Article-At-A-Glance

- Final expense insurance for seniors in Atlanta typically costs between $40-$200 monthly depending on age, health, and coverage amount

- No-medical exam options make qualification easier for seniors with health conditions, though premiums may be slightly higher

- The average funeral in Atlanta costs $8,000-$12,000, making adequate coverage essential for protecting loved ones

- Georgia’s insurance regulations provide important consumer protections including a 30-day free look period

- Ranwell Insurance offers specialized final expense policies designed specifically for Atlanta seniors’ needs

Finding affordable final expense insurance doesn’t have to be complicated. For Atlanta seniors concerned about burdening loved ones with funeral expenses and end-of-life costs, the right policy provides invaluable peace of mind. Ranwell Insurance specializes in helping Georgia seniors secure appropriate coverage with simplified application processes and competitive rates.

Final expense insurance serves as a practical financial tool designed specifically for seniors. Unlike traditional life insurance that might require extensive medical examinations, final expense policies typically offer more accessible qualification requirements, making them ideal for those in their golden years who may have health concerns.

What Atlanta Seniors Need to Know About Final Expense Insurance

“Final Expense Insurance for Seniors | Aflac” from www.aflac.com and used with no modifications.

Final expense insurance is a specialized type of whole life policy that helps cover costs associated with end-of-life expenses. These policies typically offer coverage amounts between $5,000 and $50,000, making them perfect for covering funeral services, outstanding medical bills, and other related expenses. The permanent nature of these policies means they won’t expire as long as premiums are paid, providing lasting security for Atlanta seniors.

One of the most appealing aspects of final expense insurance is the simplified underwriting process. Many policies don’t require a medical exam, instead using a health questionnaire to determine eligibility. This makes qualification much more accessible for seniors with health conditions that might otherwise make insurance difficult to obtain. The application process is straightforward, with many Atlanta seniors receiving approval within days rather than the weeks traditional insurance might require.

The funds from a final expense policy go directly to your named beneficiary upon your passing. This immediate payout helps ensure your loved ones have quick access to the money needed for funeral arrangements and other immediate expenses, eliminating financial stress during an already difficult time. Your beneficiary has complete discretion over how to use the funds, providing flexibility to address whatever needs arise.

Current Final Expense Insurance Rates in Atlanta (2025)

“Burial Insurance in Atlanta and Georgia” from beringinsurance.com and used with no modifications.

