Key Takeaways

- Seniors in Georgia who use oxygen can qualify for certain life insurance policies despite this medical condition

- Final expense and guaranteed issue policies from Ranwell Insurance offer the most accessible coverage options for oxygen-dependent seniors

- The reason for oxygen use significantly impacts eligibility and premium rates, with sleep apnea being viewed more favorably than COPD

- Georgia seniors have multiple no-medical-exam insurance options available that provide immediate coverage

- Working with specialists who understand oxygen-related conditions increases your chances of finding affordable coverage

If you’re a Georgia senior who uses supplemental oxygen, you might assume that life insurance is out of reach. The truth is that while oxygen use does impact your options, it doesn’t close the door completely on obtaining quality coverage. Ranwell Insurance specializes in helping seniors with health challenges find appropriate life insurance solutions that provide peace of mind and financial protection for their families.

The key factor that insurance companies consider isn’t simply that you use oxygen, but why you need it. For instance, oxygen use for sleep apnea is viewed very differently than oxygen needed for advanced COPD or emphysema. This distinction can mean the difference between qualifying for standard coverage or needing to explore specialized policy options.

Georgia offers numerous insurance providers who understand the unique needs of seniors with health challenges. The Peach State has regulations that protect consumers while still allowing insurance companies to offer specialized policies for those with pre-existing conditions. This regulatory environment creates opportunities for oxygen-dependent seniors to find appropriate coverage.

Yes, Seniors on Oxygen Can Get Life Insurance in Georgia

“Using Oxygen Therapy …” from www.oxygenconcentratorstore.com and used with no modifications.

Despite what you might have heard, using supplemental oxygen doesn’t automatically disqualify you from obtaining life insurance in Georgia. Insurance companies understand that oxygen therapy is prescribed for various conditions with different levels of severity and prognosis. Many Georgia seniors using oxygen have successfully secured life insurance policies tailored to their specific health situations.

The insurance industry has evolved to recognize that medical advances have improved longevity for people with respiratory conditions. While traditional term life policies might be challenging to qualify for when using oxygen, several specialized insurance products exist specifically designed for seniors with health challenges. Final expense insurance and guaranteed issue policies are particularly accessible options for oxygen users.

“Many of our clients are surprised to learn they have multiple insurance options despite being on oxygen. The key is working with companies that specialize in higher-risk applicants and understand the nuances of different respiratory conditions.” – Senior Insurance Specialist at Ranwell Insurance

Your specific oxygen usage pattern makes a significant difference in how insurers evaluate your application. For example, if you only use oxygen at night for sleep apnea, you’ll generally have more options and better rates than someone requiring continuous oxygen for COPD. Similarly, if your oxygen use is temporary rather than permanent, insurers may view your application more favorably.

Types of Life Insurance Available for Oxygen-Dependent Seniors

For Georgia seniors who use oxygen, several life insurance options remain accessible. Final expense insurance, sometimes called burial insurance, is often the most practical choice. These policies typically offer coverage amounts between $5,000 and $25,000, specifically designed to cover funeral expenses and remaining medical bills. The application process is straightforward, and many final expense policies don’t require medical exams, though they will ask health questions related to your oxygen use.

Guaranteed issue life insurance represents another viable option for oxygen-dependent seniors in Georgia. These policies accept virtually all applicants regardless of health conditions, making them ideal for those with more severe respiratory issues. The tradeoff comes in the form of higher premiums and a waiting period—usually two years—before the full death benefit becomes available. During this waiting period, if death occurs from natural causes, the beneficiary typically receives the premiums paid plus interest rather than the full benefit amount. For more information on costs, you might consider reading about life insurance costs for seniors in Georgia.

Some oxygen users may also qualify for simplified issue policies, which fall between traditional and guaranteed issue coverage. These policies require answering health questions but no medical exam. While oxygen use will be considered, if it’s for a less severe condition like sleep apnea, you might still qualify. Ranwell Insurance can help navigate which of these options best suits your specific health situation and financial goals.

