Key Takeaways

- While there’s no universal cutoff age to stop buying life insurance in Georgia, most insurers limit new policies around age 80-85, though some specialized products remain available beyond that.

- Term life insurance becomes prohibitively expensive after 65, while guaranteed issue and final expense policies become more practical options for Georgia seniors.

- Ranwell Insurance helps Georgia residents navigate senior life insurance options with personalized guidance for your unique financial situation.

- Georgia’s insurance regulations provide specific protections for senior policyholders, including a free-look period and rate stability guarantees.

- The decision to stop buying life insurance should be based on your financial obligations, dependents’ needs, and estate planning goals rather than age alone.

Life insurance decisions become increasingly complex as you age, especially in Georgia where regulations and market offerings create unique considerations for seniors. Understanding when to stop purchasing new coverage can save you thousands while ensuring your loved ones remain protected.

Life Insurance Age Cut-Offs: Georgia’s Unique Considerations

“Health & Life Insurance Broker” from rwealthgroup.com and used with no modifications.

In Georgia, as in most states, there’s no legal maximum age at which you must stop buying life insurance. However, insurance companies set their own age limits that effectively create practical cutoffs. These limits vary by company and policy type, with most traditional insurers capping new term policies around age 80 and permanent policies around age 85. Ranwell Insurance specializes in helping Georgia residents navigate these age restrictions to find appropriate coverage regardless of your stage in life.

Georgia’s insurance market offers some advantages for older buyers. The state’s competitive insurance landscape means seniors often have more options than in less populated states. Additionally, Georgia’s insurance regulations include specific protections for senior consumers, including mandatory disclosure requirements and extended free-look periods that give you more time to review a new policy before it becomes binding.

Understanding these Georgia-specific factors is crucial when determining if you should continue pursuing new coverage or maintain existing policies as you age. Local market conditions can significantly impact both availability and affordability of senior life insurance products.

Why Age Matters When Buying Life Insurance in Georgia

Age serves as the primary pricing factor for life insurance because it directly correlates with mortality risk. Each birthday increases your statistical likelihood of death, which translates to higher premiums. In Georgia, a 65-year-old man might pay three to four times more for the same coverage compared to when he was 45. By age 75, that same policy could cost ten times more than at 45, if available at all.

Beyond simple cost increases, age affects insurability in profound ways. Medical underwriting becomes more stringent with each passing year, especially after 65. Conditions that might have been overlooked or rated moderately in your 50s could result in flat rejection in your 70s. Georgia insurers, like those nationally, become increasingly selective about which health risks they’ll accept as applicant age increases.

“The relationship between age and insurance cost isn’t linear—it’s exponential. A five-year delay in purchasing coverage between ages 30-35 might increase premiums by 15%, while the same five-year delay between 65-70 could double your costs.”

Age-related pricing isn’t just about mortality statistics—it also reflects decreased premium payment periods. When issuing a policy to an older adult, insurers have fewer years to collect premiums before likely paying a death claim. This compressed timeline fundamentally alters the economic equation for insurance companies and directly impacts the rates offered to Georgia seniors.

