Key Takeaways

- The average cost of final expense insurance for an 80-year-old in Georgia ranges from $150-$300 monthly for a $10,000-$20,000 policy

- Health conditions significantly impact premiums, with tobacco users potentially paying 30-50% more than non-smokers

- At age 80, final expense/burial insurance is typically the most accessible option as term policies become limited

- Women generally qualify for lower rates than men of the same age due to longer life expectancy statistics

- Working with an independent insurance agent who specializes in senior coverage can help you find competitive rates specific to Georgia

Life insurance options narrow considerably when you reach your 80s, but coverage remains available in Georgia for those who need it. The monthly premiums will be higher than what younger applicants pay, yet securing a policy can provide invaluable peace of mind for your family. At Ranwell Insurance, we help Georgia seniors navigate complex insurance decisions and find affordable coverage that won’t break the bank.

For most 80-year-olds in Georgia, final expense insurance becomes the primary option, as traditional term life policies become scarce and prohibitively expensive. The good news is that several reputable insurance carriers still offer affordable burial insurance designed specifically for seniors in their 80s, with simplified underwriting processes that make approval more accessible.

Final Expense Insurance: The Most Common Option at 80

“What Is Final Expense Insurance …” from www.harrylevineinsurance.com and used with no modifications.

Final expense insurance (also called burial or funeral insurance) is typically the most practical and affordable life insurance option for 80-year-olds in Georgia. These whole life policies provide permanent coverage with fixed premiums that never increase, regardless of health changes after you’re approved.

For an 80-year-old male in Georgia, monthly premiums for a $10,000 final expense policy typically range from $150-$200 for those in relatively good health. Female applicants usually receive more favorable rates, with monthly costs between $120-$170 for the same coverage amount. These policies are designed primarily to cover funeral costs, which average around $9,000-$12,000 in Georgia, though they can also help with other end-of-life expenses.

Sample Monthly Rates for $10,000 Final Expense Policy in Georgia (Age 80)

Male, Non-Smoker, Good Health: $155-$190

Male, Smoker, Good Health: $200-$245

Female, Non-Smoker, Good Health: $120-$165

Female, Smoker, Good Health: $170-$210

Most final expense policies for 80-year-olds feature simplified underwriting, meaning you answer health questions but typically don’t need a medical exam. However, your health status will still affect both eligibility and premium costs. Many insurers offer three basic health classification levels: Level (preferred rates for those in good health), Graded (higher rates with a 2-3 year partial benefit period for moderate health issues), and Guaranteed Issue (highest rates but no health questions, though usually with a 2-year waiting period). It’s important to lock in life insurance coverage while you’re healthy to secure better rates.

Whole Life Insurance Rates for 80-Year-Olds

Traditional whole life insurance with larger death benefits becomes increasingly expensive at age 80. In Georgia, an 80-year-old seeking a $50,000 whole life policy might face monthly premiums between $400-$700 depending on health, gender, and the specific insurance carrier. These policies build cash value over time, though the accumulation potential is limited given the advanced age at purchase.

The primary advantages of whole life insurance include lifetime coverage and fixed premiums. For 80-year-olds concerned about leaving a more substantial legacy beyond funeral costs, this option provides guaranteed death benefits regardless of when you pass away, provided premiums are maintained. However, the high cost means many seniors find better value in final expense policies with lower face values that focus specifically on covering burial costs.

Term Life Insurance Options at Age 80

Term life insurance becomes extremely limited for 80-year-olds in Georgia. Most insurance carriers cap term life eligibility at age 75 or earlier, meaning your options are few and far between. The handful of companies that do offer term policies to 80-year-olds typically limit these to 5 or 10-year terms with significant premium costs that reflect the high risk assessment.

For example, an 80-year-old male in Georgia seeking a $100,000 10-year term policy might face monthly premiums of $800-$1,200 if they qualify at all. Women fare somewhat better with rates approximately 25-30% lower, but the costs remain substantial. Additionally, these policies almost always require full medical underwriting with extensive health examinations, blood tests, and medical record reviews. For more information on life insurance for seniors over 80, you can explore additional resources.

Given these limitations and costs, term insurance rarely represents the most practical option for those turning 80. The likelihood of outliving a term policy purchased at this age is relatively high, which would result in no benefit after years of premium payments. For most seniors at this stage, final expense or smaller whole life policies offer more reliable value.