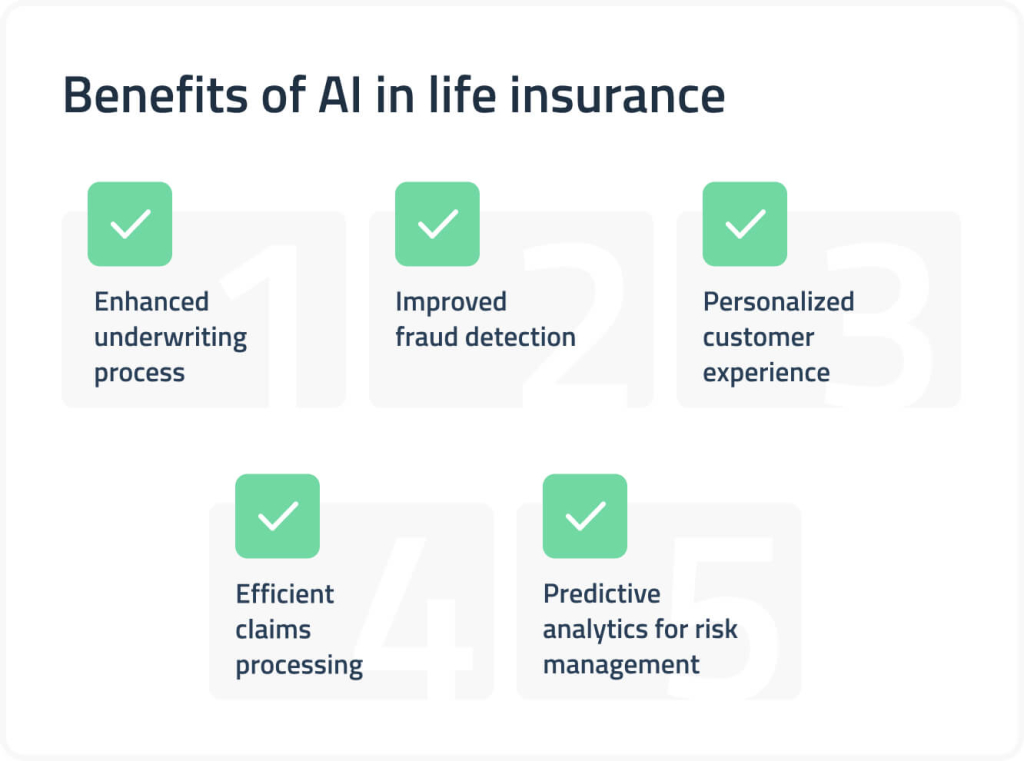

How Insurance Companies Evaluate Oxygen Use

“AI in Life Insurance: Benefits and …” from diceus.com and used with no modifications.

Insurance underwriters assess oxygen use based on several critical factors that determine your eligibility and premium rates. The underlying medical condition requiring oxygen is perhaps the most significant consideration. Sleep apnea typically receives more favorable ratings than emphysema or late-stage COPD, as it generally has less impact on overall life expectancy when properly managed. For more information on insurance options for pre-existing conditions, you can visit Choice Mutual’s guide.

The frequency and duration of oxygen use also weigh heavily in underwriting decisions. Occasional or nighttime-only oxygen use presents lower risk than continuous dependence. Similarly, recent improvements in your condition or reduced oxygen requirements can positively influence an underwriter’s assessment. Georgia insurers typically request medical records documenting the progression of your condition and oxygen requirements over time.

- Underlying condition (sleep apnea vs. COPD vs. temporary condition)

- Oxygen flow rate and concentration requirements

- Frequency of use (continuous, nighttime only, as needed)

- Duration of oxygen therapy (recent prescription vs. long-term use)

- Stability of your condition over time

- Additional health complications or risk factors

The stability of your overall health plays a crucial role as well. Insurance companies view stable conditions more favorably than those showing recent deterioration. If your oxygen requirements have remained consistent for at least 12-24 months and you haven’t experienced hospitalizations related to your respiratory condition, underwriters will likely offer better terms than if your condition appears to be worsening.

Cost Expectations and Policy Limits

Premium costs for oxygen-dependent seniors in Georgia vary widely based on age, gender, and the severity of your condition. Generally, you can expect to pay between 15-50% more than someone without oxygen requirements in the same age bracket. For example, a 70-year-old male on oxygen might pay $100-200 monthly for a $10,000 final expense policy, compared to $70-140 for someone without respiratory issues.

| Policy Type | Typical Coverage Limits | Monthly Premium Range | Medical Exam Required |

|---|---|---|---|

| Guaranteed Issue | $5,000-$25,000 | $50-$300+ | No |

| Final Expense | $5,000-$35,000 | $40-$250 | No (health questions only) |

| Simplified Issue | $10,000-$50,000 | $60-$350 | No (detailed health questions) |

Policy limits also tend to be more restricted for oxygen users. While standard applicants might qualify for coverage exceeding $100,000, oxygen-dependent seniors typically find their options capped at $25,000-$50,000, depending on the severity of their condition. It’s worth noting that Georgia insurance regulations provide some consumer protections regarding rate increases, which can help keep your premiums more stable over time compared to some other states.

