Key Takeaways

- Funeral costs in Macon, GA are rising faster than the national average, with local services now typically costing $8,000-$12,000.

- Most Macon residents can qualify for final expense insurance without a medical exam, making coverage accessible even for those with health concerns.

- Final expense insurance premiums can start as low as $30 per month for Macon residents, with rates locked in for the life of the policy.

- Coverage extends beyond just funeral expenses to include medical bills, outstanding debts, and legacy planning benefits.

- Ranwell Insurance offer specialized policies tailored to Macon’s unique economic conditions and family needs.

Planning for end-of-life expenses isn’t a conversation many people want to have, but for Macon residents, it’s becoming increasingly necessary. With funeral costs climbing and financial security more uncertain than ever, having a solid plan in place isn’t just smart—it’s essential. Ranwell Insurance can help Macon families find the right final expense coverage to protect their loved ones from unexpected financial burdens.

The reality of final expenses hits hard when families are already dealing with grief. In Macon, where the average funeral now costs significantly more than many households have in emergency savings, the financial impact can be devastating. Without proper coverage, families often resort to depleting retirement accounts, taking on high-interest debt, or even setting up crowdfunding campaigns to cover these unavoidable costs.

The Financial Reality Every Macon Family Needs to Know

When a loved one passes, families in Macon face immediate expenses that many aren’t prepared for. The median household savings in Macon sits well below the national average, yet final expenses can easily reach $10,000 or more. This gap creates a financial emergency at precisely the moment when families should be focused on honoring their loved one and beginning the grieving process.

The Hidden Cost Burden When Someone Dies in Macon

“The Hidden Costs of Dying That No One …” from www.workandmoney.com and used with no modifications.

Death comes with hidden costs that extend far beyond the funeral service itself. From medical bills that continue to arrive after passing to immediate cash needs for family travel arrangements, the financial burden can quickly spiral. In Macon’s tight-knit communities, families often feel pressured to provide dignified services that can stretch budgets to breaking point.

These unexpected expenses frequently include probate costs, which in Georgia can be particularly complex. Legal fees, court costs, and executor expenses add thousands to the final bill. Many Macon families discover too late that their loved one’s estate must go through this process, further depleting whatever assets might have been left behind.

The Financial Gap Most Families Face

The median household in Macon has less than $5,000 in liquid savings, according to recent economic surveys. Yet the average combined cost of end-of-life medical care, funeral services, and estate settlement typically exceeds $15,000. This gap of $10,000 or more represents a financial emergency that catches most families unprepared. To help bridge this gap, consider exploring final expense insurance quotes as a viable option.

Macon End-of-Life Expense Reality

Average Funeral Cost: $8,000-$12,000

Median Household Liquid Savings: Under $5,000

Typical Financial Gap: $7,000+

Percentage of Families Financially Unprepared: 67%

While many Macon residents assume their savings or existing life insurance will cover these expenses, the reality often falls short. Social Security provides only a $255 death benefit—barely enough to cover the cost of flowers for a typical service. Medicare and standard health insurance stop payment upon death, leaving families responsible for final medical expenses.

