Key Takeaways

- When a term life insurance policy expires, coverage ends completely, leaving beneficiaries without death benefit protection

- Georgia seniors have several options when their policies expire, including conversion to permanent insurance, which Ranwell Insurance can facilitate without medical exams

- Converting your term policy before expiration can save you significantly on premiums compared to applying for new coverage in your senior years

- Many term policies include a conversion rider that allows transition to permanent coverage, but this option typically expires before the policy does

- Planning ahead is crucial – ideally, Georgia seniors should start exploring their options 3-5 years before their term policy expires

Term life insurance provides affordable protection for a specific period, but what happens when that time runs out? For Georgia seniors approaching the end of their term policies, understanding the available options is crucial for maintaining financial security.

Many Georgians purchase term life insurance during their working years to protect their families from income loss, mortgage payments, and educational expenses. As retirement approaches and these policies near expiration, the question becomes: what now? Ranwell Insurance specializes in helping Georgia seniors navigate these critical transitions to ensure continuous protection for loved ones.

Term Life Insurance Has an Expiration Date – Here’s What That Means for Georgia Seniors

“Term Life Insurance Explained …” from www.partnersinsuranceinc.com and used with no modifications.

Unlike permanent life insurance, term policies provide coverage for a specific period—typically 10, 20, or 30 years—after which they simply expire. When your term policy reaches its maturity date, your coverage ends completely. This means if you pass away after expiration, your beneficiaries receive nothing, regardless of how many years you paid premiums.

For Georgia seniors, this expiration can create a significant protection gap. Many assume their need for life insurance diminishes with age, but this isn’t always true. Even in retirement, life insurance can cover final expenses, provide inheritance for children and grandchildren, or protect a surviving spouse from financial hardship.

The timing of your policy’s expiration matters significantly. Most term policies terminate between ages 65-75 for those who purchased 20-30 year terms in their 40s or 50s. Unfortunately, this coincides with a period when securing new coverage becomes substantially more expensive and sometimes impossible due to health conditions that may have developed over the decades. If you’re considering new coverage, it’s crucial to understand why you should lock in life insurance coverage while you’re healthy.

Reality Check: A 70-year-old Georgia resident might pay 5-10 times more for a new term policy than they paid for their original policy purchased at age 40, assuming they still qualify based on their health status.

4 Options When Your Term Life Insurance Policy Expires

When your term life policy approaches expiration, you have several choices to consider. Understanding each option allows you to make an informed decision based on your current health, financial situation, and protection needs.

- Convert to permanent insurance: Many term policies include a conversion privilege allowing you to transition to whole life or universal life insurance without proving insurability through medical exams. This option preserves your original health classification but typically must be exercised before a specific age or deadline.

- Renew the term policy: Some policies offer guaranteed renewability, allowing you to extend coverage annually, though at progressively higher premiums reflecting your current age.

- Purchase a new policy: You can apply for a new term or permanent policy, which requires new underwriting and medical examinations. This option works best for healthy seniors who can qualify for reasonable rates.

- Let the policy expire: If you’ve achieved financial independence with substantial savings, paid off debts, and have no dependents requiring financial support, you might choose to let coverage lapse.

Why Georgia Seniors Should Plan for Policy Expiration

“Fun Day Trips for Seniors in Georgia …” from somerbypeachtreecity.com and used with no modifications.

Planning ahead is the cornerstone of financial security in retirement. The expiration of a term life policy isn’t something that should catch you by surprise, yet many Georgia seniors find themselves unprepared when their coverage ends. Ideally, you should begin exploring your options 3-5 years before your policy’s expiration date to avoid last-minute decisions that could be costly. For more insights, read about return of premium term life insurance in Georgia.

Georgia’s cost of living continues to rise, particularly in metropolitan areas like Atlanta, making financial protection increasingly important for seniors. Funeral expenses alone average $7,000-$12,000 in Georgia, while potential medical debts and other end-of-life costs can quickly deplete savings meant for surviving spouses or heirs. Having a strategy for continued life insurance coverage helps ensure these expenses don’t become burdens for your loved ones. For those interested in learning more about life insurance options, here’s a guide to the best life insurance options in Georgia.

One critical aspect many policyholders overlook is the conversion period, which typically expires before the policy itself does. For example, a 20-year term policy might only allow conversion during the first 15 years. Missing this window eliminates what is often the most advantageous option for seniors who have developed health conditions since their original purchase.

