Article-At-A-Glance

- Despite oxygen use, Georgia seniors can qualify for guaranteed issue life insurance with no health questions asked

- The severity and cause of your oxygen dependency greatly impacts your eligibility and premium rates

- Simplified issue life insurance offers a middle ground with fewer health questions and faster approval

- Some companies offer specialized policies for seniors with respiratory conditions, though premiums may be higher

- Working with Ranwell Insurance who specializes in high-risk life insurance can help you find coverage despite oxygen dependency

Finding life insurance when you’re on oxygen therapy might seem impossible, but don’t give up hope. While your options are more limited, several paths to coverage exist for Georgia seniors who depend on supplemental oxygen thanks to Ranwell Insurance

The key lies in their understanding of which insurance companies specialize in high-risk applicants and knowing exactly which type of policy to apply for. The wrong approach could lead to unnecessary rejection or paying significantly more than necessary for your coverage.

Yes, Seniors on Oxygen Can Get Life Insurance in Georgia

“Long-term care insurance for seniors …” from www.magnoliamanor.com and used with no modifications.

The short answer is yes – Georgia seniors on oxygen can absolutely get life insurance coverage. The insurance industry has evolved to recognize that oxygen use doesn’t automatically make someone uninsurable. Choice Mutual specializes in helping seniors with medical conditions find appropriate coverage options that protect their families while accommodating health challenges like oxygen dependency.

Your chances of approval and premium rates will vary based on several factors: the underlying condition requiring oxygen, how frequently you use it, and how long you’ve been dependent on supplemental oxygen. For example, someone using oxygen only at night for sleep apnea will have more options than someone requiring 24/7 oxygen for advanced COPD or pulmonary fibrosis.

While traditional fully-underwritten policies with medical exams may be difficult to obtain, alternative policy types like guaranteed issue and simplified issue life insurance create pathways to coverage specifically designed for people with health challenges. These policies typically offer lower death benefits (usually between $5,000-$25,000) but provide essential coverage for final expenses and outstanding medical bills.

Important: Most insurance companies impose a 2-year graded benefit period for oxygen-dependent applicants. This means if you pass away from natural causes within the first two years, your beneficiaries typically receive only the premiums paid plus interest (usually 10%). After this period, the full death benefit becomes available.

Why Oxygen Use Makes Getting Life Insurance Harder

Insurance underwriters view oxygen therapy as a significant health risk indicator. From their perspective, supplemental oxygen signals the presence of serious underlying conditions that could shorten your lifespan. These might include COPD, emphysema, pulmonary fibrosis, advanced heart failure, or other chronic respiratory conditions.

The statistical data insurers rely on shows higher mortality rates among oxygen-dependent individuals. This translates directly to higher risk for the insurance company, resulting in stricter underwriting standards, higher premiums, or outright denials for traditional policies. Additionally, most traditional underwriting guidelines automatically decline applicants who require daily oxygen use.

Another challenge is inconsistent underwriting standards across companies. One insurer might reject all oxygen users, while another may approve applicants who use oxygen only at night or intermittently. This variability makes working with an experienced independent agent who knows which companies are more lenient with oxygen users particularly valuable.

The timing of your application also matters significantly. Insurance companies typically look more favorably on stable, long-term oxygen use rather than recently prescribed therapy. If you’ve been on a stable oxygen regimen for 12+ months without hospitalization, your options improve considerably compared to someone who just started oxygen therapy.