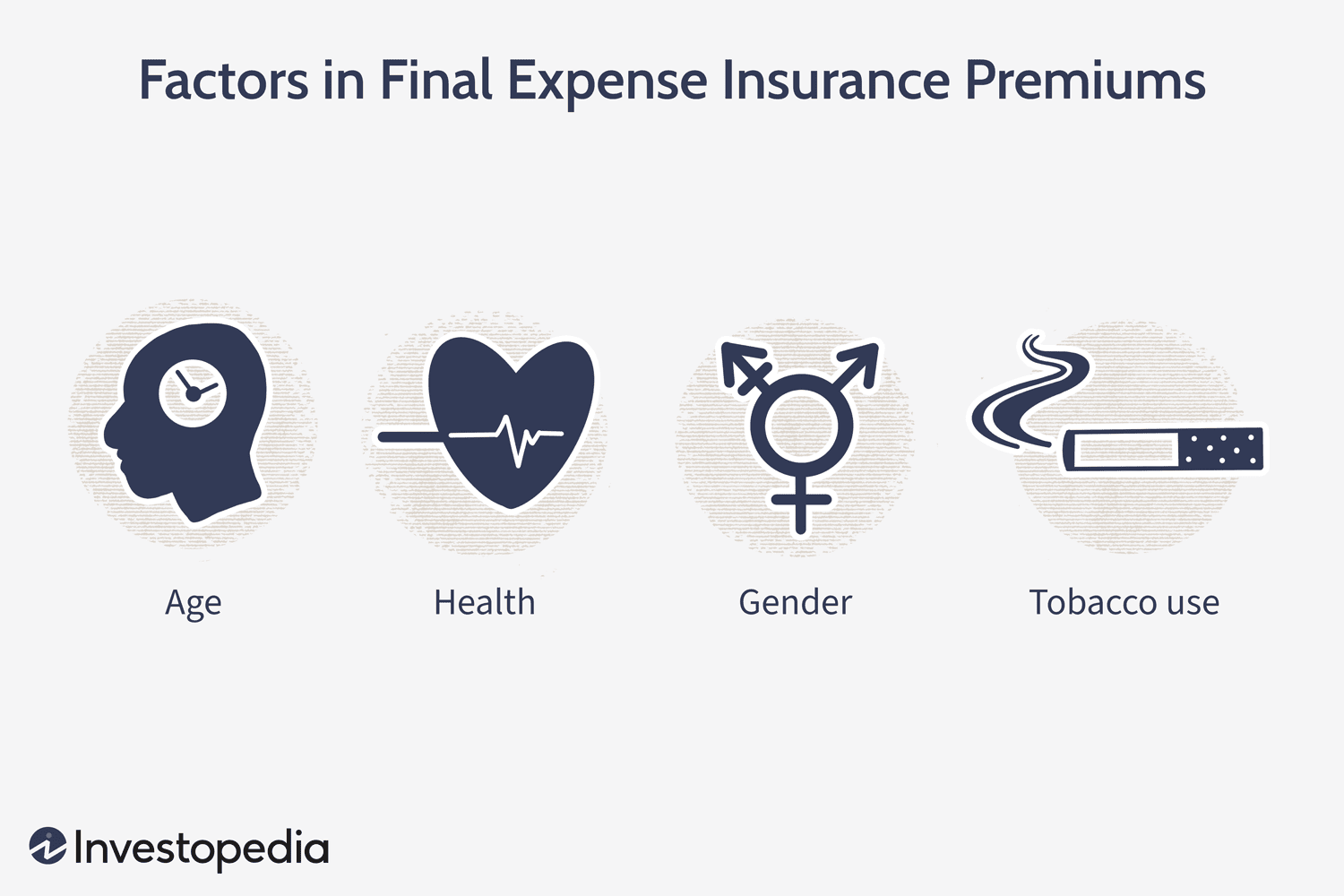

Insurance rates for final expense policies in Atlanta vary based on several key factors. Age plays the most significant role in determining premiums, with rates increasing as you get older. Gender also affects pricing, with women typically paying less than men due to longer average lifespans. Health conditions impact rates as well, though less dramatically than with traditional life insurance since many final expense policies offer simplified underwriting.

Average Monthly Premiums for 65-70 Year Olds

For Atlanta seniors in the 65-70 age bracket, final expense insurance remains quite affordable. A healthy 65-year-old woman might pay between $40-$65 monthly for a $10,000 policy, while a man of the same age could expect to pay $50-$80. Those seeking higher coverage amounts of $20,000 might see premiums ranging from $75-$120 for women and $90-$150 for men in this age group.

| Coverage Amount | Female (Monthly Premium) | Male (Monthly Premium) |

|---|---|---|

| $10,000 | $40-$65 | $50-$80 |

| $15,000 | $60-$90 | $70-$110 |

| $20,000 | $75-$120 | $90-$150 |

These rates reflect standard policies with simplified underwriting. Guaranteed issue policies, which accept virtually all applicants regardless of health, typically cost 20-30% more but provide an important option for those with serious health conditions. Many Atlanta insurance providers offer discounts for non-smokers, further reducing premium costs for those who qualify.

Average Monthly Premiums for 71-80 Year Olds

As Atlanta seniors enter their 70s, premium rates naturally increase, but final expense insurance remains accessible. For a $10,000 policy, 75-year-old women can expect to pay approximately $85-$110 monthly, while men of the same age typically pay $110-$135. These rates reflect the national averages reported by industry experts, with Atlanta’s rates closely aligning with these figures despite some regional variations.

For those seeking more substantial coverage, a $15,000 policy for this age group typically costs between $125-$160 for women and $160-$195 for men. When considering these premiums, it’s important to remember that these policies build cash value over time and provide permanent coverage regardless of future health developments – features particularly valuable to older policyholders.

Average Monthly Premiums for Those Over 80

Atlanta seniors over 80 will encounter higher premiums, but final expense insurance remains available and valuable at this life stage. For an $8,000 policy, the average monthly premium ranges from $120-$175 for women and $160-$220 for men. These rates reflect the increased mortality risk in this age bracket, but the guaranteed acceptance options ensure coverage remains accessible even for those with health concerns.

It’s worth noting that while premiums are higher for this age group, the application process typically remains simplified, with many insurers offering same-day approval. The peace of mind that comes from knowing final expenses won’t burden loved ones often outweighs the premium costs for many Atlanta families with elderly members.

How Much Coverage Do Atlanta Seniors Actually Need?

“senior care cost in Atlanta, Ga …” from 4seasonscare.com and used with no modifications.

