Key Takeaways

- Life insurance provides financial protection for your loved ones, covering expenses like mortgage payments, debt repayment, and educational costs after you’re gone.

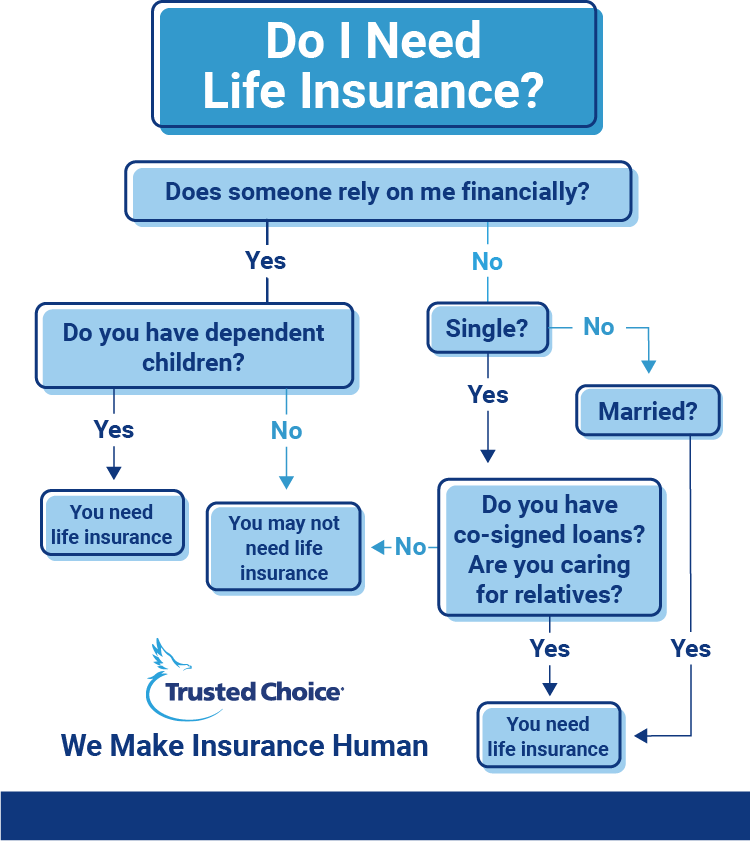

- People with dependents, mortgages, or business partners typically benefit most from life insurance coverage.

- Not everyone needs life insurance—singles without dependents or those with substantial savings may find it unnecessary.

- Term life insurance offers affordable protection for a specific period, while whole life provides lifetime coverage with a cash value component.

- Ranwell Insurance can help match you with the right policy by comparing quotes from multiple top-rated insurance providers to find the best coverage for your specific needs.

Life insurance isn’t for everyone, but when you need it, it’s invaluable. The right policy creates an immediate financial safety net that protects the people who depend on you most.

I’ve guided hundreds of clients through this decision, and the answer always comes down to one question: Would someone suffer financially if you were gone tomorrow? If yes, life insurance deserves serious consideration. If no, your money might be better invested elsewhere.

Let’s cut through the confusion and help you determine if life insurance makes sense for your specific situation.

Life Insurance Explained: What You Need to Know Now

“Life Insurance Types And Their …” from managed-accounts-ir.com and used with no modifications.

Life insurance is fundamentally a contract between you and an insurance company. You pay regular premiums, and in exchange, the insurer promises to pay a tax-free death benefit to your chosen beneficiaries when you pass away. This lump sum payment provides immediate financial support precisely when your loved ones might be most vulnerable.

Think of life insurance as a financial shield that activates exactly when needed. The coverage amount and policy type you select should align with your specific financial situation and the needs of those who depend on you. Whether it’s replacing lost income, paying off a mortgage, covering final expenses, or funding a child’s education, life insurance creates financial certainty during an otherwise uncertain time.

How Life Insurance Actually Works

The mechanics of life insurance are surprisingly straightforward. After applying and completing the underwriting process (which may include health questions, a medical exam, and financial verification), you’ll pay regular premiums to keep your policy active. These payments can be monthly, quarterly, or annually, depending on what works best for your budget. For more insights, you can explore who needs life insurance to better understand your needs.

If you pass away while the policy is in force, your beneficiaries file a claim with the insurance company by submitting a death certificate. The insurer then verifies the claim and pays the death benefit directly to your beneficiaries, typically within 30-60 days. This money isn’t subject to income tax and can be used however your beneficiaries choose—there are no restrictions on how they allocate these funds.