Health Concerns and Policy Renewal for Seniors

Health status becomes increasingly significant as you age, particularly when it comes to life insurance options. Georgia seniors with conditions like diabetes, heart disease, or cancer history face substantial challenges when seeking new coverage after their term policies expire. These conditions, which may have developed years after purchasing your original policy, can make new insurance prohibitively expensive or entirely unavailable.

The medical underwriting process grows more stringent for applicants over 65. Insurers typically require more extensive testing, including EKGs, blood profiles, and sometimes even cognitive assessments. This rigorous screening process serves as a compelling reason to consider policy conversion options that don’t require proof of insurability.

For those taking multiple medications or managing chronic conditions, guaranteed issue policies provide an alternative, though typically at much higher premiums and with lower benefit amounts. These policies accept all applicants regardless of health status but usually impose a 2-3 year waiting period during which only accidental deaths are covered at full benefit.

Term vs. Permanent Life Insurance: Making the Right Choice Now

“Life Insurance” from crainfinancial.com and used with no modifications.

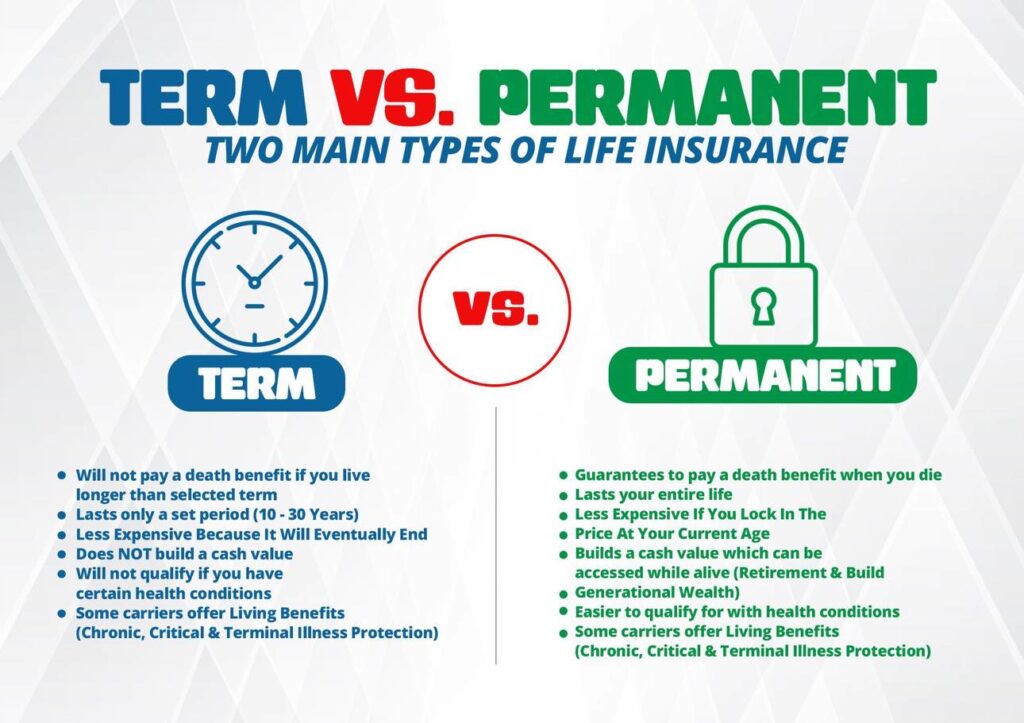

As your term policy approaches expiration, understanding the fundamental differences between term and permanent insurance becomes crucial for making informed decisions. Term insurance offers pure death benefit protection for a specific period with no cash value accumulation, making it initially affordable but increasingly expensive with age. Permanent insurance, while more costly initially, provides lifetime coverage, builds cash value over time, and offers premium stability that becomes advantageous in later years. For Georgia seniors, the decision often hinges on factors like remaining life expectancy, ongoing financial obligations, and legacy planning objectives—considerations that Ranwell Insurance expertly helps clients navigate through personalized consultations.

The Financial Impact of Letting Your Policy Expire

Allowing your term life policy to expire without replacement creates immediate financial vulnerability for your loved ones. While you may have built substantial assets during your working years, specific expenses like mortgage balances, outstanding debts, and income replacement needs could still require protection.

Many Georgia seniors underestimate the long-term financial impact of policy expiration, particularly regarding tax efficiency in estate planning. Life insurance death benefits transfer to beneficiaries tax-free, unlike many other assets that may trigger income or estate taxes when inherited. This tax advantage makes life insurance an exceptionally efficient wealth transfer mechanism.