Determining the right coverage amount requires careful consideration of current and anticipated expenses. While every situation is unique, most financial advisors recommend sufficient coverage to handle funeral costs plus outstanding debts and potential medical expenses. The goal is to ensure loved ones aren’t left with financial burdens during an already difficult time, while also avoiding paying for unnecessary coverage.

Average Funeral Costs in Atlanta Metro Area

Funeral expenses in Atlanta have steadily increased in recent years, with traditional services now averaging $8,000-$12,000. This typically includes the basic professional services fee ($2,000-$2,500), embalming and preparation ($1,000-$1,500), viewing and ceremony costs ($1,000-$2,000), casket ($2,500-$4,000), and transportation ($300-$500). Cemetery costs add another significant expense, with plots in the Atlanta metro area ranging from $3,000-$10,000 depending on location and availability.

Cremation offers a more economical alternative, with direct cremation services in Atlanta starting around $1,800-$3,000, though memorial services and urns can add to this cost. When calculating needed coverage, it’s prudent to consider these expenses along with a buffer for inflation, as funeral costs have historically increased at a rate of 3-5% annually.

Additional End-of-Life Expenses to Consider

Beyond funeral costs, Atlanta seniors should account for potential medical bills, outstanding debts, and legal fees when determining appropriate coverage amounts. The average senior accumulates approximately $5,000-$10,000 in out-of-pocket medical expenses during their final year of life, even with Medicare coverage. Home care costs in Atlanta average $25-$30 per hour, quickly accumulating for those requiring assistance in their final months.

“Many families are shocked by the unexpected expenses that arise following a loved one’s passing. Beyond the funeral itself, there are often medical bills, credit card balances, and administrative costs that can easily add another $5,000-$15,000 to the financial burden. Planning for these costs is one of the most considerate things a senior can do for their family.” – Georgia Elder Care Association

Legal expenses for probate and estate administration in Georgia typically range from $3,000-$7,000 for even modestly sized estates. While final expense insurance can’t cover every possible cost, having sufficient coverage provides a financial buffer that gives families breathing room to handle these matters without immediate financial pressure.

Recommended Coverage Amounts Based on Your Situation

Most Atlanta financial advisors recommend a minimum final expense policy of $15,000-$20,000 to cover basic funeral costs and immediate expenses. For those with outstanding debts or anticipated medical bills, increasing coverage to $25,000-$30,000 provides additional protection. Seniors with more complex financial situations or those wishing to leave a small inheritance might consider policies up to $50,000, though premiums increase accordingly with higher coverage amounts.

No Medical Exam Policies vs. Traditional Underwriting in Georgia

“Do I Need No-Medical Life Insurance …” from www.policyadvisor.com and used with no modifications.

The choice between traditional and simplified underwriting policies presents an important decision for Atlanta seniors. Traditional life insurance policies typically require comprehensive medical examinations and detailed health histories, resulting in lower premiums for healthy individuals but potentially excluding those with health conditions. These policies often take weeks for approval and frequently deny coverage to seniors with common age-related health issues.

Final expense insurance, by contrast, typically offers simplified or guaranteed underwriting options that eliminate medical exams. While premiums may be slightly higher than traditional policies for the exceptionally healthy, the accessibility and rapid approval make these policies particularly valuable for the average senior. The tradeoff between slightly higher premiums and significantly easier qualification process makes these policies the preferred choice for most Atlanta seniors.

Qualification Requirements for Simplified Issue Policies

Simplified issue policies strike a balance between affordability and accessibility for Atlanta seniors. These policies typically require answering health questions but don’t mandate a medical examination. Applicants must generally disclose major health conditions like cancer, heart disease, or stroke history, but many chronic conditions like controlled diabetes or high blood pressure are often acceptable. Most insurers look back only 2-3 years for major health events, making these policies accessible even to those with older health issues.

The application process typically takes just 15-30 minutes, with approval often coming within 1-3 business days. For Atlanta seniors concerned about health qualification but seeking reasonable rates, simplified issue policies offer an excellent middle ground. These policies typically provide immediate full coverage without waiting periods for those who qualify.

When Guaranteed Issue Policies Make Sense

Guaranteed issue final expense policies serve as a valuable last resort for Atlanta seniors with significant health challenges. These policies accept virtually all applicants regardless of health status, requiring no medical exam and asking few or no health questions. While premiums run approximately 30-50% higher than simplified issue policies, they provide an essential option for those who would otherwise be uninsurable.