3 Types of Life Insurance Available for Oxygen Users in Georgia

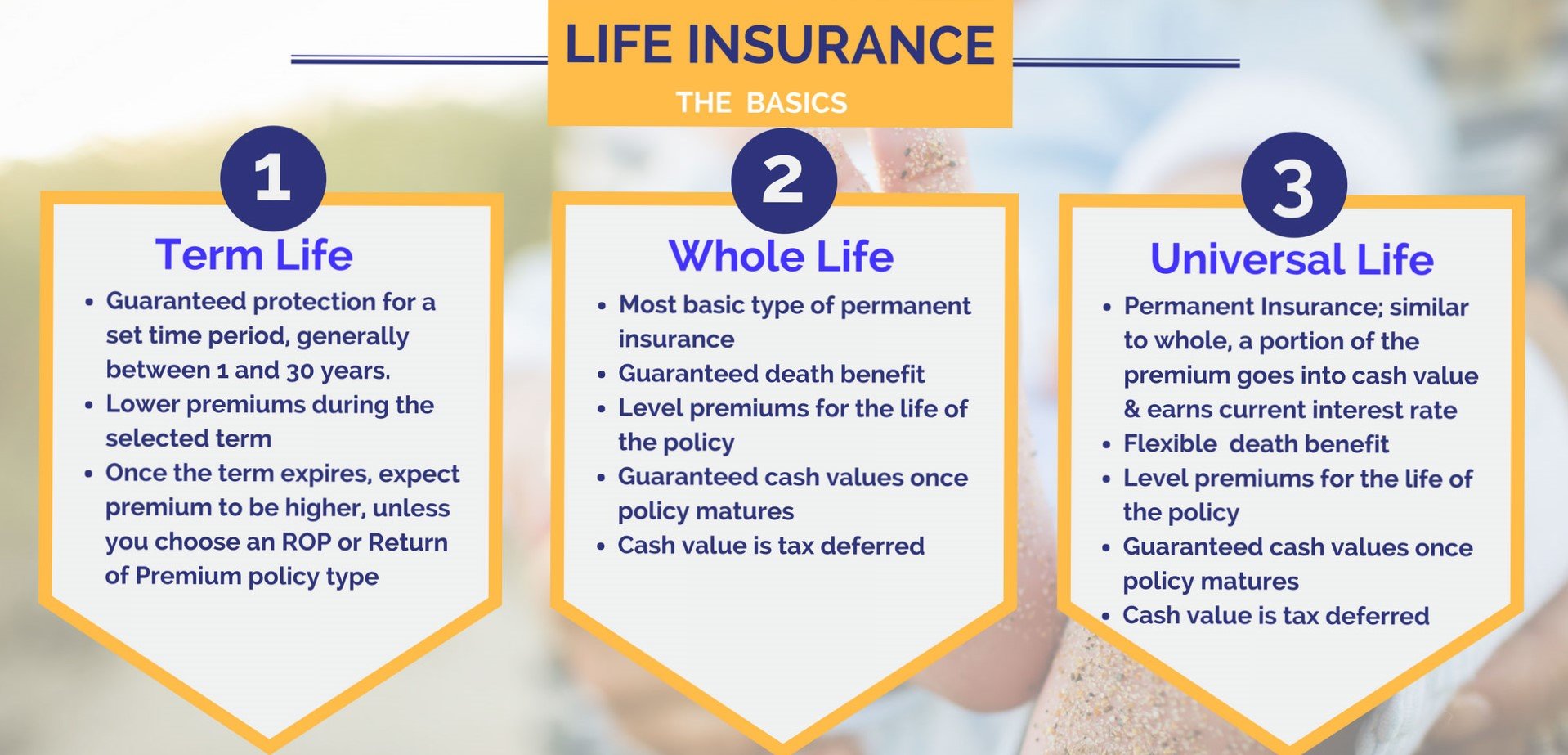

“Types Of Life Insurance Policies Explained” from www.easyquotes4you.com and used with no modifications.

Despite the challenges, three specific types of life insurance remain accessible to Georgia seniors on oxygen therapy. Each option presents different trade-offs between ease of approval, cost, and coverage amount.

- Guaranteed Issue Life Insurance: This represents the surest path to coverage for oxygen-dependent seniors. These policies ask no health questions and approve all applicants within the eligible age range (typically 50-85). The trade-off comes in higher premiums and lower coverage amounts, usually capped at $25,000. Most importantly, these policies include a 2-3 year graded death benefit period.

- Simplified Issue Life Insurance: Some carriers offer simplified issue policies with limited health questions that might accommodate certain oxygen users. These typically ask whether you use oxygen but may approve applicants who use it only intermittently or for specific conditions. The application process involves answering 10-15 health questions but no medical exam.

- Final Expense Insurance: Specialized final expense policies designed for seniors often have more lenient underwriting for oxygen users, especially when used for sleep apnea or on an as-needed basis. These policies typically offer $5,000-$30,000 in coverage specifically intended to cover funeral costs and end-of-life expenses.

The best choice depends on your specific health situation, budget, and coverage needs. Oxygen users with minimal other health complications might qualify for simplified issue policies with better rates, while those with multiple health challenges may need to pursue guaranteed issue coverage.

Best Insurance Company for Georgia Seniors on Oxygen

After researching dozens of insurance providers that serve Georgia seniors, several companies consistently demonstrate more favorable underwriting for oxygen users. These specialized insurers understand that not all oxygen use indicates the same level of risk and have developed products specifically for applicants with respiratory conditions.

The best companies typically offer flexible underwriting that considers the specific condition requiring oxygen, usage patterns, and overall health stability. Some may approve applicants who use oxygen only at night or who maintain stable oxygen requirements without recent hospitalizations. Others specialize in guaranteed acceptance regardless of oxygen use.

- AIG’s Guaranteed Issue policy accepts all oxygen users regardless of condition

- Mutual of Omaha offers simplified issue policies that may accept nighttime-only oxygen users

- Gerber Life provides guaranteed acceptance with no health questions

- Liberty Bankers Life has been known to consider some oxygen users for their simplified issue products

- Prosperity Life Group offers specialized policies for applicants with respiratory conditions

Ranwell Insurance

As a Georgia-based independent agency, Ranwell Insurance specializes in finding coverage for seniors with complex health conditions, including oxygen dependency. Their agents have extensive experience navigating the specific underwriting guidelines of dozens of insurance companies, allowing them to match oxygen users with the most appropriate and affordable coverage options available.

