Key Takeaways

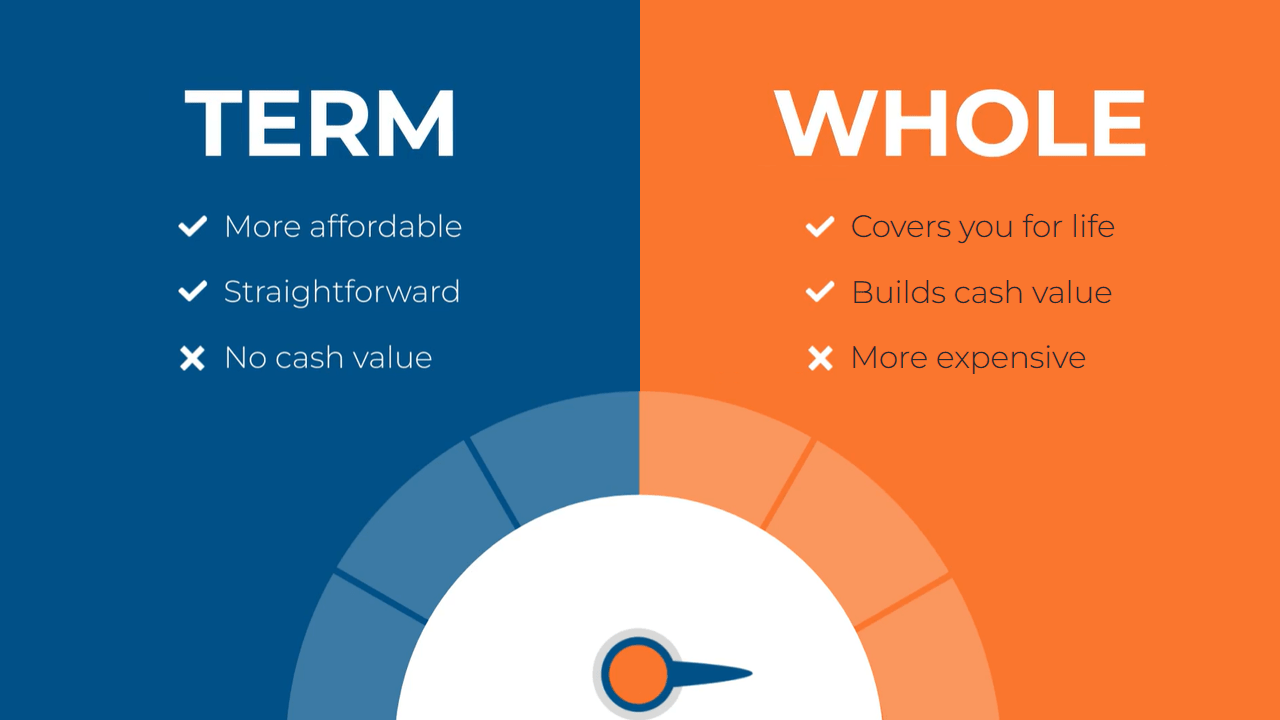

- Term life insurance offers temporary coverage at lower premiums, making it ideal for those with specific timeframes like mortgage payoff or children’s education.

- Whole life insurance provides lifetime coverage and builds cash value over time, functioning as both protection and a financial asset.

- For young families on tight budgets, term life insurance typically delivers 5-10 times more coverage for the same premium compared to whole life policies.

- While term insurance is more affordable, whole life insurance offers unique benefits for estate planning, business succession, and long-term financial strategies.

- Ranwell Insurance offers guidance on selecting the right insurance option based on your specific financial situation and long-term goals.

Term vs. Whole Life Insurance: What’s at Stake for Your Future

“Term vs. Whole Life Insurance: Which is …” from www.westernsouthern.com and used with no modifications.

Life insurance isn’t just about death benefits—it’s about securing financial peace of mind for your loved ones. Choosing between term and whole life insurance can significantly impact your family’s future and your current budget. The right choice depends on your unique circumstances, financial goals, and long-term plans.