- Seniors with recent cancer diagnosis or treatment (within past 2 years)

- Those with history of heart attack or stroke within past 12-24 months

- Individuals with chronic conditions like COPD, kidney failure, or liver disease

- Residents of nursing homes or those receiving hospice care

- Anyone who has been declined for simplified issue coverage

Most guaranteed issue policies include a 2-3 year graded death benefit period, during which natural causes of death result in a return of premiums plus interest rather than the full benefit amount. Accidental deaths, however, typically receive the full benefit amount immediately. Despite these limitations, guaranteed issue policies provide crucial coverage for seniors who might otherwise leave their families with significant financial burdens.

When considering guaranteed issue coverage, it’s important to carefully review the graded benefit period and premium rates. Some Georgia insurers offer more competitive terms than others, making it worthwhile to compare several quotes before making a decision.

Atlanta-Specific Insurance Regulations Seniors Should Know

“Understanding Georgia Insurance Laws: A …” from www.odumgeorgia.com and used with no modifications.

Georgia insurance laws provide important protections for Atlanta seniors purchasing final expense insurance. The Georgia Insurance Commissioner’s Office actively regulates all insurance providers operating in the state, ensuring policies meet specific standards for clarity and fair practice. These regulations help prevent predatory practices and ensure seniors receive the coverage they expect when purchasing final expense insurance.

Atlanta seniors should understand that insurance is regulated at the state level, meaning Georgia laws supersede company policies when conflicts arise. This provides an additional layer of consumer protection when dealing with national insurance carriers. The Georgia Department of Insurance offers assistance to seniors who believe their rights have been violated, providing a valuable resource for resolving disputes or clarifying policy terms.

Georgia’s Free Look Period Rules

Georgia law mandates a 30-day “free look” period for all life insurance policies, including final expense insurance. This consumer protection allows Atlanta seniors to review their policy documents thoroughly after purchase and cancel for a full refund if they’re not satisfied for any reason. This period begins when you physically receive your policy documents, not when you apply or are approved.

Taking full advantage of this examination period is essential. Review your policy with family members or a trusted advisor to ensure it meets your needs. Pay special attention to the beneficiary designation, coverage amount, premium schedule, and any waiting period provisions. If you decide to cancel during this period, Georgia law requires insurers to refund 100% of premiums paid with no questions asked or penalties assessed.

Beneficiary Protections Under Georgia Law

Georgia offers strong protections for life insurance beneficiaries that Atlanta seniors should understand when purchasing final expense policies. Under state law, insurance proceeds paid to named beneficiaries are generally protected from creditors of the deceased. This means that even if you leave behind unpaid medical bills or other debts, your insurance benefit will go directly to your loved ones as intended.

Additionally, Georgia law establishes clear timelines for insurance companies to pay claims. Once a complete death claim is submitted with required documentation, insurers must pay the claim within 30 days or provide written explanation for any delay. The state imposes interest penalties on insurance companies that delay payment without reasonable cause, providing financial incentive for timely claim settlement.

Smart Ways to Lower Your Final Expense Premium Costs

“What Is Final Expense Insurance?” from www.investopedia.com and used with no modifications.

While final expense insurance is already designed to be affordable, Atlanta seniors can employ several strategies to further reduce their premium costs. Shopping around and comparing quotes from multiple providers often reveals significant price variations for identical coverage. The competitive Atlanta insurance market means companies frequently offer special rates to attract new customers, making comparison shopping particularly valuable.

Applying Earlier Rather Than Later

The single most effective strategy for reducing final expense insurance costs is applying at a younger age. Premiums increase approximately 8-15% for each year you delay, meaning a policy purchased at age 65 could cost nearly half what the same coverage would at age 75. This substantial difference makes early application one of the most financially sound decisions for Atlanta seniors, even for those in good health who don’t anticipate needing coverage immediately.

Health also typically deteriorates with age, potentially affecting qualification for preferred rates. By securing coverage earlier, you lock in your health classification based on your current condition rather than future developments. Many Atlanta seniors find that applying for final expense insurance during their mid-60s strikes an ideal balance between affordable premiums and practical planning.

Policy Bundling Opportunities

Many insurance providers offer discounts when you purchase multiple policy types through the same company. Atlanta seniors who already have auto, homeowners, or other insurance policies may qualify for multi-policy discounts when adding final expense coverage. These bundle discounts typically range from 5-15% off standard premium rates, creating meaningful savings over the life of the policy.

