Key Takeaways

- Georgia seniors face mounting medical debt with average out-of-pocket costs exceeding $6,500 annually, making specialized life insurance policies crucial for financial protection

- Ranwell Insurance offers tailored life insurance solutions for Georgia seniors that can help cover existing and future medical debts while providing peace of mind

- Final expense and simplified issue policies are particularly valuable for seniors with health concerns, as they often require minimal or no medical examinations

- Strategic life insurance planning can protect family assets from being seized to cover medical debts after a senior’s passing

- Understanding Georgia’s specific laws regarding medical debt inheritance is essential when selecting appropriate coverage amounts and policy types

Medical debt is silently crushing thousands of Georgia seniors, with many facing the impossible choice between life-saving care and financial stability. As healthcare costs continue to climb across the Peach State, finding protection against these mounting expenses has never been more critical. At Ranwell Insurance, we’ve seen firsthand how the right life insurance policy can become a financial lifeline for seniors struggling with medical expenses.

Medical Debt Crisis Facing Georgia Seniors: The Hard Truth

“Medical Debt and Debt Settlement in Georgia” from www.konnlaw.com and used with no modifications.

Georgia’s senior population faces a particularly challenging healthcare landscape. With the state ranking 41st nationally for healthcare affordability, older residents are disproportionately affected by rising costs. The average Georgia senior now pays over $6,500 annually in out-of-pocket medical expenses, a figure that has increased by 23% in just five years.

What makes this situation uniquely troubling is Georgia’s limited Medicaid expansion, leaving many seniors in the coverage gap – too “wealthy” for assistance but unable to afford comprehensive insurance. This reality is compounded by Georgia having one of the highest rates of hospital closures in rural areas, forcing seniors to travel farther for care and incur additional expenses.

The statistics paint a sobering picture. Over 68% of personal bankruptcies in Georgia involve substantial medical debt, with seniors accounting for nearly a third of these cases. Even more concerning, medical debt collection actions have risen 47% for Georgians aged 65+ since 2018. Behind these numbers are real people facing impossible choices – between medications and groceries, between treatments and keeping their homes. For those seeking financial relief, understanding life insurance costs for seniors can be a crucial step.

Why Traditional Insurance Plans Fail Georgia Seniors

Medicare, while valuable, leaves significant gaps that become financial pitfalls for Georgia seniors. Original Medicare (Parts A and B) typically covers only about 80% of approved costs, leaving seniors responsible for the remaining 20% with no annual out-of-pocket maximum. For serious conditions like cancer or heart disease, this 20% can quickly escalate into tens of thousands of dollars. Supplemental plans that could cover these gaps often come with restrictive underwriting requirements that many seniors with pre-existing conditions cannot meet. To understand more about the financial challenges faced, explore life insurance costs for an 80-year-old in Georgia.

Traditional health insurance alternatives present their own challenges. The average premium for private health insurance for a 65+ individual in Georgia has reached approximately $1,250 monthly – an impossible expense for those living on fixed incomes. Meanwhile, Georgia’s specific insurance regulations allow for age-rating factors that can make premiums up to 3 times higher for seniors compared to younger policyholders.

Medicare Advantage plans, while growing in popularity, carry hidden risks many Georgia seniors discover too late. Many plans limit coverage networks, creating significant obstacles in rural Georgia where healthcare options are already scarce. In fact, 41% of Georgia seniors in Medicare Advantage plans report having been denied coverage for what they believed was medically necessary care, forcing them to pay out-of-pocket or forego treatment entirely.

Life Insurance as a Strategic Solution for Medical Debt

While not conventionally viewed as health protection, life insurance offers unique advantages for Georgia seniors concerned about medical debt. Unlike health insurance, which typically addresses current medical needs, life insurance provides a financial safety net that can be strategically leveraged against both existing and future medical obligations. This makes it an invaluable component of comprehensive financial planning for seniors.

The key benefit lies in how life insurance death benefits can be structured to address medical debt concerns. These proceeds can be specifically directed to cover outstanding medical balances, preventing family assets from being depleted through debt collection after passing. In Georgia, where medical creditors have up to five years to make claims against an estate, this protection is particularly valuable. Additionally, certain policy types offer living benefits that can be accessed during health crises, providing immediate financial relief when medical expenses become overwhelming.