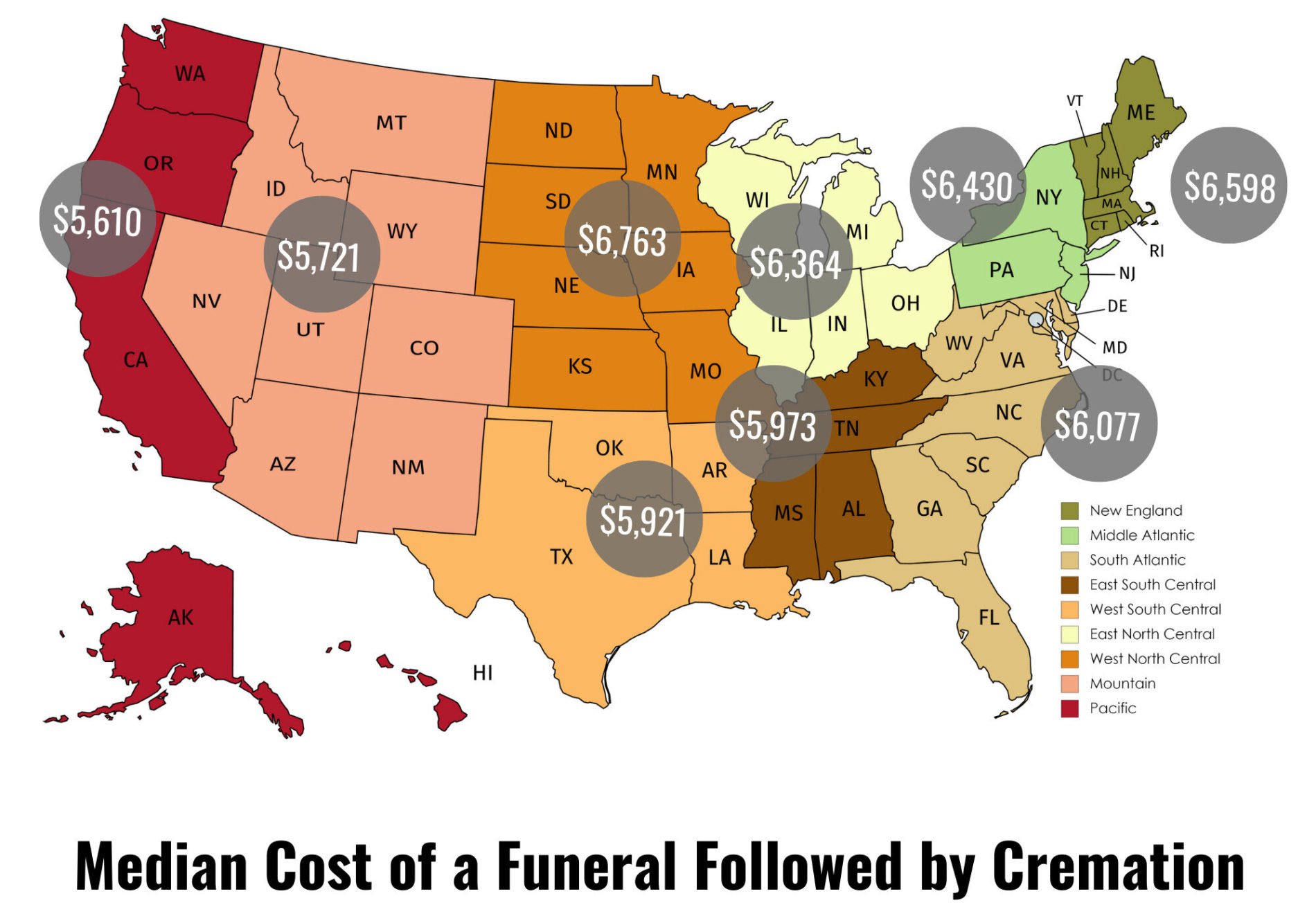

Funeral Costs in Macon Are Rising Faster Than the National Average

“2025 Cremation Cost Guide – Funeral …” from funeraladvantage.com and used with no modifications.

Macon’s funeral costs have increased at an alarming 8% annually over the past five years, outpacing the national average of 5.7%. This accelerated growth means a basic funeral service that cost $7,000 in 2018 now approaches $10,000 or more. The trend shows no sign of slowing, with industry experts projecting continued increases due to rising property values and operational costs affecting local funeral homes. For those considering financial planning, exploring final expense insurance could be a wise decision.

These rising expenses come at a time when many Macon families are still recovering financially from recent economic challenges. The combination of higher costs and strained household budgets creates a perfect storm that final expense insurance is specifically designed to address. Unlike general life insurance, these policies focus exclusively on covering these immediate needs.

- Basic funeral services in Macon now average $9,500 (compared to $7,848 nationally)

- Cemetery plots have increased 12% in value over just three years

- Casket prices have risen 15% since 2020 due to material and labor costs

- Optional services like memorial videos and catering add $1,500-$3,000 to final bills

- Transportation and administrative costs have increased by 7% annually

For Macon’s aging population on fixed incomes, these escalating costs represent a significant concern. Many seniors express anxiety about becoming a financial burden to their children and grandchildren. Final expense insurance offers peace of mind by ensuring these costs won’t fall unexpectedly on loved ones.