Most policies include a contestability period (usually the first two years), during which the insurer can investigate and potentially deny claims if they discover application fraud. After this period, policies become virtually incontestable except in rare circumstances of fraud. To understand more about why this period is crucial, check out this guide on life insurance needs.

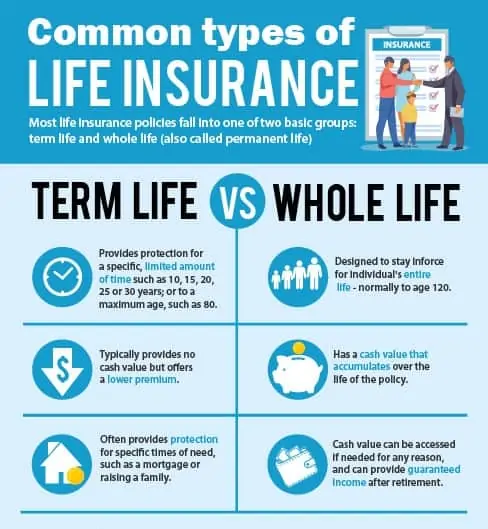

Term vs. Whole Life: The Core Differences

Life insurance comes in two primary flavors: term and permanent (with whole life being the most common permanent option). Understanding the difference is crucial for making the right choice.

Term life insurance provides coverage for a specific period—typically 10, 20, or 30 years. It’s pure protection with no bells and whistles, making it significantly more affordable. Think of it like renting an apartment—you get protection for the duration of your term, but there’s no equity buildup. This option works well for those needing coverage during specific financial vulnerability periods, like while raising children or paying off a mortgage.

Whole life insurance, by contrast, covers you for your entire lifetime and includes a cash value component that grows over time. This cash value builds tax-deferred and can be borrowed against if needed. The premiums are substantially higher—often 5-15 times more than comparable term coverage—but the policy never expires as long as you pay the premiums. This option makes sense for those with permanent insurance needs or those using life insurance as part of a complex estate planning strategy.

“Term life is like renting protection when you need it most, while whole life is like buying a financial asset that combines protection with long-term value accumulation.”

5 Clear Signs You Need Life Insurance

“Life Insurance Cost: How Much Is It …” from www.trustedchoice.com and used with no modifications.

Deciding whether life insurance makes sense for you isn’t always straightforward. However, certain life situations strongly indicate you should consider coverage. The following five scenarios represent the most common and compelling reasons to purchase a life insurance policy.

1. You Have Financial Dependents

Having children, a spouse, or other family members who rely on your income creates an immediate need for life insurance. If your income suddenly disappeared, your dependents could face significant financial hardship. Life insurance creates an instant financial safety net that replaces your income, allowing your family to maintain their standard of living and pursue their goals despite your absence.

The financial impact is especially critical for single-income households or families where one partner earns substantially more. Even stay-at-home parents should consider coverage since their passing would create childcare expenses that could strain family finances. Coverage amounts typically range from 5-15 times your annual income, depending on your family’s specific needs and future goals.

2. You’re a Homeowner With a Mortgage

A mortgage is likely your largest financial obligation, and life insurance ensures your family can keep their home if you’re no longer around to help make payments. Without this protection, your spouse or co-owner might be forced to sell the home quickly—often at a loss—or face potential foreclosure during an already difficult time.

Many financial advisors recommend having enough coverage to pay off your mortgage entirely or at least cover several years of payments. This approach gives your family breathing room to make thoughtful decisions about whether to stay in the home long-term or transition to more affordable housing without financial pressure.

3. You Have Significant Debts

Personal debts don’t disappear when you die—they become a claim against your estate. Co-signed debts can directly impact your co-signer’s financial health. Student loans, car loans, credit card balances, and personal loans could all become your family’s responsibility, depending on the type of debt and whether someone co-signed with you.

Life insurance creates an immediate source of funds to settle these obligations, preventing debt collectors from targeting your estate or co-signers. This protection is particularly important for young professionals carrying substantial student loan debt or entrepreneurs with business-related personal guarantees.

4. You Want to Cover Final Expenses

Funeral services, burial costs, and final medical expenses often create an immediate financial burden on families. The average funeral now costs between $7,000 and $12,000, and final medical bills can reach tens of thousands depending on circumstances. Life insurance provides your loved ones with readily available funds to cover these expenses without dipping into savings or taking on debt.