Converting even a portion of your expiring term coverage to permanent insurance can create a guaranteed financial legacy. Some seniors choose to convert just enough coverage to handle final expenses and small inheritances while self-insuring for larger financial needs through retirement savings and investments.

- Final expenses (funeral, medical bills) can range from $15,000-$25,000

- Income replacement for a surviving spouse may be necessary for 5-10 years

- Outstanding debts including mortgages must be considered in coverage decisions

- Educational funds for grandchildren or charitable bequests may warrant continued coverage

- Long-term care expenses not covered by Medicare could deplete savings intended for heirs

Frequently Asked Questions

How much more expensive is a new term policy for Georgia seniors over 65?

The cost increase for Georgia seniors seeking new term life insurance after age 65 is substantial. On average, a 65-year-old can expect to pay 3-4 times more than they would have at age 50 for the same coverage amount. By age 70, this multiplier often jumps to 5-8 times higher, with premiums potentially exceeding $100-$200 monthly for even modest coverage amounts of $50,000-$100,000. These increases reflect the heightened mortality risk insurers assume when covering older individuals. Additionally, policy options typically become more limited, with maximum terms shortening from 20-30 years to just 10-15 years for seniors in this age group. For more details, check out return of premium term life insurance in Georgia.

Can I convert my term policy to permanent insurance without a medical exam?

Yes, most term life insurance policies include a conversion privilege that allows you to convert to permanent insurance without undergoing a new medical examination or proving insurability. This valuable feature preserves your original health classification from when you first purchased the policy, even if your health has deteriorated significantly since then. The conversion typically must occur before a specific deadline (often your 70th birthday or within the first 15 years of a 20-year policy). Ranwell Insurance specializes in helping Georgia seniors navigate these conversion options, ensuring you understand the various permanent insurance types available and how to maximize this benefit before it expires.

What happens to the premiums I’ve already paid when my term policy expires?

When a term life insurance policy expires, you receive no refund or return of the premiums paid throughout the policy’s duration. Term insurance functions similarly to auto or homeowner’s insurance—you pay for protection during a specific period, and once that period ends, so does the coverage. The premiums you’ve paid purchased the death benefit protection that would have been paid had you passed away during the term, along with the guarantee of insurability throughout the covered period.

Some term policies offer a “return of premium” feature that refunds all or part of your payments if you outlive the term, but these policies typically cost 2-3 times more than standard term insurance. If your policy doesn’t include this feature, the expiration means the insurance company keeps all premiums paid, as they fulfilled their contractual obligation of providing coverage during the specified term.

Are there Georgia-specific programs that help seniors with life insurance needs?

Georgia offers several resources for seniors navigating life insurance decisions, though no state-sponsored life insurance programs exist specifically. The Georgia Department of Insurance provides free counseling through their Senior Health Insurance Information Program (SHIIP), helping seniors understand various insurance options, including life insurance. Additionally, the Division of Aging Services offers financial counseling that can incorporate life insurance planning into broader retirement strategies.

For lower-income seniors, some Georgia counties provide burial assistance programs that can serve as alternatives to traditional life insurance for covering final expenses. Organizations like the Georgia Council on Aging also maintain resources connecting seniors with financial professionals specializing in elder care planning. While these programs don’t directly provide life insurance, they can help seniors make informed decisions about converting or replacing expiring term policies based on their specific financial situation and needs.

How long before policy expiration should I start exploring my options?

Ideally, you should begin exploring your options at least 3-5 years before your term policy expires. This timeframe gives you adequate opportunity to understand all available alternatives, evaluate your current insurance needs, and implement the most cost-effective strategy. Starting early is particularly crucial if you’re considering purchasing new coverage, as premiums increase substantially with age, and health issues that might develop closer to expiration could limit your insurability.

For those interested in converting to permanent insurance, the conversion deadline often precedes the policy expiration date by several years. By starting your exploration early, you’ll avoid missing this critical window of opportunity. Early planning also allows for more gradual financial adjustments if you’ll be transitioning to higher-premium permanent coverage, giving you time to incorporate these changes into your retirement budget without financial strain.

The most successful transitions occur when seniors work with experienced insurance professionals who specialize in senior life insurance needs. Ranwell Insurance provides comprehensive guidance for Georgia seniors approaching this important transition, helping you navigate conversion options, policy comparisons, and application processes while ensuring continuous coverage protection for your loved ones.

When it comes to securing your family’s financial future as your term life insurance approaches expiration, Ranwell Insurance offers Georgia seniors personalized solutions that provide peace of mind and lasting protection for the people who matter most. For more information, you might want to explore return of premium term life insurance options in Georgia.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.