Application Tips to Improve Approval Chances

When applying for life insurance as an oxygen-dependent senior in Georgia, preparation makes all the difference. Start by gathering comprehensive medical documentation, including your diagnosis, treatment plan, and recent pulmonary function test results. Having this information readily available shows insurers you’re managing your condition responsibly and provides a complete picture of your health status beyond just oxygen use.

Timing your application strategically can significantly impact approval odds. If you’ve recently started oxygen therapy, consider waiting 6-12 months before applying, as this demonstrates stability in your condition. Similarly, if you’ve recently reduced your oxygen requirements or shown improvement, highlight this positive trend in your application. Insurance companies favor applicants whose conditions are stable or improving rather than newly diagnosed or worsening.

Working with an independent insurance broker specializing in high-risk cases, like Ranwell Insurance, dramatically improves your chances of success. These specialists know which Georgia insurers are most accommodating to oxygen users and can target your application accordingly. They can also help frame your medical situation in the most favorable light without misrepresenting any facts, potentially securing better rates than you might find on your own.

Be completely honest about your medical condition and oxygen use. While it might be tempting to downplay your oxygen requirements to secure better rates, misrepresentation can lead to denied claims and policy cancellation. Insurance companies verify medical information through doctor records and prescription databases, making transparency the only viable approach for long-term coverage security.

Real Success Stories: Georgia Seniors Who Got Covered

“Life-Changing Impact of Life Insurance …” from www.youtube.com and used with no modifications.

Margaret, 72, from Atlanta, was diagnosed with COPD requiring nighttime oxygen. Initially declined by two major insurers, she worked with a specialized broker who helped her secure a $15,000 final expense policy with no waiting period. The key to her approval was demonstrating that her condition had remained stable for over two years and that she followed her treatment plan diligently.

Richard, 68, from Savannah, needed continuous oxygen for pulmonary fibrosis. Though traditional policies weren’t an option, he obtained a guaranteed issue policy with a $20,000 death benefit. While his premiums were higher than standard rates, the coverage provided essential peace of mind for his family’s financial security. His case illustrates that even with more severe oxygen requirements, insurance options remain available.

“I thought my oxygen tank meant no company would insure me. I was wrong—working with a specialist who understood my condition made all the difference. Now my children won’t have to worry about funeral expenses.” – James, 75, Columbus, GA

Elaine, 70, from Macon, used oxygen for sleep apnea and successfully qualified for a simplified issue policy with a $30,000 benefit. Her case highlights how the underlying reason for oxygen use significantly impacts insurability. Because sleep apnea is generally viewed more favorably than other respiratory conditions, she secured better coverage at lower rates than initially expected.

Frequently Asked Questions

Will my oxygen prescription automatically disqualify me from traditional life insurance?

Oxygen use doesn’t automatically disqualify you from all traditional life insurance, though it does limit your options. The key factors are your underlying condition, oxygen usage patterns, and overall health stability. Sleep apnea patients using nighttime-only oxygen often qualify for simplified issue policies, while those with advanced COPD may need to pursue guaranteed issue options. Some Georgia insurers offer modified traditional policies with higher premiums but without the waiting periods associated with guaranteed issue coverage.

| Condition Requiring Oxygen | Insurance Accessibility | Best Policy Types to Consider |

|---|---|---|

| Sleep Apnea | Medium-High | Simplified Issue, Final Expense |

| Temporary Use (Recovery) | Medium | Simplified Issue, Final Expense |

| COPD/Emphysema | Low-Medium | Final Expense, Guaranteed Issue |

Each insurer has different underwriting guidelines regarding oxygen use, which is why working with a specialized broker familiar with multiple companies’ policies can dramatically increase your approval chances. Ranwell Insurance maintains relationships with numerous Georgia insurers who offer more lenient underwriting for seniors with respiratory conditions, potentially opening doors to coverage options you might not find elsewhere.

How long after starting oxygen therapy should I wait before applying?

If you’ve recently been prescribed oxygen therapy within the last 3-6 months, it’s generally advisable to wait before applying for life insurance. Most insurers prefer to see a period of stability with your oxygen requirements, as this helps them better assess your long-term risk profile. The ideal waiting period depends on your specific condition and whether your oxygen use is expected to be temporary or permanent.

