Key Takeaways

- Rural Georgia seniors can find affordable burial insurance starting at around $25-50 per month for basic coverage, with policy amounts ranging from $5,000-$25,000.

- No medical exam options are widely available for seniors, making qualification simpler even with health conditions.

- The average funeral in Georgia costs approximately $7,000-$9,000, making burial insurance an important financial planning tool.

- Rural residents may have fewer local insurance agents nearby, but Ranwell Insurance provides access to the same national carriers online as those available in larger cities.

- Georgia seniors on Medicaid should carefully structure burial insurance to avoid impacting their benefits eligibility.

Finding affordable burial insurance shouldn’t be difficult just because you live in rural Georgia. The truth is, final expense coverage remains one of the most accessible types of life insurance for seniors, regardless of where you call home. With monthly premiums often starting around $30-50 for basic coverage, these specialized policies can provide the peace of mind your family needs.

The Real Cost of Burial Insurance for Rural Georgia Seniors

“Final Expense Insurance – Georgia …” from senior-lifeservices.com and used with no modifications.

In rural Georgia, end-of-life expenses can quickly add up to $15,000-$19,000 when you factor in medical costs, funeral services, and burial or cremation expenses. The funeral alone typically costs around $7,000 in Georgia, which can place a significant financial burden on families without proper planning. Burial insurance offers a practical solution for covering these expenses without depleting your savings or burdening your loved ones.

Contrary to what many believe, rural Georgia residents generally pay similar rates to their urban counterparts. Your location within Georgia doesn’t significantly impact pricing – instead, factors like age, health condition, gender, and coverage amount determine your premium. For example, a healthy 65-year-old might pay $40-60 monthly for a $10,000 policy, while someone in their 80s might pay $100-200 for the same coverage.

Most insurers offer policies ranging from $5,000 to $25,000, giving you flexibility to match your anticipated final expenses. The good news is that once you secure a policy, your premium typically remains fixed for life – a valuable feature during retirement when managing a fixed income becomes essential.

What Exactly Is Burial Insurance and Why Do Rural Seniors Need It?

Burial insurance (also called final expense insurance) is a specialized whole life insurance policy designed to cover end-of-life expenses. Unlike term life insurance that expires after a specific period, burial insurance provides permanent coverage as long as you continue paying premiums. These policies accumulate cash value over time, which can be borrowed against if needed, though doing so reduces the death benefit. For those living in Georgia, understanding the specifics of Georgia insurance can be particularly beneficial.

For rural Georgia seniors, burial insurance addresses unique challenges. Limited access to funeral homes in rural areas can mean higher transportation costs and fewer options for competitive pricing. Additionally, rural healthcare facilities may require transfers to urban centers for terminal care, creating additional expenses. Burial insurance provides the financial cushion needed to handle these rural-specific costs while ensuring your family isn’t left struggling to cover unexpected expenses.

The application process is remarkably straightforward compared to traditional life insurance. Most policies don’t require medical exams – instead, you’ll answer health questions over the phone or online. Many insurers offer guaranteed acceptance options for those with serious health conditions, though these typically come with a 2-3 year graded benefit period where death from natural causes results in a return of premiums plus interest rather than the full benefit.

“Many families in rural Georgia communities still maintain traditional burial practices that can involve multiple days of services, family gatherings, and cemetery costs. Burial insurance ensures these important cultural traditions can be maintained without financial hardship.” – Ranwell Insurance

5 Most Affordable Burial Insurance Options for Rural Georgia Seniors

“Funeral and Burial Insurance …” from funeraladvantage.com and used with no modifications.

Finding affordable coverage requires understanding which insurance providers offer the best value for rural Georgia residents. While national carriers serve the entire state, some regional insurers have developed products specifically addressing the needs of Georgia’s rural communities. Ranwell Insurance has partnered with multiple top-rated carriers that understand the unique needs of rural Georgia families.