- Auto insurance + final expense insurance bundles (average 8-12% discount)

- Homeowners/renters + final expense insurance packages (typical 5-10% savings)

- Medicare supplement + final expense combination offers (specialized senior bundles)

- Multiple family member policy discounts (for couples or parent/adult child coverage)

- Loyalty discounts for existing customers (increasing over time)

When exploring bundling options, it’s important to evaluate the total cost across all policies rather than focusing solely on the final expense premium. Some companies may offer excellent bundle discounts but have higher base rates, potentially negating the savings. Working with an independent agent who can compare multiple carriers often yields the best overall value.

Several Atlanta insurance agencies specialize in senior-focused policy bundles, creating packages specifically designed to address the most common senior insurance needs. These specialized bundles frequently include additional perks like simplified paperwork, dedicated senior customer service lines, and consolidated billing that many older adults appreciate.

Payment Frequency Discounts

Many final expense insurance providers offer discounts for annual or semi-annual premium payments instead of monthly installments. These payment frequency discounts typically save Atlanta seniors 3-8% on their total annual premium costs, making them worth considering for those who can manage larger lump-sum payments. Some companies also offer automatic payment discounts of 1-3% when you authorize electronic funds transfers from your checking account rather than paying by check or credit card.

Frequently Asked Questions

When researching final expense insurance, Atlanta seniors often share common questions about how these policies work. Understanding these fundamentals helps make informed decisions about coverage options, policy features, and application procedures. The following questions address the most common concerns specifically relevant to Georgia residents.

These straightforward answers provide clarity on key aspects of final expense insurance while highlighting important Georgia-specific considerations. For more detailed information tailored to your unique situation, consulting with a licensed insurance professional familiar with Atlanta’s insurance marketplace is recommended.

How quickly can I get approved for final expense insurance in Atlanta?

The approval timeline for final expense insurance in Atlanta varies by underwriting type, but is typically much faster than traditional life insurance. Simplified issue policies usually provide approval within 24-48 hours after application submission, with policies being delivered within 7-10 business days. Guaranteed issue policies often offer same-day approval with immediate coverage for accidental death and coverage for natural causes after the waiting period (typically 2 years).

Electronic application processes have significantly accelerated approval times for Atlanta seniors. Many local insurance providers now offer digital application submission, electronic signature capabilities, and even video-based identity verification that eliminates the need for in-person meetings. These technological advances mean many Atlanta seniors can complete the entire application process from home in under an hour.

Can I be denied final expense insurance because of health conditions?

While simplified issue final expense policies may deny coverage based on serious health conditions or recent major medical events, guaranteed issue policies are available to virtually all Atlanta seniors regardless of health status. These guaranteed policies typically cost more and include a 2-3 year waiting period for natural death benefits, but provide an important option for those with significant health challenges who might otherwise remain uninsured.

Do final expense insurance rates increase over time in Georgia?

No, final expense insurance premiums in Georgia remain fixed for the life of the policy once issued. This rate guarantee provides valuable budget predictability for Atlanta seniors living on fixed incomes. The premium amount established at the time of policy issuance is contractually guaranteed never to increase, regardless of changes in your health, inflation rates, or insurance market conditions.

This premium stability represents one of the most valuable features of final expense insurance for Atlanta’s senior population. Unlike health insurance or long-term care insurance premiums that often increase as you age, final expense insurance premiums remain consistent. This predictability allows for confident financial planning even on limited retirement budgets.

Can I purchase final expense insurance for my elderly parent in Atlanta?

Yes, you can purchase final expense insurance for an elderly parent in Atlanta, though you’ll need their consent and involvement in the application process. Georgia insurance regulations require the insured person’s signature and agreement, even when someone else pays the premiums. Additionally, you must demonstrate “insurable interest” – meaning you would face financial impact from their passing, which is generally assumed for immediate family members.

What happens if I move away from Atlanta after purchasing a policy?

Final expense insurance policies remain fully effective regardless of where you move after purchase. Since these are individual insurance contracts rather than group policies, they’re portable across state lines and even internationally. Your premium rates, coverage amount, and policy provisions remain unchanged regardless of your new location.

If you relocate, you should update your contact information with your insurance provider to ensure you continue receiving premium notices and other important communications. Most companies allow you to maintain your original payment methods even after moving, though you may need to update banking information if you change financial institutions.

Georgia’s strong consumer protection laws regarding insurance continue to benefit policyholders even after they’ve moved to other states. If you purchased your policy while residing in Georgia, many of these protections remain applicable to your policy regardless of your current residence.

Ranwell Insurance offers specialized final expense insurance policies designed specifically for Atlanta seniors looking to protect their families from unexpected end-of-life expenses. With flexible coverage options, competitive rates, and a simplified application process, we make securing peace of mind straightforward and affordable.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.