“For temporary oxygen users recovering from an acute condition, we recommend waiting until you’ve completely discontinued oxygen use before applying. For those with chronic conditions, waiting 6-12 months demonstrates stability and can lead to better offers.” – Underwriting Specialist at Ranwell Insurance

For conditions like COPD where oxygen use indicates disease progression, insurers typically want to see 12-24 months of stable oxygen requirements. This waiting period allows them to evaluate whether your condition has stabilized or is continuing to worsen. If your oxygen needs have decreased over time, this positive trend should be emphasized in your application as it suggests improved health management. Learn more about life insurance options in Georgia for individuals with chronic health conditions.

While waiting for this stability period, focus on consistently following your treatment plan, keeping all doctor appointments, and maintaining detailed records of your oxygen use and any changes to your prescription. This documentation will strengthen your eventual application by demonstrating responsible health management and providing clear evidence of your condition’s stability.

Does Medicare or Medicaid affect my life insurance options in Georgia?

Being enrolled in Medicare or Medicaid doesn’t directly impact your life insurance eligibility in Georgia, but these programs do interact with your insurance planning in important ways. Medicare and Medicaid provide limited or no death benefits for funeral expenses, creating a coverage gap that appropriate life insurance can fill. This makes securing life insurance particularly important for seniors relying on these government health programs.

Georgia Medicaid recipients should be aware of asset limits that could be affected by certain types of life insurance. While term policies generally don’t count toward Medicaid asset tests since they have no cash value, whole life or final expense policies with cash value components could potentially affect eligibility if their value exceeds certain thresholds. Consult with a Medicaid specialist before purchasing any permanent life insurance to ensure your benefits won’t be jeopardized.

- Term life policies don’t affect Medicaid eligibility (no cash value)

- Permanent policies with cash values over $1,500 may count toward Medicaid asset limits in Georgia

- Some policies can be structured to benefit a funeral home directly, avoiding Medicaid complications

- Irrevocable funeral trusts funded with life insurance may preserve Medicaid eligibility

For Medicare recipients, supplemental insurance planning becomes especially important since Medicare provides no death benefit for funeral expenses. Final expense policies can effectively fill this coverage gap without affecting your Medicare benefits or premiums. Georgia seniors often find that coordinating their Medicare coverage with appropriate life insurance provides a more comprehensive financial safety net for both healthcare needs and end-of-life expenses.

Can I get life insurance if I use oxygen only at night?

Nighttime-only oxygen use typically presents a more favorable insurance scenario than continuous oxygen dependency. Many Georgia insurers view nighttime oxygen use for conditions like sleep apnea as a positive sign of proper condition management rather than a high-risk indicator. With appropriate documentation showing your condition is well-controlled and limited to nighttime use only, you’ll have access to a broader range of policy options and potentially lower premiums than those requiring continuous oxygen support.

For nighttime oxygen users, simplified issue and even some traditional policies may remain accessible, particularly if your oxygen use is related to sleep apnea rather than more progressive conditions like COPD or pulmonary fibrosis. Be prepared to provide documentation from your sleep study and ongoing CPAP/oxygen compliance reports, as these demonstrate responsible management of your condition and improve your risk profile from an underwriter’s perspective. Ranwell Insurance can help identify Georgia insurers who offer the most favorable terms for those with nighttime-only oxygen requirements, potentially saving you significant premium costs while securing appropriate coverage.

What happens if my oxygen needs change after I get a policy?

Once your life insurance policy is in force, changes to your oxygen requirements generally won’t affect your coverage or premiums as long as you were truthful on your original application. Most life insurance policies in Georgia are guaranteed renewable, meaning the company cannot cancel your coverage or increase your premiums based on health changes that occur after policy issuance. This protection remains one of the strongest advantages of securing coverage while you’re still insurable, even if at higher rates.

If your health improves significantly and you no longer require oxygen, you may have options to apply for reconsideration or a new policy with better rates. Some companies offer policy reviews after substantial health improvements, potentially resulting in premium reductions. Alternatively, you might apply for a new policy altogether while maintaining your existing coverage until the new policy is approved, ensuring continuous protection during the transition.

Should your condition worsen after policy issuance, your existing coverage remains secure as long as you continue paying premiums. This highlights the importance of securing appropriate coverage as early as possible, ideally when your condition is stable or newly diagnosed rather than advanced. The policy you secure today provides valuable protection regardless of how your health may change in the future, giving both you and your loved ones important peace of mind during uncertain health journeys. For more information on life insurance options, you might find it useful to explore the best life insurance options available.

Senior life insurance can be a crucial consideration for those with health conditions such as being on oxygen. Many wonder if it’s possible to secure life insurance under these circumstances. In Georgia, there are various options available for seniors seeking coverage. It’s essential to understand the policies and requirements, as well as any potential limitations. For more information on the best life insurance options, you can explore life insurance options in Georgia.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.