5. You Have a Business Partner

Business partnerships create unique life insurance needs that many entrepreneurs overlook. If you or your business partner died unexpectedly, the surviving partner might struggle to buy out the deceased partner’s ownership stake from their heirs. This situation often forces difficult decisions about bringing in new partners or selling the business under unfavorable conditions.

A properly structured life insurance policy—often through a formal buy-sell agreement—ensures business continuity by providing the surviving partner with funds to purchase the deceased partner’s interest. This arrangement protects both the business and the deceased partner’s family by creating a clean, predetermined exit strategy that fairly compensates all parties. For those in Georgia, life insurance is still possible even if denied before, ensuring peace of mind for all involved.

When You Might Not Need Life Insurance

“Reasons Not to Buy Life Insurance …” from www.mychoice.ca and used with no modifications.

While life insurance offers valuable protection for many, it’s not universally necessary. Understanding when you might reasonably skip coverage helps you allocate your financial resources more effectively. The decision should always align with your specific circumstances rather than following generic advice.

Remember that life insurance needs change throughout your lifetime. Regularly reassessing your coverage as your financial situation evolves ensures you’re neither over-insured nor under-protected. The following scenarios represent common situations where life insurance may be unnecessary or where minimal coverage might suffice.

Single With No Dependents

If no one relies on your income and you have sufficient savings to cover your final expenses, life insurance may be unnecessary. Your financial focus might better center on building emergency funds, retirement accounts, or other investments that directly benefit you during your lifetime. However, even singles should consider whether parents or siblings might need financial assistance with final arrangements, especially if family resources are limited.

Already Financially Secure

Those who’ve accumulated substantial assets and have minimal debt may have effectively “self-insured” against the financial impact of their passing. If your investment portfolio, retirement accounts, and other assets would provide adequately for any dependents, additional life insurance might be redundant. This situation typically applies to those approaching retirement age who have successfully executed their long-term financial plan. However, for those still considering options, final expense insurance might be worth exploring.

However, even wealthy individuals often maintain some life insurance coverage for estate planning purposes, charitable giving, or to provide liquidity for estate taxes without forcing the sale of illiquid assets. The decision depends on the complexity of your estate and your legacy goals.

Consider consulting with both a financial advisor and an estate planning attorney before deciding to forgo coverage entirely based solely on asset levels. They can help identify potential tax implications or liquidity challenges that might make some coverage beneficial despite your overall financial security.

Children Are Grown and Independent

Many people find their life insurance needs diminish significantly once their children are financially independent and major debts like mortgages are paid off. At this stage, you might consider reducing coverage to amounts that would simply cover final expenses or provide a modest inheritance. Some choose to convert term policies to smaller permanent coverage that will remain in force regardless of future health changes.

Common Life Insurance Myths Debunked

Life insurance discussions often include persistent misconceptions that lead to poor decisions. Let’s address some common myths: First, employer-provided coverage is rarely sufficient—these policies typically offer only 1-2 times your salary and terminate when you leave the company. Second, life insurance isn’t just for breadwinners—stay-at-home parents provide valuable services that would be expensive to replace. Third, healthy young adults don’t “waste money” on premiums—in fact, purchasing in your 20s or 30s locks in dramatically lower rates. Finally, life insurance isn’t primarily an investment vehicle—while some policies build cash value, their primary purpose remains protecting those who depend on you financially. For more insights on how universal life insurance helps parents, explore our detailed guide.

How Much Coverage Do You Actually Need?

Determining the right coverage amount requires a personalized approach rather than relying on oversimplified rules like “10 times your income.” Start by calculating your family’s financial needs: immediate expenses (final costs, debts), ongoing needs (income replacement, mortgage), and future obligations (college funding). From this total, subtract existing resources like savings, investments, and other insurance coverage. The difference represents your approximate coverage need.

Most families find their optimal coverage falls between 5-15 times their annual income, with higher multiples appropriate for younger families with children and lower multiples suitable for those approaching retirement. Remember that your needs will change over time, so revisiting this calculation every few years ensures your coverage remains aligned with your evolving financial situation.

Buying Life Insurance: A Simple Step-by-Step Guide

“Life Insurance Council of New York” from licony.org and used with no modifications.

Purchasing life insurance doesn’t need to be complicated when you break it down into manageable steps. Start by researching reputable insurance companies and gathering multiple quotes to compare options. Ranwell Insurance makes this process seamless by letting you compare policies from numerous top-rated insurers in one place, saving you time and ensuring you find the most competitive rates.

