year of delay becomes increasingly expensive, particularly if health complications begin to emerge

The ideal time to purchase life insurance is when you’re young, healthy, and beginning to establish financial independence. For most people, this falls between ages 22-30. During this period, rates are extremely competitive, and most people can easily qualify for preferred health classifications. The small monthly premium investment creates substantial long-term value through locked-in rates and guaranteed insurability.

Many financial advisors recommend securing at least a modest life insurance policy as soon as you have any financial responsibilities or dependents. Even single individuals without children often have parents who co-signed student loans, siblings they help support, or future financial plans that would be compromised by premature death. The cost difference between purchasing at 25 versus 35 typically far outweighs the additional decade of premiums. Learn more about getting life insurance in your 20s.

Life insurance serves multiple purposes beyond simply replacing income—it can cover final expenses, eliminate debt burdens on family members, fund charitable goals, provide business continuity, and establish an estate for future generations. These planning aspects often matter even before traditional family responsibilities emerge. Starting with a modest, affordable policy that includes guaranteed insurability options allows your coverage to grow as your needs and income increase.

Remember that life insurance is fundamentally about transferring risk during your most vulnerable financial periods. Your earning potential represents your largest financial asset, and protecting it early creates security that extends throughout your lifetime. The small monthly investment provides immediate peace of mind while establishing a foundation for future financial planning.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.