1. Final Expense Policies with Simplified Underwriting

Simplified issue policies represent the sweet spot for most rural Georgia seniors seeking burial insurance. These policies require answering health questions but no medical exam, striking a balance between affordability and accessibility. Approval often happens within days, sometimes even on the same day as application. For those in reasonably good health with only minor conditions like controlled high blood pressure or cholesterol, these policies typically offer the lowest premiums.

2. Guaranteed Issue Policies with No Health Questions

If you’re dealing with serious health conditions like recent cancer, heart attacks, or kidney disease, guaranteed issue policies offer a reliable path to coverage. These policies accept virtually everyone regardless of health status, making them invaluable for seniors with challenging medical histories. The trade-off is higher premiums and a waiting period—typically 2-3 years—during which death from natural causes results in a refund of premiums plus interest rather than the full benefit.

For many rural Georgia seniors with chronic health issues, the peace of mind from guaranteed coverage outweighs the additional cost. These policies generally start around $50-85 monthly for a $10,000 benefit for a 70-year-old, with rates increasing with age. Despite the waiting period, accidental death is typically covered immediately, and after the waiting period passes, you’re fully protected regardless of health changes.

3. Graded Benefit Plans for Those with Health Conditions

Graded benefit plans offer a middle ground between simplified issue and guaranteed issue policies. These plans accept applicants with moderate health concerns like controlled diabetes or past cancer that’s been in remission for 2+ years. Rather than the all-or-nothing approach of a waiting period, these policies pay a percentage of the death benefit that increases over time—perhaps 30% of the benefit in year one, 70% in year two, and 100% thereafter.

Rural Georgia seniors often find these policies attractive when their health falls in the “gray area” between perfect health and serious illness. The premiums typically fall between simplified issue and guaranteed issue rates, providing a reasonable alternative for those with manageable chronic conditions who want more immediate (albeit partial) coverage.

How Age and Health Affect Burial Insurance Rates in Georgia

The two most significant factors influencing your burial insurance premiums are age and health. Rural Georgia seniors face the same age-related premium increases as those in urban areas, but understanding these factors helps you set realistic expectations and budget accordingly. Generally, premiums increase by approximately 8-15% for each five-year age bracket, which emphasizes the value of securing coverage sooner rather than later.

Typical Monthly Premiums for Ages 65-85

Insurance rates increase predictably with age, reflecting the higher mortality risk as we grow older. For a $10,000 burial insurance policy in Georgia, a healthy 65-year-old woman might pay around $30-45 monthly, while a healthy man the same age would pay $40-55 due to statistical life expectancy differences. By age 75, these rates typically increase to $60-85 for women and $75-100 for men.

By age 85, expect premiums in the $120-200 range for the same coverage amount. This progressive increase highlights the advantage of securing coverage earlier when possible, as your rate locks in at the age you purchase the policy. Unlike term insurance or health insurance, burial insurance premiums remain level for life once issued.

Health Conditions That Impact Eligibility and Rates

Your health history significantly impacts both eligibility and pricing for burial insurance. Simplified issue policies typically ask about major conditions from the past 2-5 years, while guaranteed issue policies bypass health questions entirely. Understanding which conditions affect ratings helps you choose the appropriate policy type and prepare for likely costs.

- Minimal Impact Conditions: Controlled high blood pressure, cholesterol, mild arthritis, and controlled Type 2 diabetes (without insulin) generally qualify for standard rates

- Moderate Impact Conditions: Insulin-dependent diabetes, sleep apnea requiring CPAP, and past cancer in remission for 2+ years typically qualify for standard rates with some carriers or slightly elevated rates with others

- Significant Impact Conditions: Heart attacks or strokes within 2 years, current cancer treatment, kidney disease requiring dialysis, or oxygen use usually necessitate guaranteed issue coverage

- Cognitive Conditions: Recent diagnosis of Alzheimer’s, dementia, or cognitive impairment typically requires guaranteed issue policies

- Tobacco Use: Smoking typically increases premiums by 15-40% depending on the carrier

Rural Georgia residents may face challenges accessing specialists for managing complex conditions, potentially leading to more health-related premium increases. Working with insurance specialists familiar with various carriers’ underwriting guidelines is particularly valuable, as different insurers view the same conditions differently—what disqualifies you with one company might be acceptable to another.