Local Price Trends for Burial Services

Macon’s unique burial customs and regional preferences contribute to cost patterns that differ from national averages. Local funeral homes report that Macon families typically select more personalized services, including multi-day visitations and elaborate floral arrangements that reflect the community’s strong family traditions. These preferences add significantly to the total expense, often pushing final costs 15-20% higher than the baseline estimates families initially receive. For more information on managing these expenses, consider exploring final expense insurance quotes.

Same-Day Approval Options Available

Many Macon residents are surprised to learn they can receive approval for final expense insurance on the same day they apply. This rapid approval process stands in stark contrast to traditional life insurance, which often requires weeks of medical underwriting. For families with immediate concerns or those who simply prefer efficiency, same-day approval provides invaluable peace of mind.

The streamlined process typically involves a brief phone interview rather than lengthy paperwork. Providers serving the Macon area have invested in digital infrastructure that allows for electronic signatures and immediate policy issuance. This means coverage can begin within hours of your initial inquiry, providing immediate protection for you and financial security for your loved ones.

Coverage Starts at Just $1 Per Day for Many Macon Residents

“Make An Appointment” from www.cdhinsuranceca.com and used with no modifications.

Final expense insurance in Macon is remarkably affordable, with many residents qualifying for coverage that costs about the same as a daily cup of coffee. For approximately $30 per month, healthy individuals in their 50s and 60s can secure $10,000 in coverage—enough to handle the most immediate expenses following a death. This affordability makes final expense insurance accessible to virtually all income levels in the Macon community.

Premium Rates by Age Group

The cost of final expense insurance in Macon follows a predictable pattern based primarily on age at enrollment. Those who secure coverage in their 50s typically pay between $25-$45 monthly for $10,000 in benefits. Residents in their 60s generally see premiums of $40-$70, while those waiting until their 70s often pay $70-$120 for the same coverage. This clear cost incentive for earlier enrollment helps explain why many financial advisors in Macon recommend securing coverage sooner rather than later.

How Local Providers Compete for Your Business

The competitive insurance market in Macon works to residents’ advantage when shopping for final expense coverage. Local providers consistently offer promotional rates, special discounts for multi-policy holders, and even reduced premiums for non-smokers or those with memberships in community organizations. These competitive forces have created a buyer’s market where consumers willing to compare quotes can often save 15-20% on premiums.

Another advantage of Macon’s competitive insurance landscape is the availability of specialized riders and policy enhancements. Many local agents offer additional benefits like accelerated death benefits for terminal illness or nursing home care, often at little or no additional cost. This level of customization allows residents to tailor coverage precisely to their unique family circumstances.

Fixed Rates That Never Increase

Perhaps the most valuable feature of final expense insurance for Macon residents living on fixed or retirement incomes is the guaranteed level premium. Unlike health insurance or long-term care policies that typically increase with age, final expense insurance premiums remain exactly the same for the entire life of the policy. The rate you lock in at age 55 remains unchanged even at 85, providing predictable budgeting for the long term.

This rate stability becomes increasingly important in Macon’s economic climate, where many seniors face rising costs for housing, healthcare, and essential services. Knowing that your final expense premium will never increase provides significant peace of mind and financial security. Many policyholders report that this predictability is among the most important factors in their decision to purchase coverage.

- Guaranteed fixed rates regardless of health changes

- No annual policy reviews or premium adjustments

- Protection against inflation affecting future funeral costs

- Budget-friendly payment options including monthly, quarterly or annual plans

- Premium payments that build cash value over time

For Macon’s middle-income families who must carefully manage monthly expenses, this predictability transforms final expense insurance from an optional expense into an essential component of sound financial planning. The combination of low initial cost and guaranteed rate stability makes these policies uniquely valuable in an era of economic uncertainty.

Macon Insurance Providers Offer Specialized Final Expense Policies

“Final Expense Life Insurance: Ultimate …” from wealthnation.io and used with no modifications.

Comparing Macon’s Top Final Expense Plans

Standard Plan: $8,000-$12,000 coverage, $30-$60 monthly

Enhanced Plan: $12,000-$25,000 coverage, $50-$100 monthly

Premium Plan: $25,000-$50,000 coverage, $100-$200 monthly

All plans include immediate death benefit for accidents and 2-year graded benefit for natural causes.