Secure Your Family’s Future Despite Medical Challenges

“Portable Oxygen Therapy …” from www.brisbaneoxygen.com.au and used with no modifications.

When dealing with health challenges like oxygen dependency, securing proper life insurance becomes even more critical for protecting your loved ones. While traditional coverage may be harder to obtain, several viable pathways exist specifically designed for seniors with medical conditions like yours. The most important step is working with an agency that specializes in high-risk applicants rather than applying with companies likely to reject your application.

Always be completely honest about your oxygen use and medical conditions when applying. Misrepresentation can lead to policy cancellation or claim denial, leaving your family without the protection you intended to provide. Instead, focus on companies that specialize in coverage for people with your specific health profile, and consider starting with guaranteed issue policies if other options aren’t immediately available.

Remember that having some coverage is better than none at all. Even a smaller guaranteed issue policy can provide essential funds for final expenses and outstanding medical bills, relieving your family of financial burden during an already difficult time. Many Georgia seniors on oxygen have successfully secured appropriate life insurance coverage by taking the right approach with the right companies.

Frequently Asked Questions

How long is the waiting period for life insurance if I use oxygen?

Most guaranteed issue and simplified issue policies available to oxygen users include a 2-year graded death benefit period. During this time, death from natural causes typically results in a return of premiums plus interest (usually 10%) rather than the full death benefit. However, death from accidents is generally covered at 100% from day one. After completing this waiting period, your beneficiaries receive the full death benefit regardless of cause of death. Some companies offer shorter waiting periods of 12-18 months, though these policies may have higher premiums or stricter qualification standards.

Can I get life insurance if I only use oxygen at night?

Yes, your chances of approval improve significantly if you only use oxygen at night for conditions like sleep apnea. Several insurance companies distinguish between 24/7 oxygen dependency and nighttime-only use, viewing the latter as a lower risk. Companies like Mutual of Omaha and Liberty Bankers Life sometimes approve simplified issue policies for applicants who only require oxygen during sleep, especially if the underlying condition is well-controlled and you’ve maintained stable oxygen requirements for at least 12 months.

When applying, be specific about your oxygen usage patterns, as this distinction can mean the difference between approval and denial, or between higher and lower premium rates. An independent agent can direct you to companies with more favorable underwriting guidelines for nighttime-only oxygen users.

Will Medicare pay for any part of my life insurance as a Georgia senior?

No, Medicare does not pay for any portion of life insurance premiums or benefits. Medicare is a health insurance program that covers medical expenses, while life insurance is a separate financial product designed to provide a death benefit to your beneficiaries. You’ll need to budget for life insurance premiums separately from your Medicare coverage, though some Medicare Advantage plans in Georgia offer small life insurance benefits ($5,000-$10,000) as an added feature.

Do I need to take a medical exam to get life insurance while on oxygen?

No, you can obtain life insurance without a medical exam through guaranteed issue or simplified issue policies. Guaranteed issue policies require no health questions or exams and approve all applicants within the eligible age range, making them ideal for oxygen-dependent seniors. Simplified issue policies involve answering health questions but no physical examination, and some may accept applicants who use oxygen under specific circumstances.

Avoiding the medical exam is particularly beneficial for oxygen users, as the exam would likely reveal respiratory metrics that could trigger automatic rejection under traditional underwriting guidelines. Both guaranteed and simplified issue policies allow you to bypass this potential obstacle while still securing valuable coverage. Learn more about burial insurance with pre-existing conditions to understand your options better.

Can my life insurance policy be canceled if my oxygen needs increase?

No, once your policy is in force, the insurance company cannot cancel it due to changes in your health or increased oxygen needs. This is one of the most valuable aspects of life insurance – it’s guaranteed renewable as long as you continue paying the premiums. The company is bound by the original contract terms regardless of how your health changes after approval. If you’re concerned about eligibility, you might be interested to know that life insurance is available for insulin-dependent diabetics in Georgia, even with past declines.

This protection makes securing coverage now particularly important, even if your condition is currently stable. Future deterioration in your health or increased oxygen requirements won’t affect an existing policy, but they could make obtaining new coverage difficult or impossible if you waited to apply. For more information on securing coverage, you can explore options like final expense insurance.

Some policies even include waiver of premium riders that continue your coverage without requiring premium payments if you become seriously disabled. This provides additional protection against policy lapse during times of health crisis when finances may be strained. For more information on how pre-existing conditions affect insurance, you can explore life insurance with pre-existing conditions.

Contact Ranwell Insurance today @ (855) 508-5008 or ranwell.insurance@gmail for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.