The decision between term and whole life insurance resembles the choice between renting and buying a home. Term insurance, like renting, provides coverage for a specific period at lower costs. Whole life insurance, similar to homeownership, requires higher payments but builds equity and offers permanent benefits. Ranwell Insurance understands that this critical decision requires careful consideration of your financial situation, family needs, and long-term objectives.

This guide will walk you through the essential differences, help identify which option aligns with your circumstances, and provide a clear framework for making this important decision. Your family’s financial security is too important for a one-size-fits-all approach.

Term Life Insurance: The Straightforward Option

“Term Life Insurance Explained …” from www.partnersinsuranceinc.com and used with no modifications.

Term life insurance provides coverage for a specific period—typically 10, 20, or 30 years. If you pass away during this term, your beneficiaries receive the death benefit. If you outlive the term, the coverage simply ends. It’s straightforward, affordable, and designed to protect your dependents during your most financially vulnerable years. For those considering other options, universal life insurance might offer more flexibility.

The primary advantage of term insurance is its affordability. A healthy 30-year-old might secure $500,000 in coverage for as little as $25-35 per month. This cost-effectiveness allows young families to obtain substantial coverage when they need it most—during years of mortgage payments, child-rearing, and career building. The premiums remain level throughout the term, making it easy to budget for this important protection.

However, term insurance’s temporary nature means it eventually expires, potentially leaving you without coverage when you’re older and less insurable. About 97% of term policies never pay a death benefit because most policyholders outlive their terms. Think of term insurance as pure protection—similar to auto or home insurance—rather than as a financial asset. To understand more about life insurance options, you might consider how age affects life insurance eligibility.

Term Life Insurance at a Glance

✓ Lower premiums

✓ Simple to understand

✓ Coverage for specific time periods

✓ No cash value accumulation

✓ Expires at end of term

Whole Life Insurance: The Lifetime Solution

“How Whole Life Insurance Works” from www.investopedia.com and used with no modifications.

Whole life insurance offers permanent coverage that lasts your entire lifetime, regardless of health changes, as long as premiums are paid. Unlike term insurance, whole life includes a cash value component that grows tax-deferred over time. This cash value accumulation represents a living benefit you can access during your lifetime through policy loans or withdrawals.

The premium payments for whole life insurance are significantly higher—often 5-15 times more than term insurance for the same death benefit. However, these higher premiums serve a dual purpose: funding the death benefit and building cash value. Over decades, this cash value can become a substantial asset, potentially growing to tens or even hundreds of thousands of dollars depending on the policy size and duration.

4. Investment Savvy Individuals

For those with financial discipline and investment knowledge, term insurance paired with a separate investment strategy often outperforms whole life insurance. By purchasing term coverage and investing the premium difference in diversified portfolios, disciplined investors can potentially accumulate significantly more wealth. This “buy term and invest the difference” approach leverages the power of market returns while maintaining necessary protection.

Consider this: If you save $300-500 monthly (the typical premium difference between comparable whole and term policies) in a diversified investment portfolio averaging 7-8% returns, you could potentially accumulate $350,000-600,000 over 20 years. This approach gives you greater control over your investments, lower fees, and improved liquidity compared to whole life cash value accumulation.

5. Debt Coverage During Working Years

Term life insurance perfectly aligns with debt repayment timelines. Many families carry significant debt during their working years—mortgages, auto loans, student loans, and business loans. A term policy with a duration matching your longest debt obligation ensures your family won’t inherit these financial burdens should something happen to you. As your debts decrease over time, your need for coverage naturally diminishes, making term insurance’s temporary nature an ideal fit.

4 Cases Where Whole Life Insurance Wins

While term insurance works beautifully for many scenarios, whole life insurance offers unique advantages in specific situations. The permanent protection and cash value features solve complex financial challenges that term insurance simply cannot address. For certain financial goals and family situations, the higher cost of whole life insurance represents an investment rather than an expense.

Whole life insurance shines particularly in scenarios requiring guaranteed lifetime coverage, tax-advantaged wealth accumulation, or specific estate planning needs. These situations often involve long-term financial strategies where the permanence and cash value components provide solutions unavailable through term insurance alone. Let’s examine the situations where whole life insurance clearly outperforms term coverage.