Macon’s insurance market has evolved to meet the specific needs of local residents with customized final expense policies. These specialized plans often include features like additional coverage for transportation of remains—an important consideration for the many Macon families with relatives throughout Georgia and neighboring states. Local providers understand these regional needs in ways national insurers often miss.

Another distinctive feature of Macon-focused policies is their alignment with local funeral homes’ payment systems. Many local insurance providers have established direct payment relationships with Macon funeral homes, eliminating the need for families to pay costs upfront and wait for reimbursement. This immediate payment feature can be invaluable during an already stressful time. For more information, you can explore final expense insurance quotes tailored for the Macon area.

The specialized nature of these policies extends to their underwriting approach as well. Macon providers have developed simplified issue policies specifically designed for residents with common local health conditions like hypertension, type 2 diabetes, and cardiac issues. These conditions, which might trigger higher rates or denials from standard insurers, are often accommodated more reasonably by local providers familiar with the community’s health profile.

Local vs. National Provider Benefits

Choosing between local and national insurance providers for final expense coverage involves several important considerations for Macon residents. Local providers typically offer more personalized service, including face-to-face meetings, familiarity with regional funeral customs, and established relationships with area funeral directors. National providers, while sometimes offering slightly lower premiums, generally can’t match this level of community-specific service and understanding.

Customization Options for Macon Families

Macon’s diverse population has unique needs that the best final expense policies address through customization. Multi-generational households can opt for family policies covering multiple individuals. Military veterans can select plans that coordinate with VA benefits. Church members can choose policies that include donations to their religious organizations. These customization options ensure that final expense coverage aligns perfectly with personal values and family circumstances.

The ability to customize payment schedules represents another valuable flexibility feature. While monthly payments remain most common, many Macon providers now offer quarterly, semi-annual, or annual payment options—sometimes with modest discounts for less frequent billing. This flexibility helps families integrate premium payments into their broader financial planning strategy.

Protection Beyond Funeral Costs That Macon Families Need

“Benefits of a Prepaid Funeral Plan” from rfhr.com and used with no modifications.

While funeral expenses represent the most immediate financial concern after a death, Macon families face numerous additional costs that final expense insurance can address. Modern policies typically allow beneficiaries to allocate funds however they’re needed most—whether for outstanding medical bills, credit card debt, mortgage payments, or even providing a financial cushion during the transition period after losing a wage earner. This flexibility transforms final expense insurance from simple funeral funding into comprehensive financial protection.

Medical Bills and Outstanding Debt Coverage

The average Macon resident who passes away leaves behind $3,800 in unpaid medical expenses not covered by Medicare or private insurance. Final expense insurance provides an immediate cash benefit that can prevent these bills from becoming a burden on surviving family members. Similarly, the policy can cover credit card balances, utility payments, and other outstanding obligations that might otherwise create financial stress during an already difficult time.

Legacy Planning Benefits

Beyond covering immediate expenses, final expense insurance allows Macon residents to leave meaningful financial legacies. Some policyholders designate a portion of their benefit to grandchildren’s education funds, charitable organizations, or religious institutions. Others create small nest eggs for surviving spouses to supplement retirement income. This legacy planning dimension transforms final expense insurance from an expense into an expression of your values and commitment to family security.

Tax Advantages for Macon Residents

One often overlooked aspect of final expense insurance is its favorable tax treatment for Macon residents. Unlike some other financial assets, final expense insurance death benefits are generally income tax-free to beneficiaries. This means your loved ones receive the full face value of the policy without having to set aside a portion for tax obligations. For middle-income Macon families, this tax efficiency maximizes the financial protection each premium dollar provides.

How to Compare Final Expense Insurance Quotes in Macon Today

“Types of Final Expense Insurance Explained” from finalexpensedirect.com and used with no modifications.

Getting started with final expense insurance in Macon is simpler than most residents expect. The key is comparing multiple quotes rather than accepting the first offer you receive. Insurance premiums for identical coverage can vary by as much as 30% between providers, making comparison shopping essential for finding the best value. Fortunately, free quote services make this process straightforward and convenient.

When requesting quotes, be prepared with basic information about your age, overall health status, and desired coverage amount. Most Macon residents find that $10,000-$15,000 in coverage strikes the right balance between affordability and adequate protection. Having this figure in mind helps streamline the quoting process and ensures you receive relevant, comparable options.

