Key Takeaways

- Prescription medications can affect your life insurance rates in Georgia, but most people can still find coverage through companies like Ranwell Insurance.

- Georgia offers specific protections for insurance applicants with health conditions, including appeal rights and guaranteed issue options.

- The type of medication, dosage, length of use, and underlying condition all factor into how insurers evaluate your application.

- Working with specialized brokers like Ranwell Insurance can help you navigate the complex landscape of medication disclosure and policy options.

- Some insurers are more lenient with certain medications, making it essential to compare multiple providers rather than accepting the first quote.

Navigating life insurance options when you take prescription medications can feel overwhelming, especially in Georgia where insurance regulations and available policies have their own unique characteristics. If you’re one of the millions of Georgians managing health conditions with medication, Ranwell Insurance understands your concerns about obtaining affordable coverage that properly protects your loved ones.

Prescription medications don’t automatically disqualify you from getting life insurance, but they do influence how underwriters assess your application. Georgia residents have access to various insurance products designed to accommodate different health profiles, from traditional term and whole life policies to more specialized options for those with complex medical histories.

The good news is that Georgia’s insurance market is robust, with over 400 licensed life insurance companies competing for business. This competitive landscape benefits consumers taking medications, as different companies have different underwriting approaches to various health conditions and the prescriptions used to treat them.

How Prescription Medications Affect Life Insurance Applications

“How do prescription medications affect …” from nextgen-life-insurance.com and used with no modifications.

When you apply for life insurance in Georgia, insurance companies will request access to your prescription drug history through databases like the Medical Information Bureau (MIB). These records typically go back 5-7 years and provide insurers with information about what medications you’ve taken, dosages, and how long you’ve been taking them.

Underwriters look at medications as indicators of underlying health conditions. For example, if you take medication for high blood pressure, insurers want to know how well your condition is controlled, when you were diagnosed, and whether you’ve experienced any complications. The severity of your condition and how well it’s managed with medication significantly impacts your insurability and premium rates.

- Blood pressure medications often have minimal impact if your condition is well-controlled

- Cholesterol medications usually cause minor rate increases if no other cardiovascular issues exist

- Antidepressants may affect rates depending on the specific diagnosis, severity, and stability

- Diabetes medications typically result in higher premiums, with insulin-dependent diabetes facing stricter underwriting

- Anti-seizure medications can significantly impact rates depending on seizure frequency and control

The timing of your medication use matters too. If you’ve recently started a new medication, insurers might postpone your application to see how you respond to treatment. Conversely, if you’ve been stable on the same medication for years with no dosage increases, this demonstrates good control and may result in more favorable rates. It’s crucial to lock in life insurance coverage while you’re healthy to potentially secure better rates.

Georgia Medication Statistics: According to the Georgia Department of Public Health, approximately 65% of Georgia adults take at least one prescription medication regularly, while 24% take three or more. These statistics highlight how common prescription use is and why insurers have developed sophisticated approaches to evaluating medication-related risks.

It’s important to note that different insurance companies have different risk appetites when it comes to specific medications. Some insurers specialize in covering people with certain health conditions, making them more competitive for applicants taking particular prescriptions. This is why working with an experienced broker like Ranwell Insurance, who knows which companies are most accommodating for specific medications, can save you significant money on premiums.

Best Life Insurance Options for Georgia Residents Taking Medications

“Types of Life Insurance: A Guide to …” from www.coventrydirect.com and used with no modifications.