1. Estate Planning and Wealth Transfer

Whole life insurance excels as an estate planning tool, especially for individuals with substantial assets. The death benefit provides immediate liquidity to cover estate taxes, preventing forced sales of family businesses, properties, or investments. Since life insurance proceeds typically transfer to beneficiaries income-tax-free, a whole life policy can efficiently preserve wealth across generations.

For high-net-worth individuals, whole life insurance creates an instant, tax-advantaged inheritance. The policy can be structured within an irrevocable life insurance trust (ILIT) to exclude the death benefit from the taxable estate, potentially saving families hundreds of thousands in estate taxes. This strategy preserves family wealth while providing guaranteed financial security to future generations.

2. Special Needs Family Members

Parents or guardians of children with special needs face unique lifetime financial responsibilities. Whole life insurance provides guaranteed lifetime protection that ensures continued care after parents pass away. The permanent nature of whole life coverage addresses the ongoing financial needs of dependents who may require lifelong support, making it vastly superior to term insurance that could expire while care is still needed.

3. Business Succession Planning

Whole life insurance serves as a cornerstone of effective business succession planning. When properly structured, it funds buy-sell agreements that allow surviving business partners to purchase a deceased partner’s ownership interest, providing fair compensation to the deceased’s family while ensuring business continuity. The permanent coverage ensures the buy-sell agreement remains funded regardless of when a business owner passes away.

The cash value component of whole life insurance can also serve as an emergency fund for businesses or provide supplemental retirement income for business owners. Many business owners use whole life policies as tax-advantaged vehicles to diversify their wealth outside their businesses, creating financial security independent of business performance. For those interested in exploring options, mortgage protection insurance can also be considered as a means to protect financial assets.

4. Long-Term Care Concerns

Modern whole life insurance policies often include long-term care (LTC) riders that allow policyholders to access death benefits early to cover nursing home or in-home care expenses. This feature provides valuable protection against potentially devastating long-term care costs that could otherwise deplete retirement savings. The combined life insurance and long-term care protection creates efficiency that purchasing separate policies cannot match. For those interested in learning more about life insurance options, universal life insurance can also offer benefits worth considering.

The cash value component of whole life insurance also provides a financial safety net for unexpected healthcare costs. Unlike standalone long-term care insurance where premiums might increase or benefits might decrease over time, whole life policies with LTC riders typically offer guaranteed premiums and benefits, providing certainty in long-term financial planning.

How to Make Your Final Decision

“Own Your Decisions, Own Your Life” from www.linkedin.com and used with no modifications.

Choosing between term and whole life insurance doesn’t have to be an all-or-nothing decision. Many financial professionals recommend a blended approach—using term insurance to cover temporary needs (like mortgage protection or children’s education) while incorporating some whole life coverage for permanent needs and wealth accumulation. This strategy, sometimes called “laddering,” provides comprehensive protection while maintaining budget flexibility.

Your personal financial situation, family needs, and long-term goals should drive your decision. Consider your current budget constraints, but also look ahead to how your insurance needs might evolve over decades. The right insurance strategy grows and adapts with your changing life circumstances while providing appropriate protection at each stage.

| Factor | Choose Term If… | Choose Whole Life If… |

|---|---|---|

| Budget | Limited monthly budget for premiums | Can afford higher premiums for additional benefits |

| Coverage Duration | Need coverage for specific timeframe (e.g., 20-30 years) | Need guaranteed lifetime coverage |

| Financial Goals | Pure protection is the primary goal | Want combined protection and cash value growth |

| Investment Approach | Prefer to manage investments separately | Value guaranteed growth and simplified wealth building |

Remember that your insurance needs will likely change over time. Many term policies offer conversion options that allow you to transition to permanent coverage without additional medical underwriting. This flexibility can be valuable if your health changes or your financial situation improves, making a conversion to whole life insurance more attractive and affordable later.