Why Life Insurance Costs More at 80

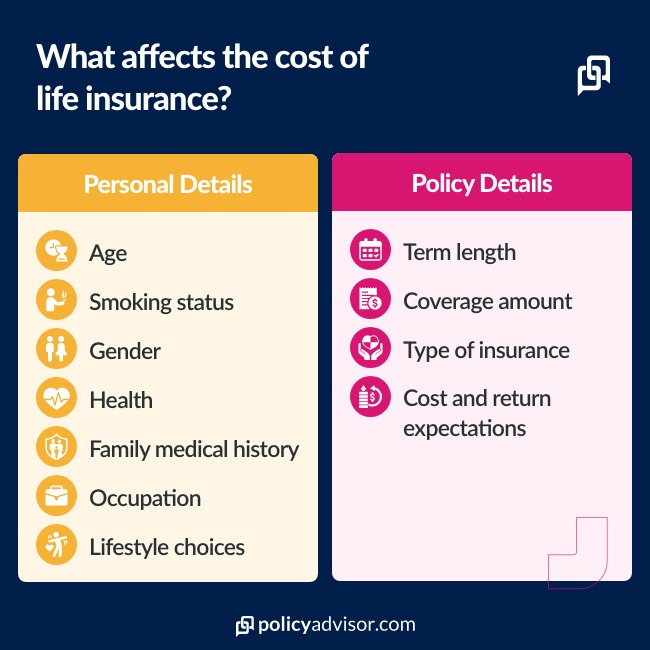

“Cost of Million-Dollar Life Insurance …” from www.policyadvisor.com and used with no modifications.

Insurance premiums increase dramatically with age because they’re based on statistical mortality risk. By age 80, life expectancy is significantly shorter than for younger applicants, which directly impacts policy pricing. In Georgia, the average life expectancy is about 77.4 years, slightly below the national average, which can further affect premium calculations for seniors.

Several factors combine to drive up costs for 80-year-old applicants. Insurance companies price policies based on actuarial tables showing that mortality risk increases substantially in your 80s. Each year after 80 typically sees premium increases of 8-15% compared to the previous year. Additionally, Georgia-specific factors like higher rates of certain chronic conditions among seniors can impact regional pricing models used by insurers.

Health conditions common among older adults such as heart disease, diabetes, and hypertension further increase premium costs. For instance, an 80-year-old with well-controlled diabetes might pay 40-60% more than someone without this condition. Tobacco use remains one of the most significant rate factors, with smokers typically paying 30-50% more than non-smokers of the same age and gender. It’s crucial to lock in life insurance coverage while you’re healthy to potentially mitigate these costs.

How to Get the Best Rates in Georgia

Despite the higher costs associated with advanced age, several strategies can help 80-year-olds in Georgia secure more affordable coverage. The insurance marketplace varies considerably between companies, with some carriers specializing in senior applicants and offering more competitive rates for this demographic. Taking a strategic approach to your application can result in meaningful savings, and understanding return of premium term life insurance in Georgia can be beneficial.

Working With Independent Agents

Ranwell Insurance agents who happen to specialize in senior life insurance can provide invaluable assistance for 80-year-olds seeking coverage in Georgia. Unlike captive agents who represent just one company, independent agents can access policies from numerous insurers, allowing them to match your specific health profile with the carrier most likely to offer favorable rates. These specialists understand which companies are more lenient with certain health conditions and can guide you toward the most cost-effective options for your situation.

Comparing Multiple Quotes

Premium differences between insurance companies can be substantial, sometimes varying by 30-50% for identical coverage. Each insurer uses slightly different underwriting guidelines and pricing models, particularly for older applicants. Some carriers may view certain health conditions more favorably than others, resulting in dramatically different premium offers.

In Georgia specifically, Ranwell Insurance can offer more competitive rates than national brands, as they have more nuanced understanding of the state’s demographics and mortality statistics. Taking time to gather and compare quotes from several different insurance companies can reveal surprising pricing variations and potential savings opportunities.

Policy Features Worth Paying For

When evaluating life insurance at age 80, certain policy features may justify higher premiums if they provide meaningful benefits for your situation. Accelerated death benefit riders, for example, allow you to access a portion of your death benefit if diagnosed with a terminal illness, potentially helping cover medical costs during your lifetime. This feature typically adds only 5-10% to premium costs but can provide crucial financial flexibility. To understand more about why life insurance is important for financial security in Georgia, consider exploring additional resources.