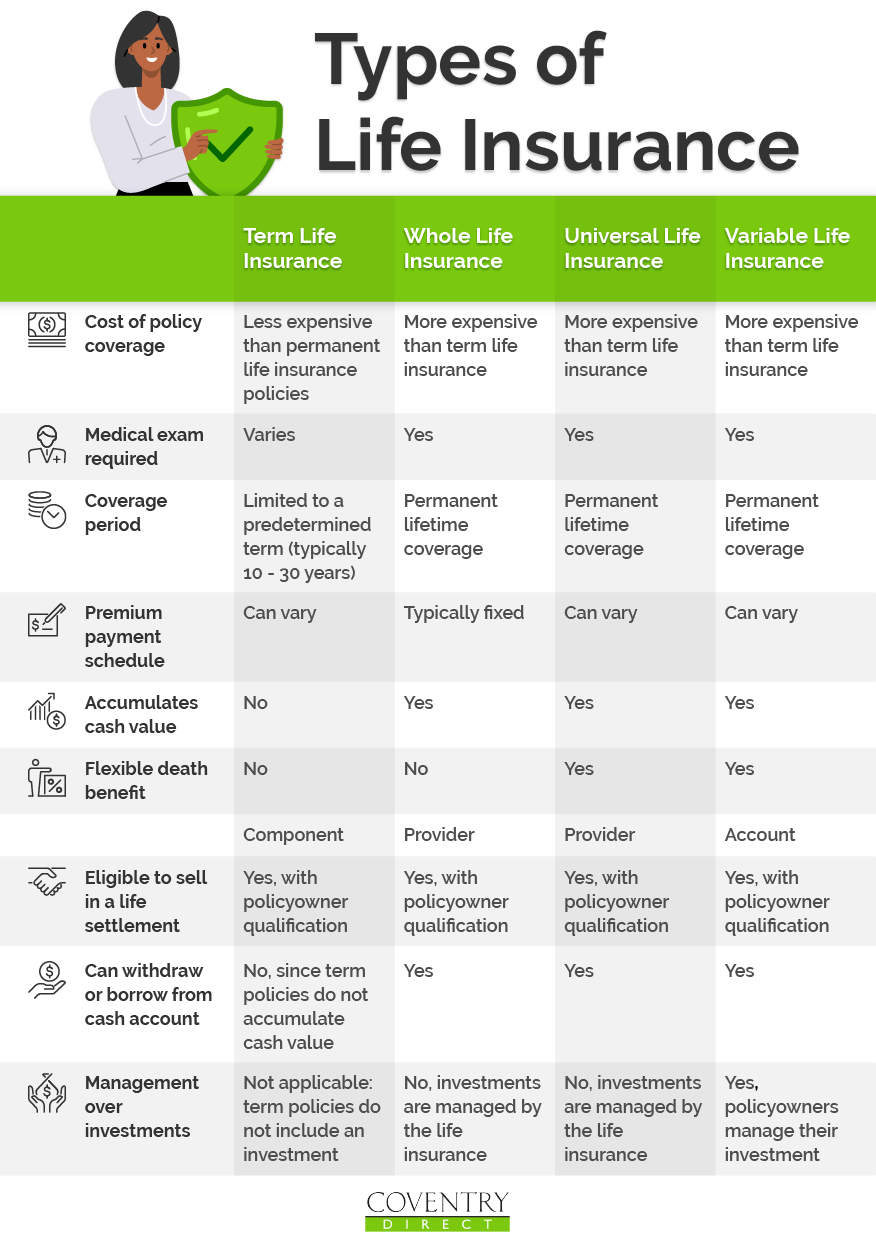

Georgia residents taking prescription medications have several types of life insurance policies to consider. Traditional term life insurance remains the most affordable option for many, offering coverage for specific periods (typically 10-30 years) with level premiums. If your condition is well-controlled with medication, many insurers will approve you for term coverage, though you might pay somewhat higher rates than those without health conditions.

Permanent life insurance options like whole life and universal life are also available to medication users in Georgia. These policies offer lifetime coverage and build cash value over time. While premiums are higher than term policies, permanent insurance can be particularly valuable if you’re concerned that your health condition might worsen over time, making future insurance more difficult to obtain.

For those with more complex medical profiles, guaranteed issue life insurance provides an alternative with no medical questions or exams. While these policies have lower coverage amounts (typically $5,000-$25,000) and higher premiums per thousand dollars of coverage, they ensure you can obtain some level of protection regardless of your medication history.