The Simple 3-Step Evaluation Method

To determine which type of life insurance best suits your needs, follow this straightforward evaluation process: First, calculate your total coverage need based on income replacement, debt elimination, and future expenses like college tuition. Second, determine how long each financial obligation will last—mortgage (typically 15-30 years), children’s dependency (18-22 years), income replacement for spouse. Third, compare the cost of term coverage for these specific timeframes against whole life options, considering both current affordability and long-term value.

When to Revisit Your Insurance Needs

Life insurance isn’t a set-it-and-forget-it decision. Major life events should trigger a review of your coverage to ensure it still aligns with your needs. Marriage, divorce, having children, buying a home, career changes, and retirement all significantly impact your insurance requirements. Most financial advisors recommend reviewing your life insurance coverage every 3-5 years or after any major life transition.

Pay particular attention to term policies approaching expiration. If you still have insurance needs as your term policy nears its end date, explore conversion options or new coverage before the policy terminates. Health changes can make securing new coverage more expensive or even impossible, so planning ahead is crucial. Remember that insurance costs increase with age, making early planning particularly valuable.

Key Questions to Ask Yourself Today

Self-Assessment Checklist

When considering life insurance options, it’s crucial to understand the different types available. For instance, many people wonder if burial insurance is better than prepaid funeral plans. Assessing your needs will help you make an informed decision.

1. How long will my financial dependents rely on my income?

2. What specific debts or expenses am I trying to cover?

3. Do I need permanent coverage or just protection during working years?

4. How important is building cash value within my insurance policy?

5. What’s my monthly budget for life insurance premiums? Consider options like burial insurance to manage costs effectively.

The answers to these questions create your personal insurance profile. If your dependents will rely on your income for decades to come, or if you have a child with special needs requiring lifelong support, permanent coverage deserves serious consideration. Conversely, if your primary concern is covering a 30-year mortgage or funding college education, term insurance perfectly matches those timeframes.

Consider not just your current financial situation, but where you expect to be in 10, 20, or 30 years. Life insurance planning requires looking beyond immediate needs to anticipate future financial responsibilities and opportunities. The right policy provides not just protection but peace of mind that comes from knowing you’ve secured your family’s financial future. For more insights on choosing the best type of life insurance, you can explore this ultimate guide.

Many financial advisors recommend securing insurance equal to 10-15 times your annual income. However, this multiplier approach is just a starting point. Your specific circumstances—including existing savings, debt load, future educational expenses, and retirement plans—should shape your final coverage amount. Quality financial protection isn’t about maximizing coverage, but about right-sizing it to your particular situation.

Frequently Asked Questions

After helping thousands of individuals and families make insurance decisions, certain questions consistently arise. The answers to these common questions often provide clarity in making the term versus whole life decision. Understanding these nuances can help you navigate the complexities of life insurance with greater confidence.

While insurance terminology can sometimes seem overwhelming, focusing on how each policy type addresses your specific needs cuts through the confusion. These frequently asked questions address the most common concerns and misconceptions about term and whole life insurance policies.

Can I convert my term life insurance to whole life later?

Many term life policies include conversion privileges that allow you to convert to permanent coverage without additional medical underwriting. This valuable feature means you can secure affordable term coverage now and convert part or all of it to whole life insurance later when your financial situation improves or your insurance needs evolve. Conversion options typically have time limitations, often allowing conversion only within the first 10-15 years of the policy or before age age 65-70.

Conversion makes particular sense if your health deteriorates during your term policy. Since no new medical exam is required, you can secure permanent coverage at standard rates based on your original health classification, potentially saving thousands in premiums compared to applying for a new policy. Review your policy’s specific conversion terms and deadlines, as these provisions vary significantly between insurance carriers.

What happens to whole life cash value if I stop paying premiums?

If you stop paying premiums on a whole life policy that has accumulated cash value, several options become available. Most policies offer reduced paid-up insurance, where the cash value purchases a smaller permanent policy with no further premiums required. Alternatively, the cash value can maintain the full death benefit temporarily through extended term insurance, essentially converting your whole life policy into term insurance for a specific period based on your accumulated cash value. For those considering other forms of insurance, you might explore mortgage protection insurance as an option to safeguard your home.