For seniors taking multiple medications, it’s worth noting that the condition being treated matters more than the medication itself. Being transparent about your health history during the application process ensures your coverage remains valid and claims won’t be contested during the contestability period (typically the first two years of the policy).

Government Assistance Programs for Georgia’s Rural Senior Population

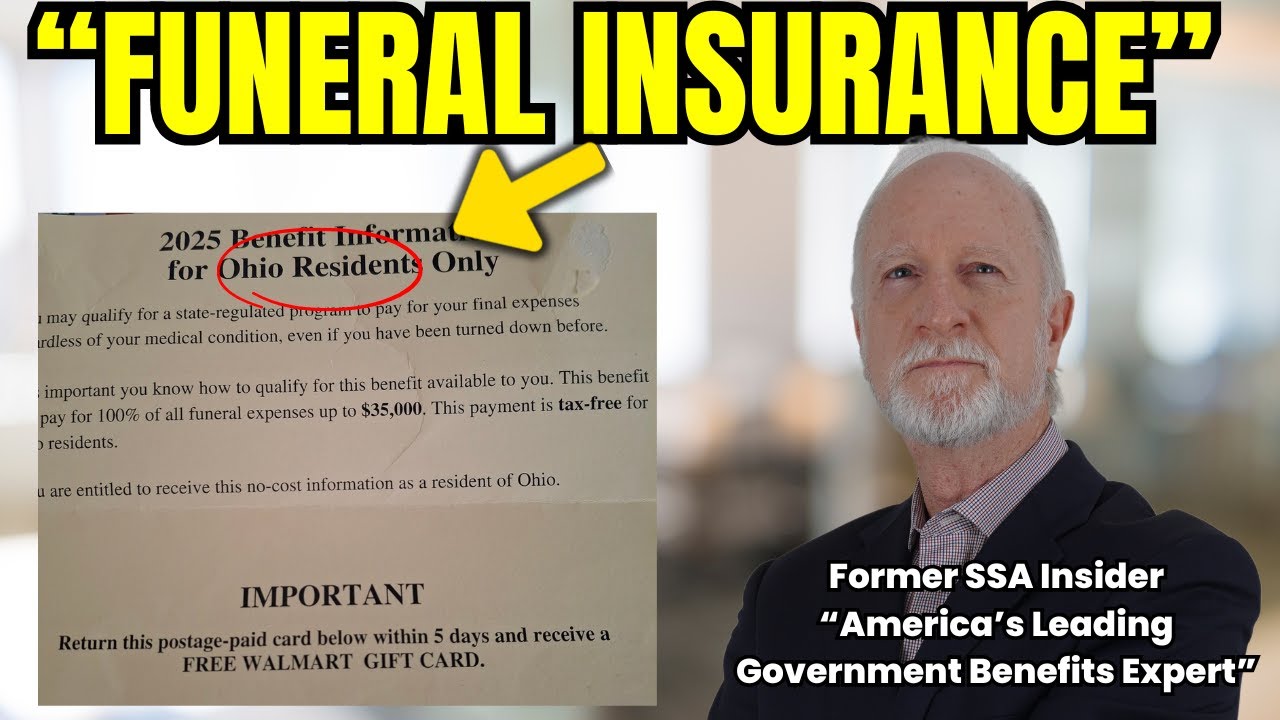

“WARNING: “Funeral Insurance” Companies …” from www.youtube.com and used with no modifications.

While private burial insurance offers the most comprehensive coverage, several government programs provide limited assistance with final expenses. Rural Georgia seniors should understand these options, both to potentially supplement burial insurance and to recognize their limitations. Many rural families mistakenly believe government programs will cover most funeral expenses, only to discover the significant gaps in coverage when it’s too late.

Social Security Death Benefit: The $255 Reality

The Social Security Administration offers a one-time death payment of just $255 to qualified survivors, which falls drastically short of covering modern funeral expenses. This benefit is only available to surviving spouses or dependent children and requires an application within two years of death. For rural Georgia seniors who are widowed or without dependent children, even this modest benefit may be unavailable.