The 3-Step Process to Get Multiple Quotes Fast

Comparing final expense insurance quotes in Macon can be accomplished in three straightforward steps. First, gather your basic personal information including birthdate, contact details, and general health status. Second, determine your desired coverage amount based on local funeral costs plus any additional expenses you wish to cover. Third, contact a multi-carrier insurance broker who can simultaneously submit your information to several reputable providers. This approach saves significant time compared to contacting individual companies and ensures you receive consistent, comparable quotes based on identical information.

Questions to Ask When Comparing Policies

When evaluating final expense insurance options, Macon residents should ask specific questions to uncover the true value of each policy. Inquire about the waiting period before full coverage takes effect, as this can range from immediate to 24 months depending on the policy. Ask about additional riders such as accelerated death benefits that allow access to funds if diagnosed with a terminal illness. Confirm whether premiums are guaranteed never to increase, and verify the company’s claims payment history and financial stability ratings. Finally, ask about payment options and whether discounts are available for annual or automatic payments.

Red Flags to Watch For

While most final expense insurance providers serving Macon are legitimate and trustworthy, residents should remain alert for certain warning signs. Be wary of any policy that seems dramatically cheaper than other quotes without a clear explanation for the price difference. Exercise caution with policies that exclude coverage for common health conditions or that feature premiums that increase as you age. Avoid insurers who pressure you to make an immediate decision without providing complete written information about the policy’s terms, conditions, and exclusions. And finally, check that any provider you’re considering is properly licensed to sell insurance in Georgia through the state’s Insurance Commissioner’s Office.

The most common complaint among Macon final expense insurance customers involves misunderstanding the graded benefit period. This is the time (typically 2-3 years) during which death from natural causes may receive only a return of premiums rather than the full benefit. Always ensure you fully understand this provision before committing to any policy.

Frequently Asked Questions

As you consider final expense insurance options in Macon, you likely have questions about how these policies work and whether they’re right for your specific situation. The following answers address the most common questions local residents ask when exploring this important coverage.

Remember that while these general answers apply to most situations, your individual circumstances might warrant specific guidance. Speaking with a licensed insurance professional who specializes in final expense coverage for Macon residents can provide personalized recommendations based on your unique needs.

At what age should Macon residents consider buying final expense insurance?

Most financial advisors recommend that Macon residents begin considering final expense insurance between ages 50-60. This timing strikes an ideal balance—you’re young enough to qualify for favorable rates but old enough that the coverage serves a clear purpose. Starting too early means paying premiums for many years before the coverage is likely needed, while waiting too long risks higher premiums or potential health-related disqualification.

That said, individual circumstances vary significantly. Macon residents with health concerns might benefit from securing coverage earlier, as qualifying becomes more challenging with certain diagnoses. Conversely, those with substantial existing life insurance through employers might reasonably delay dedicated final expense coverage until retirement when that group coverage typically ends.

Your family longevity history should also influence this decision. Macon families with histories of longevity might consider delaying purchase until their mid-60s, while those with histories of earlier health issues might benefit from securing coverage in their late 40s or early 50s.

When To Consider Final Expense Insurance in Macon

Ages 45-55: Ideal if you have health concerns or family history of health issues

Ages 55-65: Optimal balance of affordability and necessity for most residents

Ages 65-75: Still obtainable but with higher premiums

Ages 75+: Limited options but guaranteed issue policies available

The key consideration isn’t necessarily calendar age but your overall insurance strategy. Final expense coverage makes most sense when traditional term life insurance becomes prohibitively expensive or unavailable, and when existing permanent policies don’t provide sufficient coverage for specific end-of-life expenses.

Can I get final expense insurance if I have health problems?

Yes, even Macon residents with significant health challenges can typically qualify for some form of final expense insurance. Unlike traditional life insurance, which often excludes applicants with serious health conditions, final expense policies are specifically designed to accommodate individuals with health issues. While some conditions may increase premiums or require a waiting period before full coverage takes effect, outright denials are rare. Guaranteed acceptance policies—which approve all applicants regardless of health—represent the ultimate safety net, ensuring coverage is available to virtually everyone, though typically at higher premium rates and with 2-3 year waiting periods before full benefits apply for natural causes of death.

How quickly does final expense insurance pay out to beneficiaries in Macon?