- Term life insurance: Most affordable option with coverage for specific time periods

- Whole life insurance: Lifetime coverage with fixed premiums and cash value accumulation

- Universal life insurance: Flexible premium permanent insurance with investment components

- Guaranteed issue: No medical questions policies for those with serious health concerns

- Group life insurance: Coverage through Georgia employers often with limited medical underwriting

Georgia-Specific Insurance Regulations That Protect You

Georgia insurance regulations provide important protections for residents taking prescription medications. The Georgia Insurance Code prohibits unfair discrimination in underwriting practices, meaning insurers cannot arbitrarily deny coverage based solely on medication use without actuarial justification. Additionally, Georgia is one of the states that has adopted the NAIC Model Regulation for Unfair Trade Practices, which provides further consumer protections.

The Georgia Office of Insurance and Safety Fire Commissioner oversees insurance companies operating in the state and provides resources for consumers who believe they’ve been unfairly treated due to their medication history. If your application is denied or rated significantly higher due to prescriptions, you have the right to appeal and request the specific reasons for the adverse decision. For more information on life insurance options, you might explore life insurance options for Georgia.

Georgia Insurance Consumer Protections: Georgia law requires insurers to provide a 30-day free look period for life insurance policies, allowing you to review your coverage and cancel for a full refund if you’re not satisfied. This gives medication users extra time to ensure the policy meets their needs and to verify that their health status was accurately assessed.

Another key protection for Georgia residents is the state’s participation in the Interstate Insurance Product Regulation Compact (IIPRC), which standardizes certain insurance products across member states. This helps ensure that policies offered in Georgia meet minimum consumer protection standards, regardless of where the insurance company is headquartered. For more information, you can read about the free look period in Georgia life insurance policies.

How Different Health Conditions and Medications Affect Your Rates

The impact of prescription medications on your life insurance rates varies dramatically based on the underlying condition being treated. Medications for common conditions like hypertension or high cholesterol typically result in minimal rate increases if the condition is well-controlled. For instance, a 45-year-old taking a standard dose of lisinopril for mild hypertension might pay just 15-25% more than standard rates. Ranwell Insurance specialists can often find companies that view these common medications most favorably.

Medications for mental health conditions like depression or anxiety have varying impacts depending on the specific diagnosis, medication type, and treatment history. Some insurers have become more progressive in their underwriting of these conditions, recognizing that well-managed mental health conditions pose minimal mortality risk. A stable applicant taking an SSRI for mild depression with no hospitalizations might qualify for standard rates with certain companies, while others might apply a moderate rating. This is where having an experienced broker who knows which companies take a more favorable view of mental health medications becomes invaluable.

Smart Application Strategies When Taking Prescriptions

“How Do I Apply for Life Insurance …” from www.jrcinsurancegroup.com and used with no modifications.

Being strategic about your life insurance application can significantly improve your chances of approval at better rates when you take medications. Timing is crucial—if you’ve recently changed medications or dosages, consider waiting 6-12 months before applying to demonstrate stability. Similarly, if you’re working with your doctor to improve your health metrics like blood pressure or cholesterol levels, waiting until you’ve achieved better numbers can translate to substantial premium savings with Ranwell Insurance’s guidance.

Documentation makes a tremendous difference in how underwriters perceive your medication use. Obtain detailed letters from your physicians explaining your condition, how well it’s controlled, your compliance with treatment, and any improvements in your health. These medical statements can help underwriters see beyond the medication to understand your actual health status and risk profile. Ranwell Insurance can help you gather and present this documentation effectively to insurers.

Consider working with an independent broker specializing in impaired risk cases rather than applying directly with insurance companies. Brokers like Ranwell Insurance have relationships with multiple insurers and know which companies view specific medications most favorably. They can conduct informal inquiries before you formally apply, potentially saving you from application denials that could harm future insurance prospects.

Frequently Asked Questions

Can I be denied life insurance completely because of my prescriptions?

It’s rare to be completely uninsurable solely because of prescription medications, though certain combinations of medications for serious conditions might result in denials from some companies. Even if traditional policies aren’t available, Georgia residents always have access to guaranteed issue life insurance options that accept all applicants regardless of medical history. These policies typically have lower coverage amounts and higher premiums, but they ensure you can obtain some protection for your loved ones.