Next, complete the application process, which typically includes answering health questions and, for larger policies, completing a medical exam. Be completely honest during this stage—misrepresentations can lead to claim denials later. After underwriting, review your policy offer carefully, paying special attention to coverage amount, premium structure, policy duration, and any exclusions. Finally, designate your beneficiaries with specific percentages and include contingent beneficiaries as backups.

Remember to review your policy regularly—especially after major life events like marriage, divorce, having children, or purchasing a home. Most experts recommend reassessing your coverage every 3-5 years to ensure it continues to align with your changing financial circumstances and family needs.

Frequently Asked Questions

Life insurance decisions often raise numerous questions as you navigate the options available. The following section addresses the most common concerns people have when considering whether life insurance is right for them. Understanding these fundamentals can help you make more confident decisions about your financial protection strategy.

If your specific question isn’t answered below, consider consulting with a licensed insurance agent who can provide personalized guidance based on your unique situation. Many insurance companies offer free consultations that can clarify your options without any obligation to purchase.

At what age should I buy life insurance?

The ideal time to purchase life insurance is when you’re young and healthy—typically in your 20s or 30s—even if you don’t yet have dependents. Premiums increase approximately 8-10% for each year you delay purchasing, so securing coverage early can save you significantly over your lifetime. However, the right time ultimately depends on when you develop financial responsibilities that would create hardship for others if you passed away. Even if you’ve waited, don’t let age discourage you from getting quotes—affordable options exist at every life stage, and some coverage is always better than none if you have people depending on you.

Can I have multiple life insurance policies?

Yes, you can own multiple life insurance policies from different companies, and it’s sometimes strategically advantageous to do so. This approach, called “laddering,” involves purchasing several term policies with different expiration dates to match your declining insurance needs as you age and pay down debts. For instance, you might have a 30-year policy to cover your mortgage, a 20-year policy for children’s education, and a 10-year policy for other short-term obligations. The total coverage decreases over time as policies expire, potentially saving you thousands in premiums compared to maintaining maximum coverage for the longest term. For more information, you can explore this guide on life insurance.

Another valid reason for multiple policies is separating coverage for different needs—perhaps keeping business obligations separate from family protection. Just be aware that insurance companies will review your total existing coverage during underwriting to ensure you’re not over-insured relative to your financial situation.

What happens if I miss premium payments?

Most life insurance policies include a grace period—typically 30 days—during which coverage remains active even if you miss a payment. If you pay within this period, your policy continues without interruption. Beyond the grace period, term policies generally lapse and require reinstatement, which may involve proving your insurability again through health questions or even a new medical exam. Permanent policies like whole life often use accumulated cash value to cover missed premiums, preventing immediate lapse. If you anticipate payment difficulties, contact your insurer immediately—many offer hardship options or payment plans that can help preserve your valuable coverage during temporary financial setbacks.

Is life insurance worth it if I’m over 60?

Life insurance can still serve important purposes after 60, though your options and costs change significantly. If you have sufficient savings and investments, and no dependents rely on your income, you may not need extensive coverage. However, final expense policies (typically $10,000-$25,000) remain reasonably affordable and can cover burial costs, preventing this burden from falling on family members. Additionally, life insurance can be strategically valuable for estate planning, charitable giving, or leaving tax-free inheritances to grandchildren. Consider guaranteed issue policies that don’t require medical exams if health conditions make traditional underwriting challenging, but be prepared for higher premiums and possible two-year waiting periods for full benefits.

How do beneficiaries claim life insurance money?

The claims process is straightforward but requires certain documentation. Beneficiaries should contact the insurance company directly, providing the policyholder’s name, policy number, and a certified death certificate. Most insurers offer multiple payout options, including lump-sum payments, installments over time, or annuity-like income streams. The entire process typically takes 30-60 days, though simple claims can be processed faster. Beneficiaries should know that life insurance proceeds are generally income-tax-free, though they may affect estate taxes in certain situations. To make this process easier for your loved ones, keep your policy information, insurance company contact details, and agent information with your important documents, and inform your beneficiaries about the policy’s existence.

Life insurance represents one of the most selfless financial decisions you can make—protecting those you care about even after you’re gone. Whether you need coverage depends entirely on your unique financial situation and the people who depend on you. Take time to evaluate your specific needs, compare options carefully, and make an informed choice that aligns with your broader financial goals.

For personalized guidance and to compare quotes from multiple top-rated providers, Ranwell Insurance can help you find the right coverage at competitive rates—giving you and your loved ones valuable peace of mind.

Contact Ranwell Insurance today @ (855) 508-5008 or ranwell.insurance@gmail for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.