Key Takeaways

- Life insurance provides essential financial protection for Georgia families, with death benefits averaging $250,000-$500,000 to cover mortgage payments, education costs, and daily expenses.

- Georgia residents typically pay 10-15% less for life insurance than the national average, making it an affordable way to secure your family’s future.

- Ranwell Insurance helps Georgia families navigate complex insurance decisions with personalized solutions tailored to your specific needs and budget.

- Term life insurance costs approximately $25-45 monthly for a healthy 35-year-old Georgian seeking $500,000 in coverage, while permanent policies offer lifelong protection with cash value benefits.

- Georgia’s insurance regulations provide consumer protections including a free-look period of 10 days and guaranteed death benefit payouts that are tax-free to beneficiaries.

Life happens fast in Georgia. One day you’re celebrating your child’s graduation in Atlanta, the next you’re planning retirement in Savannah. But what happens if you’re not there to see these milestones? This question sits at the heart of why life insurance matters so deeply for Georgia families.

Financial security isn’t just about what you have today—it’s about protecting what matters most tomorrow. For Georgia residents, life insurance represents more than a policy; it’s peace of mind knowing your loved ones won’t face financial hardship if the unexpected occurs.

Ranwell Insurance understands that Georgia families face unique financial challenges and opportunities. Whether you’re navigating the housing market in metro Atlanta or planning for retirement along the Georgia coast, having proper life insurance coverage ensures your family’s financial foundation remains solid, regardless of life’s uncertainties.

Life Insurance: Your Family’s Financial Safety Net in Georgia

Georgia Life Insurance at a Glance:

Average policy size: $250,000-$500,000

Average term premium: $25-45/month for healthy 35-year-olds

Percentage of Georgians with life insurance: Approximately 54%

Most common reason for purchase: Mortgage protection

Free-look period in Georgia: 10 days

Life insurance functions as the ultimate safety net for Georgia families. When you’re no longer there to provide, your policy steps in, delivering a tax-free lump sum to your beneficiaries. This financial cushion allows your loved ones to maintain their standard of living, stay in your family home, and pursue educational goals without the burden of financial stress.

For Georgia homeowners, life insurance often means the difference between keeping or losing the family home. With average mortgage debt in Georgia approaching $200,000, a properly sized policy ensures your family won’t face foreclosure or be forced to downsize during an already difficult time. Beyond mortgage protection, life insurance provides liquidity to cover immediate expenses like funeral costs, which average $7,000-$10,000 in Georgia. For more information on protecting your home, consider learning about mortgage protection insurance.

Beyond the immediate financial protection, life insurance creates generational stability. Many Georgia families use policies as tools for wealth transfer, educational funding, and charitable giving. The right coverage doesn’t just protect against loss—it becomes part of your legacy planning, ensuring that your financial values continue even when you’re gone.

How Life Insurance Protects Georgia Families

“What Is Life Insurance? Types, Benefits …” from www.westernsouthern.com and used with no modifications.

Life insurance provides crucial protection for Georgia families in multiple ways. First, it replaces lost income when a breadwinner passes away. In Georgia, where the median household income is approximately $61,000, losing a primary earner without insurance coverage can devastate a family financially. A properly structured policy ensures your loved ones can maintain their lifestyle, pay bills, and meet ongoing expenses without drastic cutbacks.

Education funding represents another vital protection. Georgia’s HOPE Scholarship covers a portion of college costs, but families still face significant expenses. Life insurance proceeds can help fund those educational dreams, whether that’s attending the University of Georgia, Georgia Tech, or any other institution. For families with young children, this means peace of mind knowing that your kids’ educational future remains secure, regardless of what happens to you.

Types of Life Insurance Available to Georgia Residents

Georgia residents have several life insurance options to consider, with term and permanent coverage being the primary categories. Term life insurance provides protection for a specific period—typically 10, 20, or 30 years—with lower initial premiums making it an accessible option for young families. This type of coverage works well for specific financial obligations like mortgage protection or covering children through their college years.

Permanent life insurance, including whole life and universal life policies, offers lifelong protection combined with a cash value component that grows over time. While premiums are higher than term coverage, these policies provide valuable benefits including guaranteed death benefits, stable premium payments, and tax-advantaged cash accumulation. For Georgia business owners or those with complex estate planning needs, permanent insurance can serve multiple purposes beyond basic protection.

Many Georgians opt for a strategic combination of both term and permanent coverage. This “laddering” approach provides higher protection during your peak financial responsibility years while maintaining some permanent coverage for lifetime needs. For example, a 35-year-old Atlanta resident might purchase a $500,000 30-year term policy to cover the mortgage and children’s education, plus a $100,000 whole life policy for final expenses and legacy planning.

Georgia-Specific Life Insurance Considerations

“Types of Life Insurance | Exploring …” from fidelitylife.com and used with no modifications.

Georgia’s insurance regulations provide important consumer protections you should understand. All life insurance policies issued in Georgia include a “free look” period of 10 days, allowing you to cancel a new policy for a full refund if you change your mind. The state also enforces a two-year contestability period, after which insurance companies generally cannot dispute claims based on application errors unless there was intentional fraud.

Georgia’s climate and natural disaster risk can impact your insurance planning. While life insurance typically covers death from natural disasters, having appropriate property insurance alongside life coverage creates comprehensive protection for coastal or flood-prone areas. Residents of hurricane-vulnerable coastal regions like Savannah or Brunswick should consider how their overall insurance strategy protects their family’s financial security. For those exploring options, understanding why life insurance is important can be a crucial part of this strategy.