Remember that different insurance companies have different underwriting guidelines. While one insurer might deny coverage based on your medication profile, others might offer standard or slightly rated policies. This is why working with Ranwell Insurance, which has access to numerous insurance carriers, can help you find coverage even with complex medication histories.

Do I need to disclose medications I no longer take?

Yes, you should disclose all medications you’ve taken within the past 5-10 years on your life insurance application, even those you no longer use. Insurance companies have access to prescription databases and medical records that will reveal this information regardless, and failing to disclose could be considered misrepresentation. However, medications you took temporarily for acute conditions (like a short course of antibiotics) typically have no impact on your insurability once the condition has resolved.

Being forthcoming about past medications allows your agent to properly position your application and explain any changes in your health status. For example, if you previously took blood pressure medication but no longer need it due to lifestyle improvements, this positive health trajectory can actually work in your favor if properly documented and explained.

How long should I be off medication before applying for better rates?

The timeframe varies by medication type and underlying condition, but generally, insurers like to see stability for at least 6-12 months after medication changes. For mental health medications like antidepressants, some companies may want to see 1-2 years of stability off medication before offering their best rates. Conditions like high blood pressure or diabetes, which are typically considered chronic, may still result in standard or slightly rated classifications even if you’ve been medication-free for several years, as insurers may consider the underlying condition still present but controlled. For more on securing favorable rates, learn why you should lock in life insurance coverage while you’re healthy.

Will my premium decrease if I stop taking medication?

If you’ve already purchased a life insurance policy, stopping medication won’t automatically lower your premiums on that existing policy. However, if your health significantly improves after discontinuing medication (with doctor’s approval), you may be able to apply for a reconsideration of your rates or apply for a new policy altogether. This process typically requires you to have been off the medication for 1-2 years with documented improvement in the underlying condition. For more information on why it’s beneficial to lock in life insurance coverage while you’re healthy, check out this resource.

Keep in mind that stopping prescribed medication without medical supervision can be dangerous and may actually harm your insurability if it leads to health complications. Always work with your healthcare provider on any medication changes, and focus on overall health improvement rather than simply eliminating medications to get better insurance rates.

- Some companies offer “reconsideration periods” after 1-2 years of policy ownership

- Medical documentation of improvement is essential for rate reconsiderations

- New policies may offer better rates than reconsiderations of existing policies

- Some policies include “wellness benefits” that reward health improvements

- Ranwell Insurance can advise on timing for reconsideration or new applications

For Georgia residents who have seen significant health improvements, Ranwell Insurance can conduct a policy review to determine whether seeking a new policy might result in meaningful premium savings compared to your current coverage.

Are there any medications that don’t affect life insurance rates?

Several categories of medications typically have minimal or no impact on life insurance rates. These include medications for seasonal allergies, birth control, preventative medications like low-dose aspirin, most vitamins and supplements, and short-term antibiotics for resolved infections. Additionally, medications prescribed at low doses for off-label uses (like low-dose blood pressure medications for migraine prevention) may be viewed more favorably if the underlying condition is minor.

Common medications like statins for cholesterol management may have little to no impact on your rates if you have no other cardiovascular risk factors and your cholesterol is well-controlled. Some insurers now recognize that proactive medication use to prevent health problems demonstrates responsible health management rather than increased risk, particularly for conditions caught early and well-managed.

Even medications that typically cause rate increases can sometimes be overlooked if you otherwise present an excellent health profile. For example, a person taking a mild antidepressant but who maintains an active lifestyle, healthy weight, and has no other health concerns might still qualify for preferred rates with certain insurance companies that take a holistic view of health rather than automatically penalizing for specific medications.

For Georgia residents seeking life insurance while taking prescription medications, Ranwell Insurance offers personalized guidance to navigate the complex underwriting landscape and find the most favorable coverage options for your specific situation. With access to numerous insurance providers and specialized knowledge of medication underwriting, they can help you secure the protection your family needs at competitive rates despite your prescription history.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.