Ideal Ages to Purchase Different Types of Life Insurance

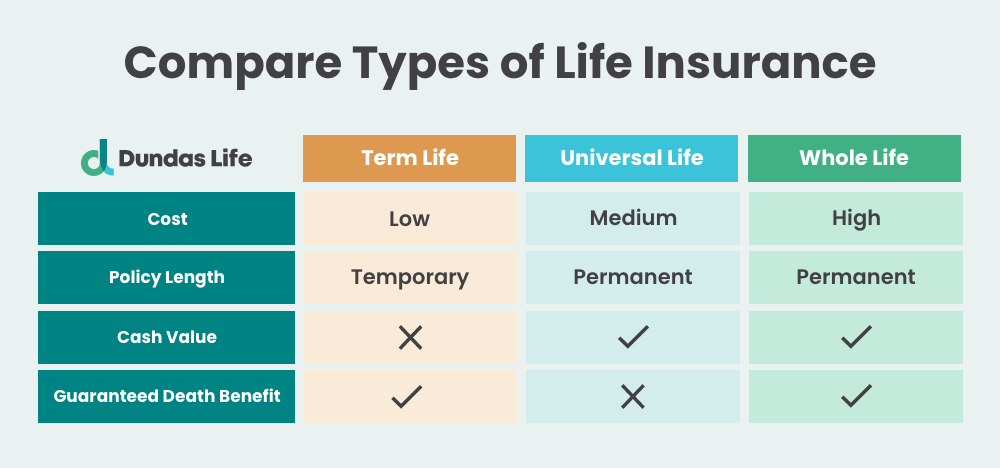

Different life insurance products have distinct ideal purchase windows based on their structure and purpose. Term life insurance offers the most value when purchased in your 30s to 50s, providing maximum coverage at minimum cost during your peak earning and family-raising years. After 55, term premiums begin climbing steeply, and by 65, they often become prohibitively expensive for most Georgia residents. Locking in coverage earlier creates substantial long-term savings.

Whole life and universal life insurance present a different calculation. These permanent policies build cash value alongside death benefits, serving dual purposes as both protection and investment vehicles. The ideal purchase window typically falls between ages 40-60, allowing sufficient time for cash value accumulation while keeping premiums manageable. After 65, the high premiums required to build meaningful cash value within your expected lifetime make these policies less efficient financial tools.

Final expense and guaranteed issue policies follow their own timeline. These specialized products, designed specifically for seniors with minimal or no medical underwriting, become increasingly relevant after 70. While available to younger applicants, their higher premiums relative to face value make them impractical until traditional options become unavailable. Many Georgia seniors find these policies provide appropriate coverage when purchased between ages 70-85. For more information on the costs involved, you can explore life insurance costs for an 80-year-old in Georgia.

When to Stop Buying New Coverage in Your 60s

Your 60s represent a transitional decade for life insurance decisions. By this age, many Georgians find their need for income replacement coverage diminishing as retirement approaches or begins. If your mortgage is paid off, children are financially independent, and retirement accounts are well-funded, extensive new coverage may be unnecessary. This decade often marks when many should pivot from acquiring new coverage to maintaining or adjusting existing policies. For instance, understanding life insurance costs for a 60-year-old can help in making informed decisions.

However, specific circumstances might warrant new coverage in your 60s. Ongoing financial obligations like mortgages, business partnerships, or dependent family members could necessitate continued protection. Additionally, estate planning considerations—particularly for high-net-worth individuals facing potential estate taxes—might justify new permanent insurance as a wealth transfer tool. Each situation requires individualized assessment rather than following arbitrary age-based rules. For more information, you can explore whether it’s too late to buy life insurance as you age.

- Consider converting existing term policies to permanent coverage rather than applying for entirely new policies

- Evaluate smaller, specialized policies targeting specific needs rather than large replacement coverage

- Review employer-provided group coverage options which may offer better rates than individual policies

- Explore simplified issue policies with limited underwriting if health concerns exist

When to Stop Buying New Coverage in Your 70s

By your 70s, traditional life insurance options narrow considerably in Georgia. Most term policies become unavailable or financially impractical, with premiums often exceeding 5% of the death benefit annually. At this stage, the primary available options shift toward guaranteed issue and final expense policies, which offer more modest death benefits ranging from $5,000 to $25,000. These policies serve specific purposes like covering funeral expenses and small debts rather than providing significant financial support to survivors. For those considering alternatives, it’s important to understand how much life insurance costs for an 80-year-old in Georgia.

When to Stop Buying New Coverage in Your 80s

In your 80s, new life insurance options become extremely limited in Georgia’s market. Most carriers stop offering new policies entirely around age 85, though a few specialized insurers may extend availability to age 90 for guaranteed issue products. Premiums at this age typically represent poor value relative to benefits, often returning less than the cumulative premiums paid unless the insured dies within a few years of purchase. To understand the costs involved, you might want to explore how much life insurance costs for an 80-year-old in Georgia.