First-day coverage (sometimes called “level benefits”) is another valuable feature worth considering despite potentially higher premiums. Many final expense policies for applicants with health issues include 2-3 year waiting periods during which they only return premiums plus interest if death occurs from natural causes. Paying more for immediate full coverage eliminates this risk, providing complete protection from day one. To understand why this is crucial, you might explore why life insurance is important for financial security.

Guaranteed premium rates are standard with most whole life and final expense policies but should be explicitly confirmed before purchase. This feature ensures your monthly cost never increases regardless of changes in health or advancing age, providing valuable budget predictability for those on fixed retirement incomes.

- Look for companies specializing in senior applicants with lenient underwriting for common health conditions

- Consider paying slightly more for first-day coverage rather than accepting a multi-year waiting period

- Evaluate whether smaller coverage amounts might better balance affordability with your actual needs

- Ask about policy discounts for auto-pay enrollment or annual payment options

- Confirm whether the policy includes a “rate lock” guarantee that prevents future premium increases

Buying Life Insurance for Elderly Parents in Georgia

“How to Buy Life Insurance” from www.whitecoatinvestor.com and used with no modifications.

Adult children often explore life insurance options for their 80-year-old parents in Georgia to ensure funeral expenses and potential medical debts won’t create financial hardship. To purchase coverage for a parent, you’ll need their consent and participation in the application process, including answering health questions and potentially completing medical exams depending on the policy type.

Georgia law requires that you have an “insurable interest” in the person being insured, meaning you would face financial consequences upon their death. As an immediate family member, you automatically meet this requirement. The policy can be structured with you as both the owner (responsible for premium payments) and beneficiary, while your parent serves as the insured person.

When considering this approach, involve your parent in all discussions and respect their wishes. Some seniors may prefer alternative arrangements for end-of-life expenses or may have existing policies you’re unaware of. Open communication can prevent misunderstandings and ensure everyone’s financial and emotional needs are addressed appropriately.

Alternatives to Traditional Life Insurance

Given the high cost of life insurance at age 80, some Georgia seniors may benefit from exploring alternative financial strategies. These approaches can sometimes provide similar benefits at lower costs or with more flexibility than conventional insurance products.

Pre-Need Funeral Plans

Pre-need funeral arrangements allow you to plan and pay for specific funeral services directly with a funeral home, either in a lump sum or through installment payments. These plans typically cover all essential services at today’s prices, protecting against future inflation. Georgia funeral homes are regulated by the state’s Funeral Service Board, providing some consumer protections for these arrangements.

Unlike life insurance, these plans aren’t contingent on health status, making them accessible regardless of medical conditions. However, they’re limited to funeral expenses only and don’t provide additional funds for other end-of-life costs. Before committing to a pre-need plan, verify the funeral home’s reputation, understand exactly what services are included, and inquire about what happens if you move to another area or the funeral home changes ownership.

Savings and Investment Options

For 80-year-olds in good health who may find insurance premiums prohibitively expensive, self-funding through dedicated savings can be an effective alternative. Setting aside a specific amount in a payable-on-death (POD) account ensures these funds transfer directly to your designated beneficiary without probate delays. Georgia banks offer these accounts with minimal setup requirements, though the funds don’t grow tax-advantaged like certain insurance products.

Some seniors utilize CDs or conservative investment options to gradually build a funeral fund, though investment risk must be carefully managed at this age. Others pre-fund burial expenses by purchasing cemetery plots and headstones in advance, significantly reducing the financial burden on family members later.

Take Action: Securing Coverage Before It’s Too Late

| Steps to Secure Life Insurance at Age 80 | Timeline | Considerations |

|---|---|---|

| Determine coverage needs | Week 1 | Gather funeral cost estimates in your Georgia region |

| Contact independent agent | Week 1-2 | Seek specialist in senior insurance products |

| Compare multiple quotes | Week 2-3 | Review at least 3-5 different insurance providers |

| Complete application | Week 3-4 | Answer health questions truthfully to avoid claim issues |

| Policy delivery & review | Week 5-6 | Carefully examine terms before free-look period expires |

The most critical advice for 80-year-olds considering life insurance in Georgia is to act promptly. Each additional year significantly increases premium costs, and developing health conditions can further limit your options. While premiums at 80 are substantially higher than those faced by younger applicants, they’ll never be lower than they are today.