The application process requires visiting a Social Security office, which can present logistical challenges for families in remote areas of Georgia. With the nearest office potentially hours away, claiming this benefit adds another burden during an already difficult time. While $255 provides minimal assistance, it’s important to view it as a supplemental benefit rather than a primary funding source for final expenses.

Veterans Benefits for Burial Expenses

Veterans who served honorably may qualify for burial benefits through the Department of Veterans Affairs. These benefits include burial in a national cemetery with a headstone, grave marker, and burial flag at no cost. For veterans who choose private cemetery burial, the VA provides a burial allowance ranging from $300-$2,000 depending on whether the death was service-related.

Rural Georgia veterans face unique challenges accessing these benefits. The nearest national cemetery might be hours away, making this option impractical for families wanting to visit regularly. Additionally, the reimbursement process for private burials requires detailed documentation and can take months for payment, forcing families to cover costs upfront. Having burial insurance ensures immediate funds regardless of VA benefit processing timeframes.

Georgia Medicaid and Burial Assistance

Georgia Medicaid recipients face strict asset limitations that impact burial planning. However, properly structured burial insurance can be excluded from countable assets. Specifically, Georgia Medicaid allows recipients to maintain a designated burial fund or prepaid funeral contract up to $10,000 without affecting eligibility. Burial insurance policies can be structured to work within these parameters if properly designated as burial funds.

Rural Georgia seniors relying on Medicaid must carefully coordinate their burial insurance with eligibility requirements. Seeking guidance from elder law attorneys or Medicaid planning specialists familiar with rural Georgia regulations ensures your burial fund remains protected. Without proper structuring, insurance proceeds could potentially disqualify surviving spouses from continued Medicaid benefits.

Finding the Best Burial Insurance When You Live Far From the City

“5 Best Burial Insurance Companies of 2025” from www.marketwatch.com and used with no modifications.

Rural Georgia seniors often face reduced access to local insurance agents, limiting their ability to compare options in person. Fortunately, Ranwell Insurance has leveled this playing field. They offer in-house, telephone and online application processes, making comprehensive coverage accessible regardless of your location. They can even provide electronic policy delivery, eliminating physical mail delays common in rural areas.

When evaluating burial insurance options, consider working with Ranwell Insurance agents who represent multiple companies rather than single-company agents. This approach provides access to various policies tailored to different health conditions and budgets. Ranwell Insurance offers telephone consultations specifically designed for rural clients, enabling you to compare multiple options without traveling to urban locations.

Look beyond the monthly premium to evaluate the overall value. Consider features like first-day coverage versus waiting periods, rate increase guarantees, and the financial stability of the insurance company (indicated by ratings from organizations like A.M. Best or Standard & Poor’s). Rural seniors should also verify that policy documents can be managed online, as this simplifies future premium payments and policy changes when in-person service isn’t readily available. For those with existing health conditions, it’s reassuring to know that life insurance is still possible even if you’ve been denied before with Ranwell Insurance.

Frequently Asked Questions

The process of securing burial insurance raises many questions, especially for rural Georgia seniors who may have limited access to insurance professionals. These frequently asked questions address the most common concerns we hear from clients throughout rural Georgia communities.

What is the average cost of burial insurance for a 75-year-old in rural Georgia?

For a 75-year-old in rural Georgia, burial insurance typically costs between $70-$120 per month for a $10,000 policy with simplified underwriting. Women generally pay rates at the lower end of this range, while men pay toward the higher end. Health conditions can increase these rates, and guaranteed issue policies (which accept everyone regardless of health) typically cost 15-40% more than simplified issue policies. Geographic location within rural Georgia doesn’t significantly impact rates, as most carriers use statewide pricing.

Can I get burial insurance if I have serious health conditions?