- Surrender the policy – Receive the cash surrender value as a lump sum (potentially subject to taxes if the amount exceeds premiums paid)

- Policy loan – Borrow against the cash value to pay premiums temporarily

- Reduced paid-up insurance – Convert to a smaller permanent policy with no further premiums

- Extended term insurance – Use cash value to purchase term insurance for the original death benefit amount

The specific options available depend on your policy’s provisions and the amount of cash value accumulated. Policies typically need to be in force for 10-20 years to accumulate significant cash value that provides meaningful non-forfeiture options. Before stopping premium payments, consult with your insurance company to understand exactly how your benefits would be affected.

Remember that accessing cash value through loans or withdrawals reduces the death benefit available to beneficiaries. Policy loans accrue interest and, if not repaid, this interest further diminishes the death benefit. Always consider the long-term implications before utilizing these options.

Is the death benefit from life insurance taxable to beneficiaries?

Death benefits from life insurance policies—both term and whole life—generally pass to beneficiaries income-tax-free. This tax advantage represents one of the most powerful benefits of life insurance as an estate planning tool. Your beneficiaries typically receive the full face value of your policy without having to report it as income on their tax returns, regardless of the policy size. This tax treatment applies whether the policy paid out $50,000 or $5 million. For more information on how life insurance can protect your family, read about universal life insurance benefits.

While income tax doesn’t apply to death benefits, estate taxes might if the policy is owned by the insured and the total estate exceeds federal or state estate tax thresholds. This potential estate tax liability can be avoided through proper ownership structuring, such as having the policy owned by an irrevocable life insurance trust (ILIT) or by the beneficiary directly. Consulting with an estate planning attorney helps ensure your life insurance proceeds provide maximum benefit to your loved ones.

How do medical exams affect premium rates for each type?

Medical examinations significantly impact premium rates for both term and whole life insurance, though the effect is more pronounced with term policies due to their lower base cost. Excellent health can reduce premiums by 25-50% compared to standard rates, while health issues like high blood pressure, elevated cholesterol, or diabetes might increase premiums by 50-300% or even result in declined applications. Some insurers offer no-exam policies for both term and whole life coverage, but these convenience policies typically charge 15-30% higher premiums and may limit coverage amounts.

Can I have multiple life insurance policies at the same time?

Yes, you can own multiple life insurance policies from different companies simultaneously, and many financial advisors actually recommend this strategy. Layering policies with different terms and coverage amounts—known as a “ladder strategy”—allows you to match your coverage to your declining financial obligations over time. For example, you might combine a 30-year term policy (for mortgage protection), a 20-year policy (for children’s education), and a small whole life policy (for final expenses and legacy planning).

- Diversification of insurance providers – Spreads risk across multiple insurance companies

- Coverage tailored to specific needs – Match policy terms to different financial obligations

- Cost optimization – Potentially lower overall premium costs compared to one large policy

- Flexibility – Adjust coverage as needs change without modifying all insurance

Insurance companies will ask about your existing coverage during the application process to ensure the total amount of insurance you’re applying for is reasonable based on your financial situation. Most insurers follow financial underwriting guidelines limiting total coverage to roughly 20-30 times your annual income, depending on your age and circumstances.

The ladder strategy often provides more appropriate coverage throughout your life at a lower overall cost. As shorter-term policies expire, your coverage naturally decreases to match your diminishing insurance needs—children become independent, mortgages get paid down, and retirement savings grow. This approach prevents you from paying for unnecessary coverage in later years.

Whether you choose term insurance, whole life insurance, or a combination approach, the most important factor is having adequate protection for your loved ones’ financial security. The right insurance policy provides not just a death benefit, but peace of mind knowing you’ve taken care of those who matter most.

Both term and whole life insurance have their place in financial planning. The best choice depends on your specific situation, budget, and long-term objectives. By understanding the fundamental differences between these policy types, you can make an informed decision that secures your family’s financial future. For instance, if you’re considering coverage for specific needs, learn how universal life insurance helps Georgia parents protect their special needs children.

Contact Ranwell Insurance today @ (855) 508-5008 or ranwell.insurance@gmail for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.