Tax considerations also matter for Georgia residents. Life insurance death benefits are generally income tax-free at both federal and state levels. Additionally, Georgia has no estate tax, but federal estate taxes may apply to larger estates. For high-net-worth families in affluent areas like Buckhead or Sea Island, properly structured life insurance can provide liquidity for estate taxes while preserving other assets for heirs.

5 Common Life Insurance Mistakes Georgia Families Make

1. Relying Only on Employer Coverage

Many Georgia professionals receive group life insurance through employers like Delta, Home Depot, or UPS, but this coverage is rarely sufficient. Employer policies typically offer only 1-2 times your annual salary, while financial experts recommend coverage of 10-15 times your income. Additionally, employer coverage terminates when you leave your job, potentially leaving you uninsured during career transitions. Smart Georgia families supplement workplace coverage with individual policies that remain in force regardless of employment changes.

2. Underinsuring to Save Money

Cutting corners on coverage amounts to save on premiums is a costly mistake. Many Georgia families purchase insufficient coverage, only to leave their loved ones financially vulnerable. A common rule of thumb suggests coverage of 10-15 times your annual income, yet many people insure for just 3-5 times their salary. The difference between a $250,000 and a $500,000 policy might be just $15-20 per month for a healthy 35-year-old—a small price to pay for double the protection.

3. Ignoring Coverage for Stay-at-Home Parents

The economic value of a stay-at-home parent often goes unrecognized in insurance planning. In Georgia, replacing services provided by a stay-at-home parent—including childcare, transportation, household management, and meal preparation—would cost approximately $60,000-$70,000 annually. Without proper coverage, the surviving parent might face significant additional expenses while dealing with the emotional impact of loss.

Life insurance for both spouses ensures complete family protection, regardless of who earns the paycheck. Even if one spouse doesn’t generate income, their contribution to family life carries substantial economic value that should be protected through appropriate coverage.

4. Waiting Too Long to Buy

Delaying life insurance purchases is a common and costly mistake among Georgia residents. Premiums increase approximately 8-10% for every year you age, meaning a policy that costs $30 monthly at age 30 might cost $45 at age 40 for the same coverage. Health conditions that develop as you age can further increase rates or even make you uninsurable. The ideal time to purchase coverage is when you’re young and healthy, locking in decades of protection at the lowest possible rates. For more information, explore what age Georgia seniors stop qualifying for life insurance.

5. Not Reviewing Policies After Life Changes

Life insurance isn’t a set-it-and-forget-it purchase. Major life events—marriage, having children, buying a home in Atlanta’s growing suburbs, or starting a business in Georgia’s entrepreneur-friendly climate—should trigger a review of your coverage. Unfortunately, many policyholders neglect these reviews, leaving coverage gaps that only become apparent when it’s too late. Experts recommend reviewing your life insurance at least every two years or after any significant life change.

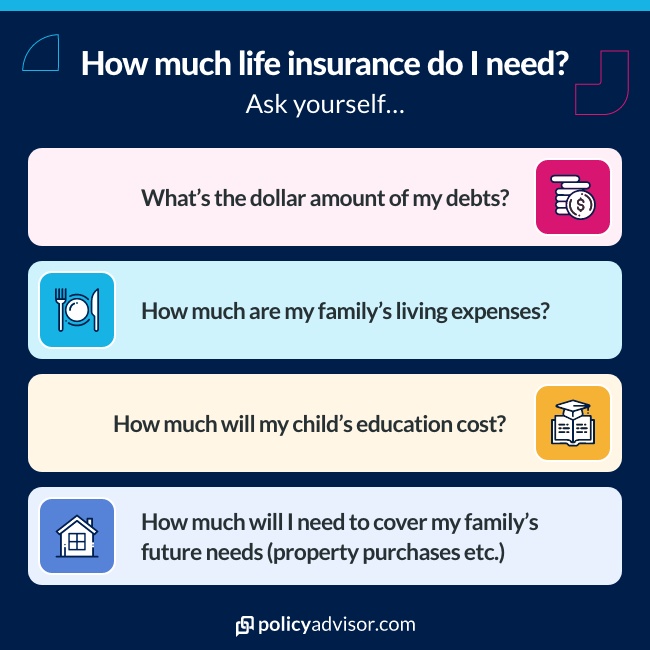

How Much Life Insurance Do You Need in Georgia?

“How Much Life Insurance Do I Need? (2025)” from www.policyadvisor.com and used with no modifications.

Determining the right amount of life insurance coverage depends on your specific financial situation and family needs. Most financial advisors recommend a coverage amount of 10-15 times your annual income, but Georgia’s unique economic landscape may require adjustments to this guideline. For example, if you live in metro Atlanta where the cost of living is higher, you might need more coverage than someone in a rural area like Valdosta or Rome.

To calculate your needs precisely, consider your current financial obligations, future expenses, and long-term goals. Start by adding up your mortgage balance, outstanding debts, anticipated college expenses for children, and approximately 5-10 years of income replacement. For a typical Georgia family with two children and a $250,000 mortgage, adequate coverage often falls between $750,000 and $1.2 million, depending on income and specific circumstances. If you’re unsure whether life insurance is the right choice for you, it’s important to weigh your options carefully.

Don’t forget to account for inflation when determining your coverage needs. What seems like adequate protection today may fall short in 10-20 years as costs rise. Georgia’s housing market has historically appreciated at about 3-4% annually, while college costs have risen even faster. Building an inflation buffer into your coverage calculations ensures long-term financial security for your loved ones. For those considering options, you might want to explore whether burial insurance is better than prepaid funeral plans in Georgia.

Contact Ranwell Insurance today @ (855) 508-5008 or ranwell.insurance@gmail for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.