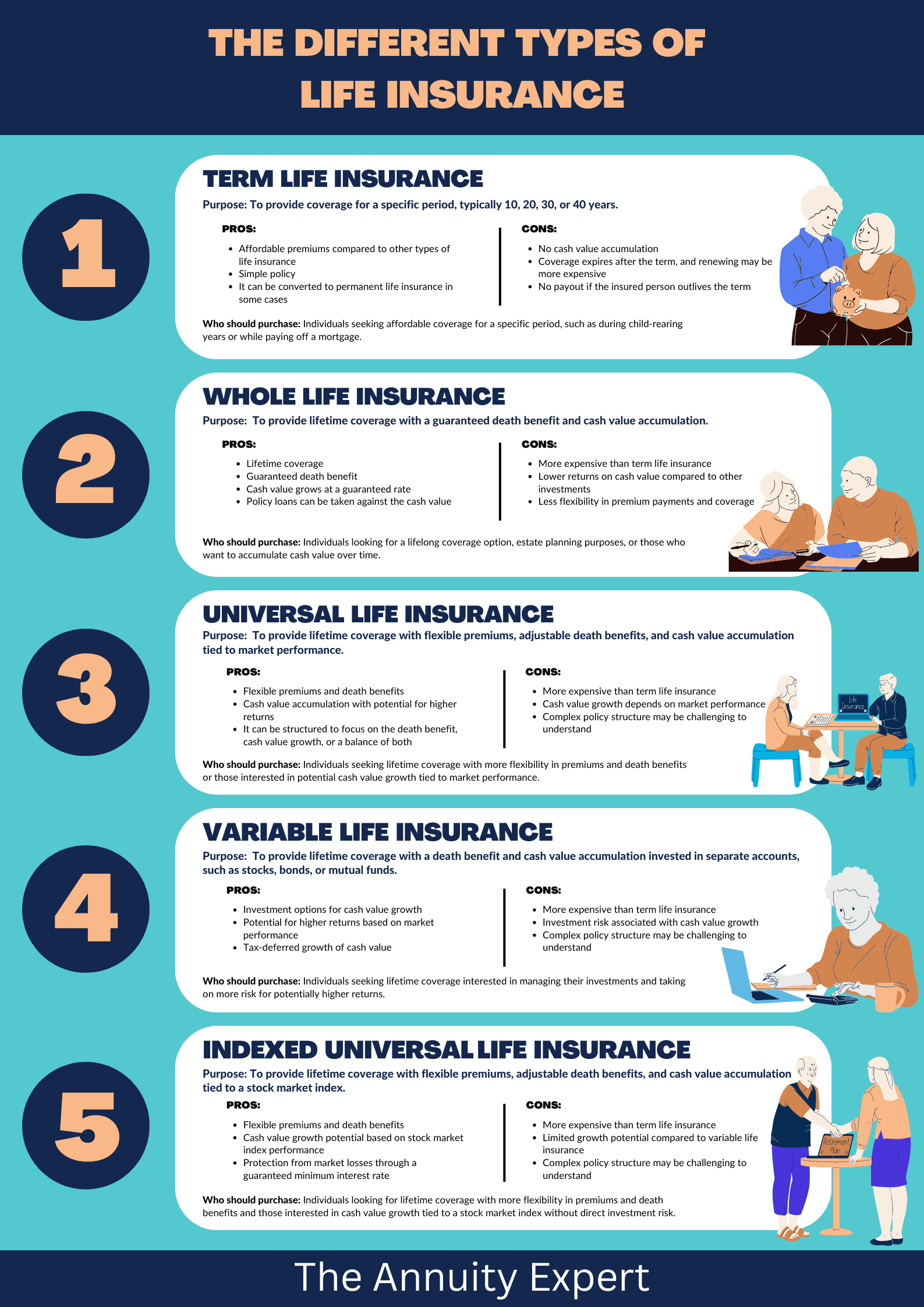

5 Types of Life Insurance Policies for Georgia Seniors

“Multiple Protection Life Insurance” from www.annuityexpertadvice.com and used with no modifications.

Georgia seniors have several life insurance options specifically designed to address medical debt concerns. Each policy type offers distinct advantages depending on your health status, financial goals, and immediate needs. Understanding these differences is crucial for selecting coverage that provides maximum protection against healthcare expenses while remaining affordable on a fixed income.

1. Final Expense Insurance: The Affordable Option

Final expense insurance stands as one of the most accessible options for Georgia seniors concerned about medical debt. With modest coverage amounts typically ranging from $5,000 to $25,000, these policies are specifically designed to cover end-of-life expenses, including outstanding medical bills. The relatively low face values translate to premiums that usually fall between $50-$150 monthly, making them attainable even for seniors on fixed incomes. Ranwell Insurance offers specialized final expense policies with acceptance rates exceeding 85% for Georgia applicants over 65, regardless of minor health conditions.

What makes final expense insurance particularly valuable is its simplified underwriting process. Most policies require only answering basic health questions rather than completing comprehensive medical exams. This accessibility ensures that seniors with common age-related conditions can still secure coverage. Additionally, these policies typically feature level premiums that won’t increase over time, providing budget certainty that’s crucial for retirees managing limited resources.