For most Georgians in their 80s, insurance dollars are better directed toward alternatives like pre-paid funeral arrangements, trusts, or simply setting aside liquid funds for end-of-life expenses. These alternatives often provide more efficient financial solutions than new insurance policies with their necessarily high premiums and potential contestability periods.

Georgia-Specific Insurance Regulations for Seniors

“Understanding Georgia Insurance Laws: A …” from www.odumgeorgia.com and used with no modifications.

Georgia has implemented several regulations specifically designed to protect senior insurance consumers. These include a mandatory 30-day free-look period for applicants over 65 (compared to the standard 10 days for younger applicants), allowing more time to review policy details before commitment. Additionally, Georgia’s Aging Services Division provides free insurance counseling through the GeorgiaCares program, offering impartial guidance for seniors navigating insurance decisions. These protections create a somewhat more favorable environment for older insurance shoppers in Georgia compared to some other states.

Georgia-Specific Insurance Regulations for Seniors

Georgia has implemented several regulations specifically designed to protect senior insurance consumers. These include a mandatory 30-day free-look period for applicants over 65 (compared to the standard 10 days for younger applicants), allowing more time to review policy details before commitment. Additionally, Georgia’s Aging Services Division provides free insurance counseling through the GeorgiaCares program, offering impartial guidance for seniors navigating insurance decisions.

The Georgia Office of Insurance and Safety Fire Commissioner also enforces rate stability regulations for senior life insurance products. These rules limit how drastically premiums can increase on certain policy types, providing more predictability for older policyholders. Georgia law further requires enhanced disclosure requirements for policies marketed to seniors, mandating clear explanation of premium obligations, benefit limitations, and surrender penalties in larger print than standard policies. For more details on how these policies protect buyers, learn about the free look period in Georgia life insurance policies.

“Georgia’s senior insurance protections rank among the most comprehensive in the Southeast, with particular strength in disclosure requirements and suitability standards. These regulations help ensure that products sold to older Georgians actually meet their needs rather than simply generating commissions.”

The Bottom Line: There’s No Perfect Age to Stop

The decision to stop purchasing life insurance should ultimately be guided by your financial situation and obligations rather than arbitrary age thresholds. While insurance availability naturally decreases with age, the more important question is whether you still have financial responsibilities that would create hardship for others if you passed away. If your mortgage is paid, children are independent, and funeral expenses are covered through savings or pre-arrangements, you may have already reached your personal stopping point.

Conversely, if you still have dependents, business obligations, or estate tax concerns, continued coverage may remain valuable regardless of age-related premium increases. The key is conducting a thorough needs analysis rather than making assumptions based solely on birthdays. Many Georgia seniors find their insurance needs evolve rather than disappear entirely, shifting from income replacement toward final expenses and legacy planning.

Remember that existing policies often provide better value than new coverage at advanced ages. If you already hold permanent insurance, maintaining those policies frequently makes more financial sense than surrendering them and pursuing new coverage, even if your needs have changed somewhat. The best approach is working with a knowledgeable advisor who can help evaluate your specific situation within Georgia’s insurance marketplace.

Frequently Asked Questions

Can I still get affordable life insurance in Georgia after age 65?

Yes, affordable coverage remains available after 65 in Georgia, though your options become more limited with each passing year. Traditional term policies become increasingly expensive, but simplified issue policies, guaranteed acceptance plans, and final expense insurance remain reasonably priced relative to their coverage amounts. A healthy 65-70 year old can still qualify for substantial coverage, though medical underwriting becomes more stringent.

| Policy Type | Typical Max Issue Age | Approximate Monthly Cost at Age 65-70 |

|---|---|---|

| 10-Year Term ($100,000) | 75-80 | $85-175 |

| Final Expense ($15,000) | 85 | $45-75 |

| Guaranteed Issue ($25,000) | 80-85 | $90-150 |

Many Georgia seniors find success working with independent agents who can shop policies across multiple carriers rather than captive agents representing single companies. This approach provides access to specialized senior-friendly insurers who may offer more favorable underwriting for common age-related conditions.