Most final expense insurance policies pay benefits to Macon beneficiaries within 7-14 days after receiving completed claim forms and a certified death certificate. This rapid payment timeline represents one of the key advantages of these policies compared to traditional life insurance, which often takes 30-60 days for benefit disbursement. Some local providers even offer expedited payment options that can deliver partial benefits within 24-48 hours specifically to cover immediate funeral expenses. To learn more about these policies, visit pros and cons of final expense insurance.

The claims process itself is typically straightforward, requiring only a death certificate and basic claim form rather than extensive documentation. Many Macon funeral homes are familiar with this process and can assist families with the necessary paperwork, sometimes even accepting assignment of the insurance benefit as payment for their services.

It’s worth noting that policies in their first two years may be subject to contestability review if the death appears unusual or if there are concerns about application accuracy. However, these reviews are uncommon and typically delay rather than prevent payment. After a policy has been in force for two years, even unintentional application errors generally cannot be used to deny claims.

What’s the difference between final expense insurance and pre-paid funeral plans in Macon?

Final expense insurance and pre-paid funeral plans serve similar purposes but operate very differently for Macon residents. Final expense insurance provides a cash benefit to your beneficiary, who can use the funds for any purpose—including but not limited to funeral costs. This flexibility allows the money to address whatever financial needs are most pressing at the time of death. In contrast, pre-paid funeral plans are contracts with specific funeral homes that lock in today’s prices for predetermined services, with payments going directly to the funeral provider rather than to beneficiaries.

The key advantage of insurance over pre-payment is flexibility. If you move away from Macon, your insurance benefit moves with you, while pre-paid plans may be difficult to transfer to different funeral homes. Similarly, if your funeral preferences change over time, insurance benefits can accommodate these changes, whereas pre-paid plans typically specify particular services that may become outdated or undesired. Many financial advisors recommend final expense insurance for its flexibility, potential for coverage beyond funeral costs, and the fact that beneficiaries—not funeral directors—control how the money is spent.

Do Macon funeral homes accept all final expense insurance policies?

Macon funeral homes generally accept benefits from all legitimate final expense insurance policies, regardless of the issuing company. However, the administrative process varies depending on the specific relationship between the insurance provider and funeral home. Some insurance companies have established direct payment arrangements with local funeral providers, allowing for immediate assignment of benefits without requiring families to pay costs upfront. Other companies issue the benefit check directly to the named beneficiary, who then becomes responsible for paying the funeral home.

This distinction becomes particularly important for families facing cash flow challenges. When selecting a final expense policy, Macon residents concerned about immediate funeral funding should verify whether the insurance company offers assignment of benefit options with local funeral homes. Most reputable local insurance agents can provide specific information about which policies offer the smoothest payment process with your preferred funeral provider.

Funeral Home Payment Options in Macon

Direct Assignment: Insurance pays funeral home directly

Beneficiary Payment: Check issued to beneficiary who then pays funeral home

Expedited Partial Payment: Some policies offer quick partial payment for immediate expenses

Pre-Need Arrangements: Some funeral homes offer discounts when insurance is designated in advance

The relationship between funeral homes and insurance providers continues to evolve in the Macon market. Several local funeral directors now offer consultations specifically about insurance coverage, helping families understand how different policies interact with their service offerings. This collaborative approach benefits consumers by ensuring that insurance coverage aligns well with anticipated funeral expenses.

No matter which final expense option you choose, the most important step is taking action now. Every day without coverage leaves your loved ones vulnerable to potential financial hardship during an already difficult time. By securing appropriate final expense insurance today, you provide both practical support and peace of mind for those who matter most.

Remember that funeral expenses represent only one component of the financial burden families face after losing a loved one. A comprehensive final expense policy accounts for all these needs, allowing your family to focus on honoring your memory rather than worrying about unexpected bills.

For Macon residents seeking personalized guidance on final expense insurance options, Ranwell Insurance provides expert assistance in comparing policies from multiple providers to find the perfect fit for your needs and budget.

Have Questions About Coverage?

If you’re comparing options or trying to understand what makes the most sense for your situation, Ranwell Insurance is available to help clarify your next step.

Call (855) 508-5008 for guidance tailored to your needs, or explore our life insurance calculators to estimate coverage and budget ranges.