2. Whole Life Insurance: Lifetime Coverage with Cash Value

Whole life insurance provides Georgia seniors with permanent protection against medical debt while simultaneously building financial value they can access during their lifetime. Unlike term policies that eventually expire, whole life coverage remains in force as long as premiums are paid, guaranteeing that funds will be available to address medical obligations regardless of when they pass. The death benefit can be structured to prioritize medical creditors, ensuring that healthcare debts don’t burden loved ones or deplete inheritance assets.

The distinguishing feature of whole life policies is their cash value component, which grows tax-deferred over time and can be accessed through policy loans or withdrawals. This creates a financial safety valve for unexpected medical expenses that may arise while the policyholder is still living. For Georgia seniors facing high-deductible Medicare plans or costly prescription medications, this liquidity can prove invaluable. Ranwell Insurance’s senior-focused whole life products allow cash value access without penalties after just two years, providing earlier financial flexibility than many competitor offerings.

3. Term Life Insurance: Temporary Protection During Critical Years

Term life insurance offers Georgia seniors temporary coverage during specific periods when medical debt risks are highest. These policies provide substantial death benefits at lower premium costs compared to permanent insurance, making them ideal for seniors needing maximum protection with budget limitations. For example, a 65-year-old Georgia resident can typically secure $100,000 in 10-year term coverage for approximately $150-$250 monthly, depending on health factors. To understand more about these costs, you can explore life insurance costs for a 60-year-old in Georgia.

Term policies work particularly well for seniors with specific timelines or financial concerns. They can be strategically timed to provide enhanced protection during higher-risk medical periods, such as scheduled surgeries or ongoing cancer treatments. Additionally, term insurance can bridge coverage gaps until other financial resources become available, such as delayed pension benefits or real estate liquidation plans. While lacking cash value components, the affordable premiums allow seniors to allocate more resources toward current medical expenses while maintaining protection against future healthcare debts.

4. Simplified Issue Policies: Coverage Without Medical Exams

Simplified issue life insurance addresses a critical barrier many Georgia seniors face when seeking coverage: medical qualification challenges. These policies require no physical examination and minimal health questions, making them accessible to individuals with existing health conditions that might otherwise result in coverage denial. While premiums typically run 15-30% higher than fully underwritten policies, this increased cost is often outweighed by the accessibility benefits for seniors with complex medical histories.

These policies are particularly valuable for Georgia seniors already managing chronic conditions like diabetes, heart disease, or COPD who need protection against accumulating additional medical debt. Coverage amounts typically range from $25,000 to $100,000, providing meaningful protection without excessive costs. Ranwell Insurance offers simplified issue policies with specialized riders that can accelerate benefits for specific medical conditions, allowing policyholders to access a portion of their death benefit if diagnosed with qualifying illnesses – creating immediate financial relief for medical expenses.

5. Guaranteed Issue Life Insurance: When Health is a Concern

Guaranteed issue life insurance represents the most accessible option for Georgia seniors with significant health challenges. These policies promise approval regardless of medical history, with no health questions asked and no medical exams required. While coverage amounts are typically modest (usually $5,000 to $25,000) and premiums higher than other options, they provide an essential financial safety net for seniors who would otherwise remain uninsurable due to pre-existing conditions.

Most guaranteed issue policies feature a graded death benefit, meaning that if death occurs within the first 2-3 years from natural causes, beneficiaries receive only returned premiums plus interest rather than the full face value. However, after this waiting period expires, the full death benefit becomes available to address medical debts and other expenses. For Georgia seniors with serious health conditions who have been declined for other coverage options, guaranteed issue policies offer peace of mind that at least some financial protection exists for their medical obligations.

How to Maximize Your Life Insurance for Medical Debt Protection

“Debt Protection Plus – All In Credit Union” from allincu.com and used with no modifications.

Strategic planning can significantly enhance how life insurance shields Georgia seniors from medical debt burdens. Start by conducting a comprehensive medical debt audit that includes not just current balances but anticipated future expenses based on your health profile. This analysis should inform your coverage amount, which ideally should accommodate both existing medical obligations and projected healthcare costs through end-of-life care. Ranwell Insurance offers complimentary medical debt projection consultations that utilize healthcare cost forecasting tools specific to Georgia’s medical pricing structures.

Consider structuring your policy with an irrevocable beneficiary designation to a medical debt repayment trust. This arrangement ensures that funds are specifically allocated to healthcare obligations rather than being vulnerable to other creditors or spending pressures. Additionally, explore combination policies that merge life insurance with long-term care benefits, which can address both current medical needs and posthumous debt concerns. For policies with living benefits, establish clear acceleration criteria aligned with your specific health vulnerabilities so funds become available precisely when medical expenses are most likely to escalate. Learn more about life insurance options for seniors to effectively manage these financial concerns.