Premium rates vary significantly between companies for identical coverage, especially for seniors. For example, one major insurer might charge $110 monthly for a policy that another offers at $75 with identical benefits. This price disparity makes comparison shopping particularly valuable for older applicants in Georgia’s competitive insurance market.

What happens to my Georgia life insurance policy when I turn 100?

Most modern life insurance policies issued in Georgia mature at age 100 or 121, depending on when they were issued and which mortality table they use. Upon reaching the maturity date, the policy typically pays out its full face value or accumulated cash value (whichever is greater) to the policy owner—not the beneficiary—as a living benefit. This payout is generally treated differently for tax purposes than a death benefit, potentially creating tax liabilities that wouldn’t exist if the benefit were paid posthumously. If you’re approaching your policy’s maturity age, consult with both your insurance advisor and tax professional about potential implications and alternatives.

Should I keep my existing policy or shop for a new one as a senior?

For most Georgia seniors, maintaining existing coverage is more advantageous than replacing it with new policies. Your existing policies were issued based on younger age and possibly better health status, resulting in more favorable pricing than newly-issued coverage. Additionally, older policies may contain valuable provisions no longer available in current offerings, such as more liberal disability waivers or guaranteed insurability options. Before surrendering any existing coverage, obtain in-force illustrations showing projected performance and compare them against new policy quotes. Many seniors find hybrid approaches most beneficial—keeping valuable existing coverage while supplementing with smaller, specialized new policies for specific needs that weren’t addressed in their original insurance portfolio. For more insights, you can explore the 3-year rule for life insurance in Georgia.

Are there any Georgia-specific senior life insurance programs?

Georgia doesn’t offer state-sponsored life insurance programs specifically for seniors, unlike some states with guaranteed-issue plans through state agencies. However, Georgia does provide valuable resources through the GeorgiaCares program, offering free, unbiased insurance counseling for seniors navigating Medicare, supplemental insurance, and life insurance options. This service helps Georgia seniors identify appropriate private market solutions tailored to their circumstances.

Additionally, several fraternal benefit societies operating in Georgia offer preferential life insurance rates to qualifying members, with many specializing in senior coverage. Organizations like Woodmen of the World, Modern Woodmen, and Catholic United Financial provide member-based insurance programs that sometimes offer more favorable terms for older applicants than standard commercial insurers. Eligibility requirements vary, with some based on religious affiliation, professional background, or heritage.

How do medical exams affect life insurance approval for Georgia seniors?

Medical exams become increasingly significant barriers to coverage as you age in Georgia’s insurance market. After 65, even minor health issues often result in substantial rate increases or outright declinations. Common senior conditions like controlled hypertension or mild diabetes, which might be rated favorably at younger ages, frequently lead to significant rate increases after 70.

The good news is that no-exam options have expanded significantly in Georgia’s insurance market. These include simplified issue policies (requiring health questions but no physical exam) and guaranteed issue policies (requiring neither exams nor health questions). While these policies typically offer lower coverage amounts at higher per-unit costs, they provide accessible options for seniors with health challenges.

Some Georgia insurers now use predictive modeling and electronic health records rather than traditional medical exams, potentially offering more favorable outcomes for seniors. These “accelerated underwriting” approaches analyze prescription histories, medical claims data, and other electronic information to make rapid approval decisions, sometimes yielding better results than traditional medical underwriting for applicants with well-managed chronic conditions.

If considering traditional underwritten coverage, timing matters substantially. Schedule medical exams early in the day when vital signs tend to be optimal, follow pre-exam guidelines carefully, and ensure you’ve taken prescribed medications appropriately before examination. These simple steps can significantly impact underwriting outcomes for Georgia seniors seeking the most favorable policy rates.

When considering life insurance, it’s important to know the right time to purchase a policy. Many people wonder at what age they should stop buying life insurance. For those living in Georgia, you might find it helpful to explore when is the best time to get life insurance in GA to make an informed decision.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.