Yes, burial insurance remains available even with serious health conditions. If you have conditions like recent cancer, heart attacks, strokes, or require oxygen, guaranteed issue policies provide coverage without health questions. These policies typically come with a 2-3 year waiting period during which death from natural causes results in a return of premiums plus interest rather than the full death benefit. For less severe conditions like controlled diabetes or high blood pressure, simplified issue policies often provide immediate coverage at standard rates. The key is working with an agent who represents multiple companies, as underwriting standards vary significantly between insurers.

How long does it take for a burial insurance policy to become active?

Most simplified issue burial insurance policies provide coverage immediately upon approval and premium payment. The application process typically takes 1-3 days, with many companies offering same-day approval. Once approved, your coverage begins as soon as your first premium payment processes. Guaranteed issue policies, while approved immediately, include a graded benefit period (typically 2-3 years) during which death from natural causes results in a partial benefit or return of premiums rather than the full death benefit. However, even with these policies, accidental death is typically covered immediately at the full benefit amount. Electronic applications have significantly reduced approval times, benefiting rural residents who previously faced delays with mail-based applications.

Will my burial insurance rates increase as I get older?

- Burial insurance premiums remain fixed for the entire life of the policy once issued

- Your rate is locked in based on your age at application, not your future age

- Unlike term life insurance, there are no age-based increases after purchase

- The insurance company cannot raise your individual rate due to health changes

- Premium increases can only occur if the state insurance commissioner approves a rate increase for an entire class of policyholders, which is extremely rare

This premium stability makes burial insurance particularly valuable for seniors on fixed incomes in rural Georgia communities. You can budget for the same premium amount year after year without worrying about surprise increases as you age. This contrasts sharply with term life insurance, which typically increases dramatically or terminates altogether at advanced ages.

The fixed nature of premiums also explains why purchasing earlier is advantageous. Each year you wait to buy coverage means locking in at a higher age-based rate. For example, the difference between purchasing at age 65 versus 70 could mean paying 15-30% more in premiums for the remainder of your life.

Even during economic downturns that have impacted rural Georgia communities, burial insurance premiums have remained remarkably stable compared to other types of insurance. This reliability provides important peace of mind for fixed-income seniors trying to manage predictable monthly expenses.

Can I purchase burial insurance for my elderly parent who lives in rural Georgia?

Yes, you can purchase burial insurance for an elderly parent in rural Georgia, but certain requirements must be met. First, you need “insurable interest,” which exists naturally in parent-child relationships. Second, you must have your parent’s knowledge and consent—no policies can be purchased secretly. Third, your parent must be mentally competent to understand and participate in the application process, including answering health questions or signing forms.

The application typically requires your parent’s participation during a telephone interview, even if you’re handling the paperwork and payments. This interview usually lasts 15-30 minutes and involves basic health questions for simplified issue policies. For parents with serious health conditions, guaranteed issue policies bypass health questions entirely, making the process even simpler. Many companies now offer three-way calls where you, your parent, and the insurance representative can all participate regardless of your locations.

When purchasing for a parent, you can be designated as both the premium payer and the beneficiary. This arrangement allows you to manage the policy while ensuring funds are available to handle your parent’s final expenses. Many families find this approach particularly valuable in rural settings where adult children may have moved to more urban areas but parents have remained in their rural communities. Ranwell Insurance has helped countless Georgia families navigate this process with dignity and simplicity.

For rural Georgia seniors seeking peace of mind about final expenses, burial insurance provides an accessible and affordable solution regardless of location, age, or health status. By understanding the options available, you can make informed decisions that protect both your financial legacy and your family’s wellbeing during a difficult time.

Finding affordable burial insurance for seniors in rural Georgia can be challenging due to limited options and higher costs associated with living in less populated areas. However, there are ways to secure coverage that fits your budget. Understanding the different types of policies available and comparing quotes from multiple providers can help you make an informed decision. Additionally, it’s important to consider how Georgia residents can still slash life insurance costs even in challenging economic times.

Contact Ranwell Insurance today @ (855) 508-5008 for good old fashioned southern service that’s as personalized as your grandma’s peach or pecan pie recipes. We shop multiple carriers so you don’t have to — get your free, personalized quote today.