Frequently Asked Questions

At what age should Georgia seniors purchase life insurance for medical debt protection?

The ideal time for Georgia seniors to secure life insurance for medical debt protection is between ages 60-70, when policies remain reasonably affordable yet provide meaningful coverage. Waiting until after 70 typically results in premium increases of 25-40% per year, substantially reducing purchasing power. For those with existing health conditions, acting sooner is particularly crucial as qualification becomes increasingly difficult with age. Ranwell Insurance data shows that Georgia seniors who purchase policies before age 65 save an average of $1,800 annually compared to those who wait until their early 70s, while also qualifying for higher coverage amounts.

Can life insurance cover medical debts that were incurred before the policy was purchased?

Yes, life insurance proceeds can absolutely address medical debts incurred before policy purchase. The death benefit functions as an unrestricted financial resource that beneficiaries can direct toward any obligation, including pre-existing medical balances. Unlike health insurance, which typically won’t cover past expenses, life insurance creates a funding mechanism for all medical debts regardless of when they were accumulated. This makes it particularly valuable for Georgia seniors already managing significant healthcare costs who want to prevent these financial burdens from transferring to family members.

How does Georgia state law affect how medical debts are handled after death?

Georgia follows specific creditor priority laws that significantly impact how medical debts are handled after death. Medical creditors are classified as general unsecured creditors, placing them behind secured debts, funeral expenses, and probate costs in the collection hierarchy. However, Georgia’s extended 5-year statute of limitations for debt collection gives medical providers substantial time to pursue claims against an estate, often resulting in delayed settlement proceedings.

Under Georgia Code § 53-7-40, estate executors must publish a notice to creditors, giving medical providers four months to file claims. After this period, executors can legally distribute assets without liability for unfiled claims. However, this doesn’t extinguish the debt itself – medical creditors can still pursue collection from distributed assets within the 5-year statute of limitations. This creates a prolonged period of financial uncertainty for heirs.

Most importantly, Georgia is one of nine states with limited “filial responsibility” provisions that, under certain circumstances, can make adult children legally responsible for their parents’ essential medical expenses when other payment sources are exhausted. While rarely enforced currently, these laws remain on the books and represent a potential liability. Life insurance provides a dedicated funding source that shields family members from these legal complexities while ensuring medical providers receive payment.

What’s the minimum coverage amount recommended for seniors with existing medical conditions?

For Georgia seniors with existing medical conditions, the minimum recommended coverage starts at $25,000 for those with managed chronic conditions and rises to $50,000-$100,000 for those with more complex health challenges. This recommendation is based on Georgia’s average medical debt per senior ($18,500) plus a buffer for final expenses and potential debt acceleration. The calculation should also factor in your specific treatment protocols, as specialized medications and therapies can significantly increase costs. Ranwell Insurance utilizes a proprietary Medical Debt Projection Calculator that analyzes Georgia’s regional healthcare pricing, Medicare coverage gaps, and condition-specific expense patterns to provide personalized coverage recommendations tailored to each senior’s unique health profile.

Can I still qualify for life insurance if I’m already dealing with significant medical debt?

Yes, Georgia seniors with significant medical debt can still qualify for life insurance, though the specific options may be more limited. While traditional underwriting considers your health condition rather than your debt status directly, many seniors find that simplified issue and guaranteed acceptance policies offer accessible alternatives regardless of financial circumstance. These policies typically have acceptance rates above 85% for Georgia seniors, even those with substantial medical obligations. To understand the costs involved, you might want to explore life insurance costs for seniors in Georgia.

Importantly, insurance companies don’t typically access your credit report during the application process, meaning your medical debt won’t directly factor into approval decisions for most policy types. However, debt-related stress can impact health markers like blood pressure, potentially affecting qualification for fully underwritten policies. For this reason, many Georgia seniors with medical debt find greater success with no-exam policies that bypass these potential complications.

Ranwell Insurance specializes in connecting Georgia seniors facing medical debt challenges with appropriate coverage options, including policies specifically designed for those with financial and health complications. Our advisors can help navigate qualification concerns while identifying the maximum coverage available within your budget constraints, ensuring you secure vital protection despite current financial challenges.

For Georgia seniors seeking financial protection against mounting medical expenses, the right life insurance policy can provide invaluable peace of mind. Ranwell Insurance is dedicated to helping you find affordable coverage that addresses your specific medical debt concerns while protecting your family’s financial future.

Life insurance is an essential financial tool for Georgia seniors who want to ensure their loved ones are not burdened with medical debt. Understanding the different options and costs involved can be overwhelming, especially for those who are 80 years old or older. To get a better idea of the expenses involved, you can learn more about life insurance costs for an 80-year-old in Georgia and make an informed decision.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.