Begin by accurately assessing your coverage needs rather than arbitrarily selecting a policy amount. In Georgia, average funeral costs range from $7,000 to $12,000, though additional expenses like medical bills, legal fees, or a desire to leave a financial gift should be factored into your coverage amount. Working with an independent agent who specializes in senior insurance provides access to multiple carriers and personalized recommendations based on your specific health profile and budget constraints.

When completing applications, answer all health questions honestly and thoroughly. Misrepresentations, even accidental ones, can result in denied claims during the contestability period. Most final expense policies include a two-year contestability window during which the insurer can investigate claim circumstances and potentially deny payment if application discrepancies are discovered.

After receiving your policy, use the free-look period (typically 10-30 days in Georgia) to thoroughly review all terms and conditions. This window allows you to cancel for a full refund if you discover unfavorable provisions or find a better option elsewhere. Store policy documents in a secure but accessible location and inform your beneficiaries of the coverage details and your insurance company’s contact information.

Frequently Asked Questions

Life insurance for 80-year-olds generates numerous questions as families navigate this complex financial decision. The following answers address the most common inquiries we receive from Georgia seniors exploring their coverage options.

Can I get life insurance at 80 without a medical exam in Georgia?

Yes, several insurance carriers offer no-exam policies for 80-year-olds in Georgia, primarily through final expense or guaranteed issue products. These simplified-issue policies typically require answering health questions on the application but don’t involve physical examinations or blood tests. For those with significant health issues, guaranteed issue policies are available that accept all applicants regardless of medical history, though these come with higher premiums and typically include a 2-year waiting period during which only premium refunds are provided for natural deaths.

How much coverage should an 80-year-old have in Georgia?

Most 80-year-olds in Georgia purchase policies between $10,000-$25,000, primarily to cover funeral expenses and minor debts. The appropriate coverage amount depends on your specific circumstances, including anticipated funeral costs in your region, outstanding debts, potential medical expenses, and whether you wish to leave additional funds to beneficiaries. Georgia’s average funeral costs range from $7,000-$12,000, making a $15,000 policy sufficient for basic needs, though those wanting to provide additional financial support might consider larger amounts if affordable.

Is there a waiting period for life insurance at age 80?

Waiting periods vary by policy type and your health status. Healthy 80-year-olds can qualify for “level benefit” final expense policies that provide full coverage from day one. Those with moderate health issues might receive “graded benefit” policies with partial coverage during the first 2-3 years. Guaranteed issue policies (available regardless of health) typically include a 2-year waiting period during which they only refund premiums plus interest for natural deaths, though they usually cover accidental deaths fully from inception. Georgia regulations require clear disclosure of any waiting periods in policy documents.

Can I be denied life insurance at 80 because of my health?

Traditional term and whole life policies often decline applicants at age 80 with significant health conditions such as recent cancer, heart attacks, strokes, or advanced diabetes complications. However, guaranteed issue final expense policies are available to all Georgia residents regardless of health status, with no possibility of denial based on medical history. These guaranteed acceptance policies provide a viable option for those unable to qualify for medically underwritten coverage, though they come with higher premiums and waiting periods. To understand more about your options, you might consider reading about life insurance in Georgia.

Between these extremes, simplified issue final expense policies offer moderate underwriting that accommodates many common health conditions like controlled diabetes, past cancer (typically 2+ years post-treatment), and stable heart conditions. Working with an independent agent helps identify which carriers are most lenient with your specific health profile.

How do Georgia life insurance rates compare to neighboring states?

Georgia’s life insurance rates for 80-year-olds typically align closely with those in neighboring states like South Carolina and Alabama, though they run slightly higher than Florida rates due to actuarial differences in life expectancy statistics. Insurance is regulated primarily at the state level, creating some regional variations in pricing models and available products. Georgia’s insurance regulations aim to protect consumers while maintaining a competitive marketplace, resulting in reasonable pricing compared to national averages.

When comparing interstate options, remember that insurance agents must be licensed in the state where you legally reside. Georgia residents cannot purchase policies from out-of-state agents unless those professionals hold Georgia insurance licenses. However, national carriers operate across state lines and may offer slightly different rates and underwriting guidelines in different regions based on their experience in those markets.

Life insurance is a critical component of financial planning, especially for seniors. As people age, the cost of life insurance tends to increase, making it important to understand the options available. For those living in Georgia, it’s essential to consider how life insurance can contribute to financial security and ensure peace of mind for loved ones.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.